Highlights

- Market Movers: Weekly Technical Outlook

- Would There Be Any Winners from a Greek Default?

- What a 10% Rise in the Oil Price Looks Like

- Look Ahead: Stocks

- Look Ahead: Commodities

- Global Data Highlights

Market Movers: Weekly Technical Outlook

Technical Developments to Watch:

- EUR/USD is back in the middle of its recent 1.05 – 1.10 range

- GBP/USD testing key psychological resistance at 1.50 as we go to press

- USD/JPY nearing support at 118.30 - a break below could target 116.00 next

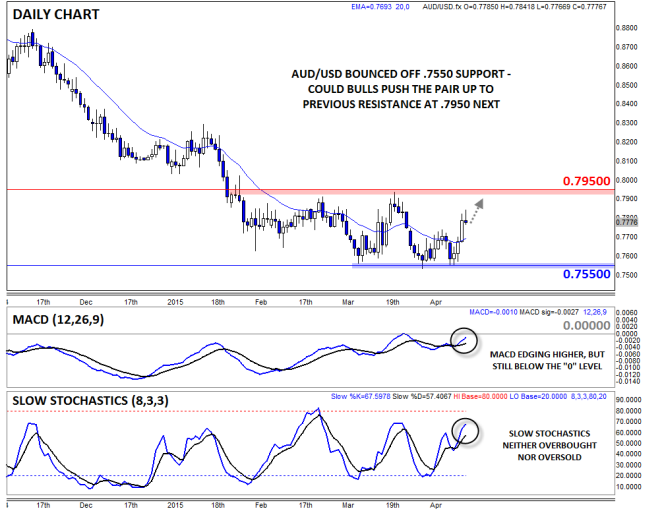

- AUD/USD bulls may look to press the pair up toward previous resistance at .7950

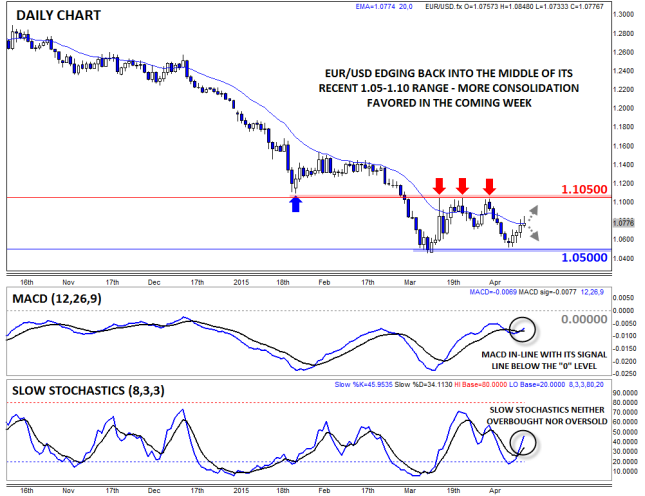

EUR/USD

EURUSD bounced from the bottom of its multi-month range at 1.0500 last week, eventually returning to the middle of this consolidation zone as of writing. From a fundamental perspective, the pair was driven more by the broad-based USD weakness than any euro-specific themes, despite Wednesday’s highly anticipated ECB press conference. As you would expect after the generally sideways price action over the last few weeks, the MACD and Slow Stochastics are indicating balanced, two-way trade. Moving forward, traders may look to fade an initial dip toward 1.0500 support, though if that level gives way, it could herald the beginning of the next leg lower.

Source: FOREX.com

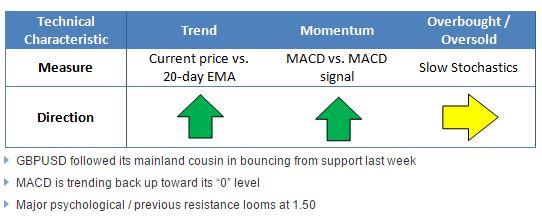

GBP/USD

GBPUSD also bounced back strongly last week. In its case, the pair found support at the 161.8% Fibonacci extension (1.4580) before recovering all the way back toward 1.50. Unlike EURUSD, the MACD has turned conclusively higher, indicating a possible shift to bullish momentum. For this week, all eyes will be on key psychological resistance at 1.50 – if that level is eclipsed, a continuation toward 1.5200 could be in play.

