Broad based USD selling in the NY session on Friday helped the GBP/USD chew through offers placed around 50-DMA and rise to a high of 1.4436. A minor bout of profit taking saw the pair end the day/week at 1.4381 levels. This was the second weekly gain as the so-called ‘Brexit’ issue has taken a backseat. However, the referendum is in June and till then another round of Brexit driven sell-off could happen.

The empty data calendar in UK and US leaves the pair at the mercy of the overall market sentiment. The main event this week is the Fed rate decision (on Wednesday), which will be followed by BOE rate decision, minutes and budget statement on Thursday. Pound’s two –week rally could end if the BOE tilts towards dovish side. Moreover, ECB’s big bazooka increases pressure on its UK counterpart to stay dovish.

Technicals – At make or break level

Sterling is looking to re-enter the falling channel (black) once again, but is having a tough time taking out the resistance at 1.4878.

Previous attempt to re-enter falling channel failed in early/mid Feb following which we had Brexit sell-off.

Hence, a failure to sustain/break above 1.4878 could push the spot back to its 50-DMA of 1.4313 – 1.4284. A break lower would expose the falling trend line (red) support at 1.4250.

Unless the daily closing is below 1.4250 the odds of a break above 1.4436 remain intact.

On the higher side, only a break above Friday’s high of 1.4436 would mean continuation of the uptrend and would expose 1.45 handle.

EUR/USD Analysis: Rising trend line resistance at 1.1178

The EUR/USD pair recovered from 1.1080 on the back of a broad based USD weakness to end the week at 1.1144 levels. The data calendar is light today and traders may look through the Eurozone industrial production release if the equity markets see action. Continuation of risk-on trading could push EUR lower and vice versa.

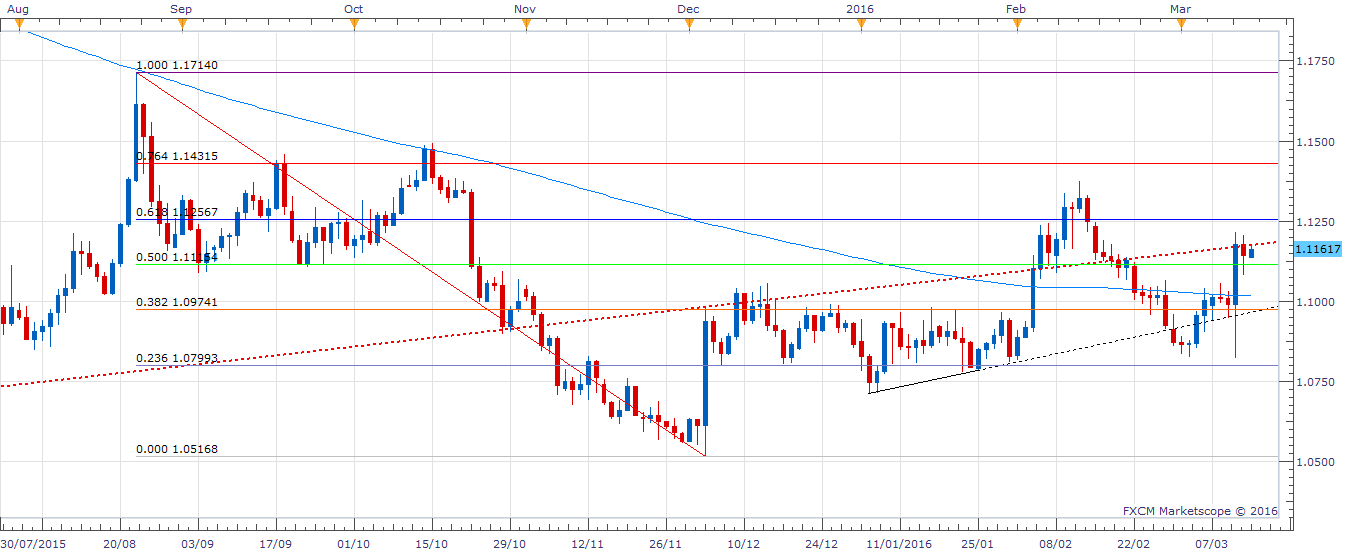

Technicals – Rising trend line resistance intact

Euro’s closing below the rising trend line resistance at 1.1178 (drawn from Mar low-Apr low and extended) and failure to take out the same in Asia today indicates the currency pair is likely to drift lower to 1.1115 (50% of 1.1714-1.0517).

Spot could chew through bids around 1.1115 amid rising stocks and open doors for a drop to 1.1080 (Mar 11 low).

On the other side, a break above 1.1178 would expose 1.1218 (Mar 10 high). However, bulls would jump in only above 1.1218 and the could take the spot higher to 1.1257 (61.8% of 1.1714-1.0517).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.