Despite of mixed economic data from the US, the US Dollar (USD) managed to rise for a second day against most of its key counterparts, including the Euro (EUR) and the British Pound (GBP). The negative effect of weaker-than-expected private sector employment data and fall in US labor efficiency got negated by lower US trade deficit and strong ISM non-manufacturing PMI number. The ADP employment report showed US private sector employment increased by 156,000 jobs in April, which was well short of consensus estimates of 205,000 jobs. The US labor efficiency fell by a 1% annual rate in the first quarter of 2016, marking a fourth quarter of decline in the past six quarters. Meanwhile, the US trade deficit shrank in March to $40.4 Billion, lowest since Feb. 2015, and the ISM non-manufacturing PMI rose to its highest level since Nov. 2015 by printing 55.7 for the month of April.

The ADP report is considered as a precursor for the official jobs report, scheduled for release on Friday. Hence, should Friday's report also disappoint, USD could resume its near-term weakening trend. As of now, it seems that the greenback might have already formed a near-term bottom.

The GBP/USD pair's decline was led by weak construction PMI number released on Wednesday. UK construction PMI fell to 52.0 in April, down from a March's reading of 54.2, indicating deteriorating activity in UK's construction sector. Back-to-back weak PMI prints have dragged the pair lower by over 300-pips from a multi-month high level touched earlier during the week. The pair, however, has recovered from Wednesday's low and is currently trading above 1.4500 handle. The EUR/USD pair too, extended its reversal from over 8-month high level of 1.1616 tested on Monday, to currently trade below 1.1500 level.

The next key event risk for the GBP/USD pair would be UK services PMI figure due later on Thursday. This along with the weekly US jobless claims and building permits data for March would be eyed for some short-term tradable moves. However, the major focus would still remain on Friday's monthly US jobs data, which is likely to have a lasting effect on the currency markets.

Technical Outlook

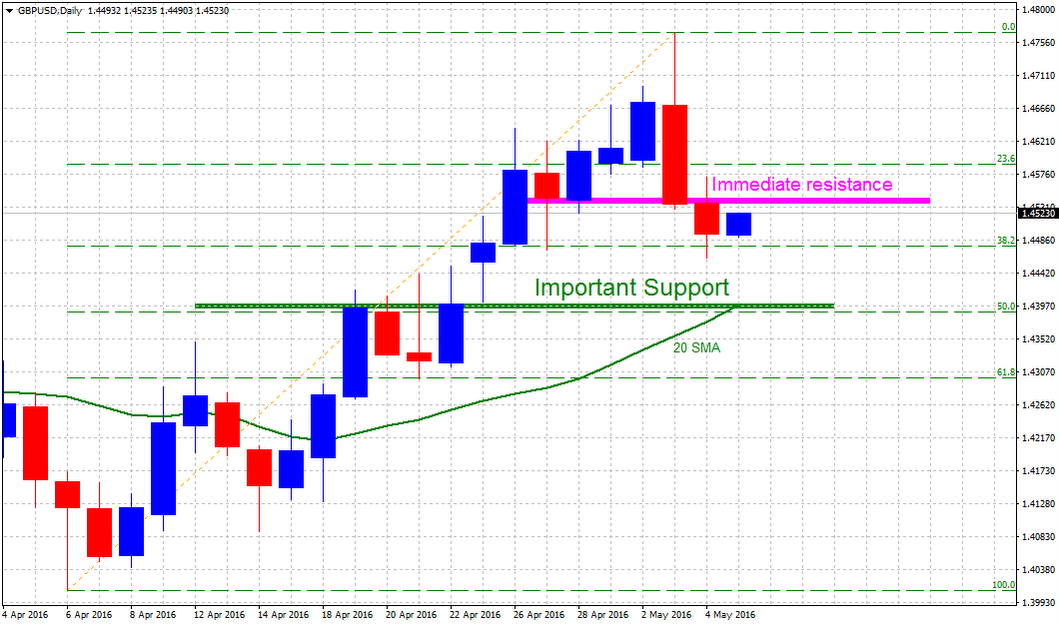

GBP/USD

The pair managed to rebound from 1.4480-70 support region (38.2% Fibonacci retracement level support of 1.4009-1.4770 up-swing) and hence, a follow through buying interest above 1.4530-35 horizontal resistance seems to assist the pair to move back towards 1.4590-1.4600 support turned resistance marked by 23.6% Fibonacci retracement level.

On the flip side, weakness back below 1.4500 handle and a subsequent break below 1.4480-70 support now seems to provide the required momentum to drag the pair towards testing its next major support near 1.4385-80 confluence region, comprising of 20-day SMA and 50% Fibonacci retracement level.

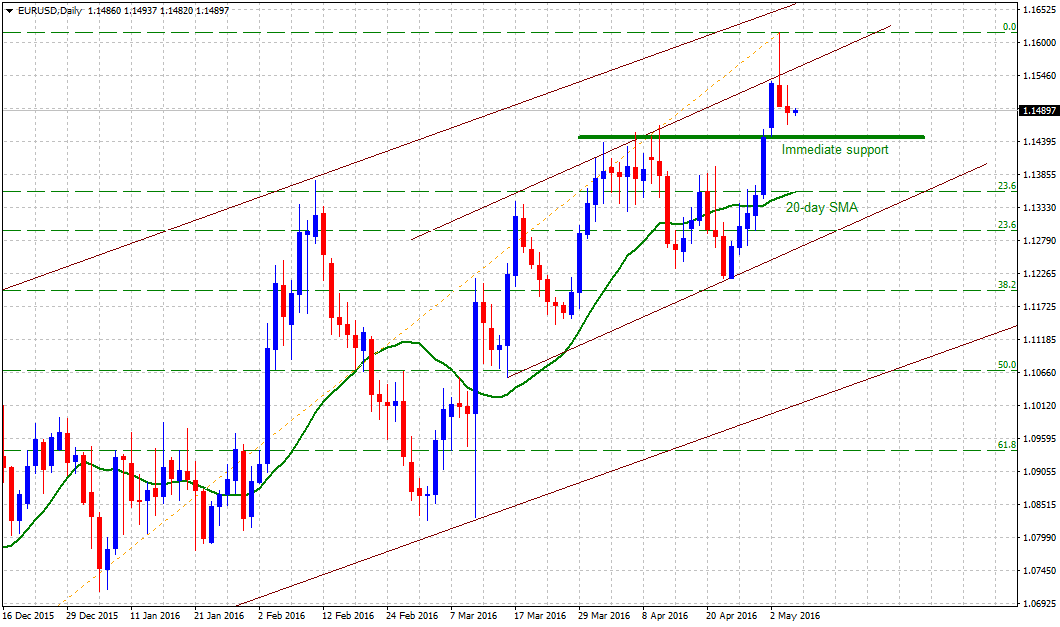

EUR/USD

The pair seems to attempt a move back above 1.1500 handle, which if cleared seems to boost the pair towards 1.1550-55 resistance area. Only a decisive move back above 1.1550 resistance would negate possibilities of any further downside and could assist the pair back towards 1.1600 round figure mark.

Alternatively, weakness below 1.1455-50 immediate support is likely to get extended towards next strong support near 1.1350 confluence region, comprising of 20-day SMA and 23.6% Fibonacci retracement level of 1.0522-1.01616 sharp up-move. Hence, a decisive break through 1.1350 support seems to open room for further corrective move in the near-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.