Source: FOREX.com

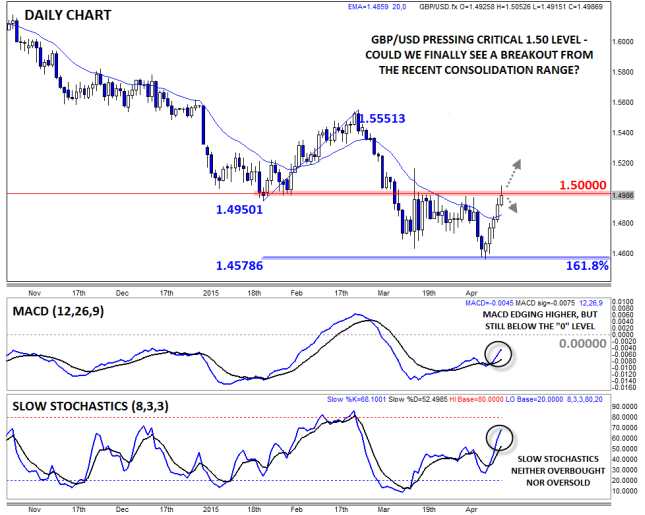

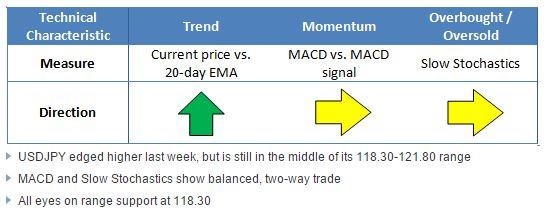

USD/JPY

Despite the last week’s drop in the greenback, USDJPY remains trapped in a sideways range between support at 118.30 and resistance up at 121.80. With neither the MACD nor the Slow Stochastics offering a clear signal, more consolidation in the recent range is probable this week, but if we do see a breakout below 118.30 support, bears could quickly target 117.00 or 116.00 next.

Source: FOREX.com

AUD/USD

AUDUSD is our currency pair in play this week due to a number of high-impact economic reports out of Australia, China, and the US (see “Data Highlights” below for more). Last week, AUDUSD saw a big rally off support at .7550 after an unambiguously strong AU jobs report. While neither the MACD nor the Slow Stochastics are giving a clear signal at this point, a continuation up toward previous resistance at .7950 would not be surprising early this week.

Source: FOREX.com

Would There Be Any Winners from a Greek Default?

With the possibility that Greece is not going to be able to meet its debt payments next month and be forced into bankruptcy, we thought that it was worth trying to see if there could be any winners from a Greek default.

Of course, with 3.5 weeks to go before Greece owes the IMF nearly EUR 1 billion, there is still time for Greece to reach a deal with its creditors. However, the rhetoric, especially from Germany, has been heating up in recent days and at the time of writing a deal does not seem likely.

Below we list three areas that we think could benefit from a Grexit/default in the coming months, and the first one may surprise you!

