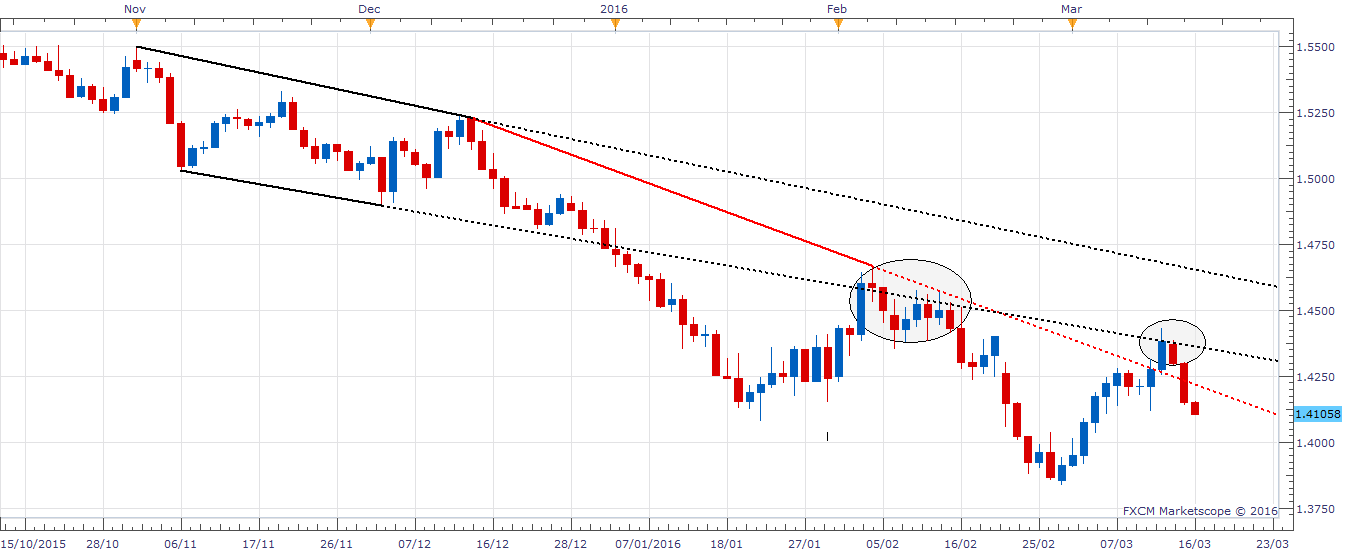

Renewed Brexit fears led to a slide in British Pound on Wednesday. The risk-off tone in the equity markets further added to the bearish pressure. Thus Cable breached the falling trend line support (then, now a resistance) and ended the day at 1.4149 levels. The main even for the day is the Fed rate decision and a possible outcome and resulting effect on GBP/USD and Gold is discussed here (Macro Scan).

BOE rate cut bets are rising

Latest Bloomberg survey showed economists put the probability of a BOE rate cut in 2016 at 23%. The probability stood at 10% a month ago. Market based measures (implied probability of hike/cut) shows a higher possibility of a rate cut in 2016. Markets see 12.5% probability of a rate cut in September and 13.7% in December. Meanwhile, rate hike probability stands at 1.7% in September and 8.6% in December.

A slowdown in the wage growth and dismal labor market data release could push up rate cut bets and weaken Pound. Apart from the data, markets would also keep a close eye on UK budget and new economic and fiscal estimates from the OBR. New estimates are likely to take into account a possibility of Brexit and thus paint a weak picture. This is likely to be referenced by the BOE statement tomorrow.

Technicals –Breaks below 50% Fibo

Sterling’s bearish daily closing back inside falling trend line (red) and below 1.4164 (23.6% of 1.5230-1.3835), followed by a break below 1.4136 (50% of 1.3835-1.4436) indicates the currency could test support at 1.4079-1.4065.

A violation there would expose 1.40 handle.

On the other hand, a recovery above 1.4117 (Mar 10 low) could see the spot re-test 1.4164 (23.6% of 1.5230-1.3835), but the bearish invalidation is seen only in case of a break above 1.4220 (rising trend line resistance).

A break above 1.4220 would shift risk in favor of 1.4284, which is followed by a hurdle at 1.4330.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.