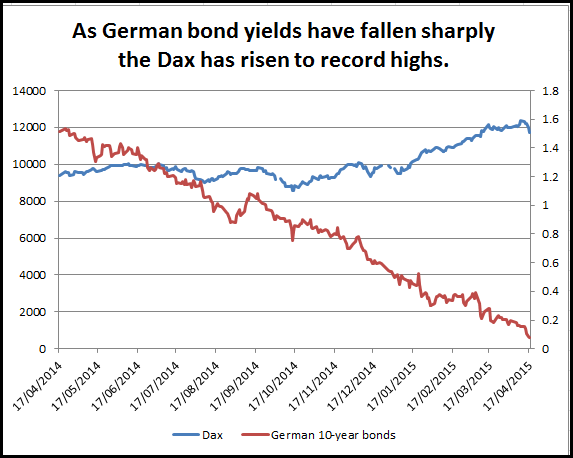

The German Stocks: While all European markets suffered from a dip in sentiment at the end of last week, including the Dax, we continue to think that the German index could be a winner from a Grexit. Firstly, it would mean Germany is no longer on the hook for Greek debts, which could reinforce the safety net for domestic corporations if we experience another financial crisis. Secondly, if we see a Grexit, we think that this could push German bond yields even lower. We have noticed that prior to the end of last week’s sell off in the Dax, the German index had a significant inverse correlation with German 10-year bond yields: as yields fell, the Dax rose 72% of the time (see chart below). Thus, while we would still expect German stocks to sell off in the immediate aftermath of a Greek default, we believe that ultimately German stocks could benefit as it could lower borrowing costs for German corporates by driving inflows into safe-haven assets like German bonds.

The Buck: EURUSD’s performance last week reinforced the significant 1.0500 support level. Some people have been looking for parity, but it may take a Grexit to push the pair down to this significant level. Even though the EUR rose last week as Greek fears started to rise, a Grexit could lead to more ECB QE, which would be good news for the EUR bears and may also boost the Dax.

Ireland and Portugal: These two countries were in serious financial straits a few years back and, like Greece, they also received bailouts. However, they managed to exit their bailouts and now have access to capital markets. In fact, Ireland is set to grow at the fastest rate in the Eurozone this year. A Greek default/Grexit would highlight how far these economies have come and could lower their borrowing costs even further. A Grexit could free up more resources for the peripheral economies, which may, after an initial sell off, also lead to a boost for their equity markets.

As you can see, a Grexit does not have to mean disaster for financial markets or for Europe. The next few weeks could make history if Greece does leave the currency bloc, but once the dust has settled there may be some winners.

Source: FOREX.com

What a 10% Rise in the Oil Price Looks Like

The dollar’s relationship with commodities was in full force last week. The sharp increase in the price of oil (up more than 10% since last Wednesday) was in stark contrast to the dollar, which fell sharply against its G10 counterparts, as you can see in the chart below.

The relationship between the dollar and commodities is a bit chicken-and-egg – what came first? Did the dollar cause commodities to rise, or was it the other way round? While this is a difficult question to answer, there is one part of the G10 FX space that can be affected: the commodity bloc of currencies.

As you can see in the chart below, the biggest movers were the NOK and the CAD, all up more than 3.5% last week vs. the USD. Norway and Canada are some of the largest producers of oil in the G10 space, so a 10% rise in the price of crude is likely to have a big impact.

But what about the dollar? The US is a major oil producer, yet the greenback tumbled last week. Even though the US is a major oil producer, the buck is not considered a commodity currency; instead, it tends to be lumped with the safe-haven currencies. As you may have guessed, labels can stick in the currency market.

So where will these currencies go next? The Nokkie and the loonie have both lost ground vs. the USD since the start of the year. The NOK had a renaissance at the start of this month, but USDNOK was already finding support ahead of 7.68 – the 100-day sma, as the crude oil price lost some ground on Friday. Thus, the strength of the Nokkie’s comeback could be determined by where the price of oil goes next.

The CAD is more interesting. It has been outperforming the dollar in recent weeks and USDCAD has tested some critical levels of support including the 100-day sma at 1.2214 after peaking above 1.28 in March. Interestingly, the correlation between oil and CAD has weakened this month. In March, the correlation with Brent was 62% while it was 68% for WTI. So far in April, the correlation has slipped to 42% with Brent and 53% with WTI. We continue to think that the oil price will be a major driver of the CAD; however, a spate of better economic data including CPI, retail sales and an optimistic tone from the Bank of Canada could protect the CAD compared to the other commodity currencies if the oil price loses ground this week.

Overall, commodities and currencies have a strong link, as we saw last week. However, there are many drivers of the FX market, so be careful not to rely too heavily on the oil price when trading the commodity bloc, especially the CAD.

_17_04_chart2_20150417194005.png)

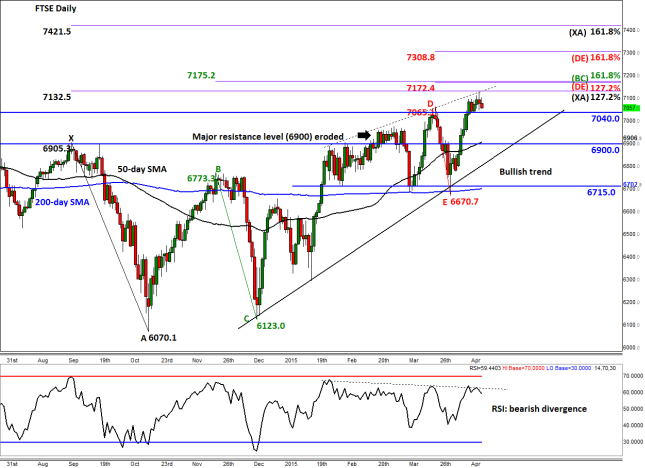

Look Ahead: Equities

Although the European stock markets were heavily in the red on Friday and for the week, the FTSE is managing to hold its own relatively well at the time of this writing. It hit a fresh record high on Thursday before pulling back slightly. In contrast, the mainland European stocks have sold off with the DAX for example easing over 500 points from its record level over the past five days. A combination of factors has weighed on risk sentiment, not least worries about the health of the world’s largest economies – the US and China – following the release of some soft data. In addition, concerns are growing over the future of Greece, where bond yields have jumped ahead of another key finance ministers’ meeting next Friday. If the Greek government fails to come to an agreement with the IMF then that could put the country in a technical default, which would undoubtedly rattle the markets.

On top of the Greek worries, the EUR/USD currency pair, which has been correlating strongly with the European indices of late, has staged a mini rally on the back of some soft US macroeconomic data. The small bounce in the EUR/USD has eroded the attractiveness of some European export-oriented companies which probably explains why the German DAX index has underperformed the most. Nevertheless, we remain fundamentally bullish on European stocks due to the ECB’s QE stimulus program and signs of an improving Eurozone economy. If uncertainty over the Greek situation eases, then the likes of the DAX and Spain’s IBEX could resume their upward trends soon. The focus for the US markets meanwhile will be the quarterly reporting season which has just got underway.

As mentioned, the FTSE has done relatively well compared to its European peers. But given the uncertainty surrounding the UK elections and the Greek situation, among other risks, are the bulls being too complacent? Although it might be tempting to think that way, it is important to remember that for long periods over the past couple of years, the FTSE has been underperforming quite badly; in other words, it is merely playing catch up now. Also, it is worth remembering that the FTSE is comprised mainly of large multinational corporations and as such the outcome of the election may not have a lasting impact on the FTSE, though certain stocks or sectors could be affected nonetheless. That being said, the biggest risk for the FTSE could be if we get a hung parliament. Even if this potential outcome has no economic impact, the uncertainty that comes with it may well undermine the appetite for risk in the short term.

Another reason why the FTSE has done well in recent days is the fact that oil prices have rallied (see below), which has boosted this commodity-heavy index. If oil prices continue to push higher from these still-low levels then that could be further good news for the FTSE next week. But there some technical signs that suggest a correction could be on the way. As can be seen from the chart, the recent higher highs on the FTSE have not been confirmed by the momentum indicator RSI, which in fact has created a series of lower highs. This suggests that the bullish momentum is waning. If the index closes below the 7040 support level on Friday then this could give rise to further follow-up technical selling at the start of next week. In this scenario, the index could potentially drop all the way back to the 6900 support level before making its next move. There it may also find some additional support from the 50-day moving average. The near-term trend would remain bullish until and unless it goes on to break the bullish trend line, which, if seen, could signal the start of a much larger correction. Meanwhile on the upside, the next bullish targets are the Fibonacci extensions levels that are displayed on the chart, derived from the past three price swings.

Source: FOREX.com. Please note this product is not available to US clients

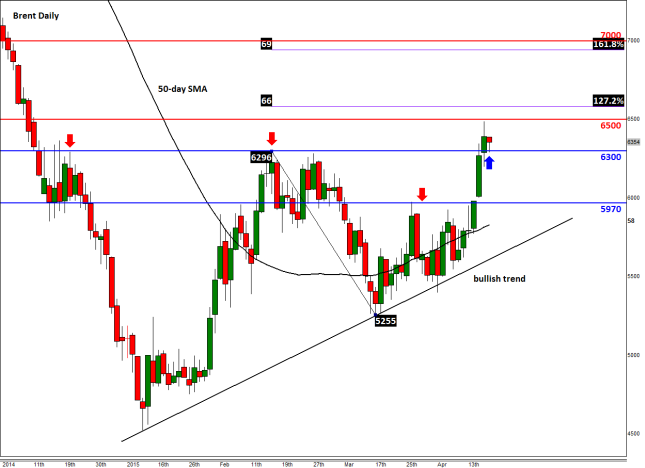

Look Ahead: Commodities

Crude oil prices have surged higher this week, breaking some key technical levels. Investors have piled back into the markets after the latest data from the Energy Information Administration showed US stockpiles grew a lot less strongly in the week to April 10 than they had been since the start of the year. The build of just 1.3 million barrels was below the expected reading of 3.5 million. On top of this, gasoline inventories decreased by a good 2.1 million barrels. Whether or not the market overreacted to the news remains to be seen for after all the small build was helped primarily by a 1.1 million decrease in imports from the previous week. But evidently, speculators are probably thinking that the worst days are behind us and may therefore expect to see an imminent drop in US oil output after months of falling rig counts. But if sanctions over Iranian oil are lifted – as a result of the recent nuclear agreement – then we would be back to square one as Tehran would undoubtedly ramp up output and other OPEC members will likely maintain their existing production levels to defend their market share. In other words, the oil market surplus may remain intact and thus continue to exert pressure on prices.

Meanwhile the longer term technical outlook for oil does not look as bearish now, with both contracts taking out key technical levels. Brent has taken out $63.00, an area which had acted as strong resistance in the past. Now that this is cleared, it may lead to fresh buying interest with the next potential bullish targets being at $65.00 (a psychological level) followed by the two Fibonacci extension levels of the last downswing at $65.75 (127.2%) and $69.40 (161.8%). Meanwhile WTI has now also cleared its corresponding resistance level of $54.00, a level which may turn into support upon retest. The near-term trend for the WTI contract is now bullish while it holds above the trend line or the broken resistance at $54.00. The next potential bullish targets could be the Fibonacci extension levels at $57.50 (127.2%) and $61.70 (161.8%). There is also the psychological handle of $60.00 which must be watched closely too, should we get there.

Source: FOREX.com. Please note this product is not available to US clients

Source: FOREX.com. Please note this product is not available to US clients

Global Data Highlights

Sunday, April 19, 2015

22:45 GMT New Zealand’s Consumer Price Index (Q1)

Just like everywhere else across the civilized world, New Zealand has been struggling with keeping a presentable inflation rate. There have been four straight quarterly consensus misses on this indicator, which may be one of the reasons consensus is so pessimistic this time around as it is predicting a -0.2% m/m reading. Whenever there is a negative sign in front of these numbers that means deflation, which is a bad thing in an economic sense; however, if this can jump back in to inflation territory, the NZD may benefit as a result.

Monday, April 20, 2015

No significant news events.

Tuesday, April 21, 2015

9:00 GMT German ZEW Survey – Current Situation & Economic Sentiment (April)

This indicator of sentiment in Germany has been gradually climbing over the last five months, but has slowed that growth on the last two releases. Consensus is calling for another increase, but not as aggressively as recent increases. Making the bar a little lower could give it the chance to both improve upon last month’s figure and be better than expected which may help give the EUR some “oomph” in the early part of the week.

12:30 GMT Canadian Wholesale Sales (February)

Don’t look now, but Canada is looking like an economic rock star of late. With the Bank of Canada taking a more optimistic stance, employment on the rise, and inflation back to decent, the CAD has become a currency trader’s favorite brand. Unfortunately, this Wholesale Sales release is a measure of February, when things looked a little more dire, so it may not follow the recent trend of great Canadian data releases. If that is the case, watch for a little CAD comeuppance as a result.

23:50 GMT Japanese Trade Balance (March)

There may not be much fanfare over this release, but it still has the potential to move markets. Japan has run a trade deficit since early 2011, and that isn’t expected to turn on this release, but getting back to a surplus is something that Abenomics is ultimately trying to accomplish by weakening the yen. Consensus is expecting a better result than last month and is actually within range of getting back to surplus. If it shows that surplus is potentially within reach in the near future, Japanese officials who think the USD/JPY should be closer to 105 may be closer to getting their wish as well.

Wednesday, April 22, 2015

1:30 GMT Australia’s Consumer Price Index (Q2)

We’re running out of ways to say that the world is struggling with inflation in the current global atmosphere, so here’s some caveman economics: inflation good, deflation bad. That’s all you really need to know about Australia’s CPI release as the higher the number is, the better it will be for the AUD. The recent trend is down, and expectations are dangerously close to deflation territory at only 0.1%; any beat of that figure could continue the AUD’s streak of strength.

8:30 GMT Bank of England’s Monetary Policy Committee Vote Count

This is another release where there may be much ado about nothing as the voters most likely voted unanimously to keep rates static. However, toward the end of 2014, there were a couple MPC voters who thought that a rate increase was appropriate. Considering the current lack of inflation in the UK as well, those voters most likely will remain with the majority.

14:00 GMT US Existing Home Sales (March)

The worm is slowly turning when it comes to opinions of US economic dominance over the last month or so as US data hasn’t lived up to increased expectations of late. The “death of a thousand cuts” type of thought process is coming to fruition as pessimism starts to creep in to the equation. It could be said that this has happened multiple times over the last couple months, but the USD has persevered. However, if we keep seeing data misses, that slow creep could trigger an avalanche. Existing Home Sales has missed consensus for four straight months, but is expected to be relatively strong this time around. If this indicator can shine through, USD dominance may start all over again.

Thursday, April 23, 2015

1:45 GMT Chinese HSBC Flash Manufacturing PMI (April)

The most recent release of Chinese GDP was a lackluster (for China) 7.0%, the worst reading since 2009. Economic prognosticators have been warning about the eventual decline of the Chinese growth engine for years, but now those warnings appear to be a little more grounded in reality. One reason for skepticism is the HSBC Manufacturing PMI that dropped back below 50 for the third time in four months. Expectations are that it will come in below that figure again, and if it does, the AUD and NZD may bear the brunt of increased doubt in Chinese economics.

8:30 GMT UK Retail Sales (March)

This has been one of the more hot releases in the UK of late as it has beat consensus in four of the last five months. Last month’s 0.7% increase was typical of the recent trend, but not as exuberant as the other beats. For what it’s worth, consensus is only expecting a 0.4% rise this time around, and if recent history can tell us anything, watch for a decent figure to be the ultimate result.

14:00 GMT US New Home Sales (March)

Unlike Existing Home Sales, the New Home variety has been on a bit of a hot streak with three straight better than expected results. Last month’s 539k was a seven-year high for the data point and potentially signaled a renewed vigor in US consumers. If that streak can be kept alive, watch for the USD to once again be crowned as King Dollar.

Friday, April 24, 2015

All Day Eurogroup Meeting

Greece. That’s really all you need to know about this Eurogroup meeting as tensions will be high heading in to it. Will Greece eventually default? If they do, look out below as parity in the EUR/USD could be reached. But, as we have seen time and time again, they may end up patching together something before the doomsday clock hits midnight.

12:30 GMT US Durable Goods Orders (March)

We tend to always include this seemingly minor release because of the difficulty in predicting what it will say. Consensus is often way off on the eventual result but, for what it’s worth, consensus is expecting a 0.7% increase. Going back on the last 12 releases, six have been better and six have been worse than consensus, so there may be no clear way to handicap it. Watch for a move for the USD in whichever way it leans after the release which may last longer than most economic releases simply due to its randomness.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.