The GBP/USD pair snapped the 6-day winning streak on Tuesday by closing at 1.4211. The spot clocked a daily low of 1.4173 in the NY session and a high of 1.4275 in Europe. Sterling’s decline could be attributed to China-led risk-off in the equities and (dovish) comments from BOE’s Weale, who said rates could be cut or QE could be restarted if required. Meanwhile, Carney’s refused to provide full analysis of Brexit, but did mention a possibility of slide in Pound and rise in (imported) inflation if Brits vote to leave. The pair dipped in Asia today and currently trades around 1.4184 levels.

Eyes Industrial production figure

UK industrial production numbers are scheduled for release today. In annualized terms, the production is seen rising 0.1%, while month-on-month figure is seen at 0.5%. Manufacturing production is seen coming in at 0.2% m/m and -0.7% y/y.

Data could beat estimates

The Markit/CIPS Purchasing Managers’ Index, beat economists’ expectations and rose to a three-month high of 52.9 in January, up from 52.1 in December. January’s rise in UK manufacturing production was driven by a rise in domestic orders.

The survey had also painted a more upbeat picture than official data for last year, which showed manufacturing output stagnated in the final quarter of 2015.

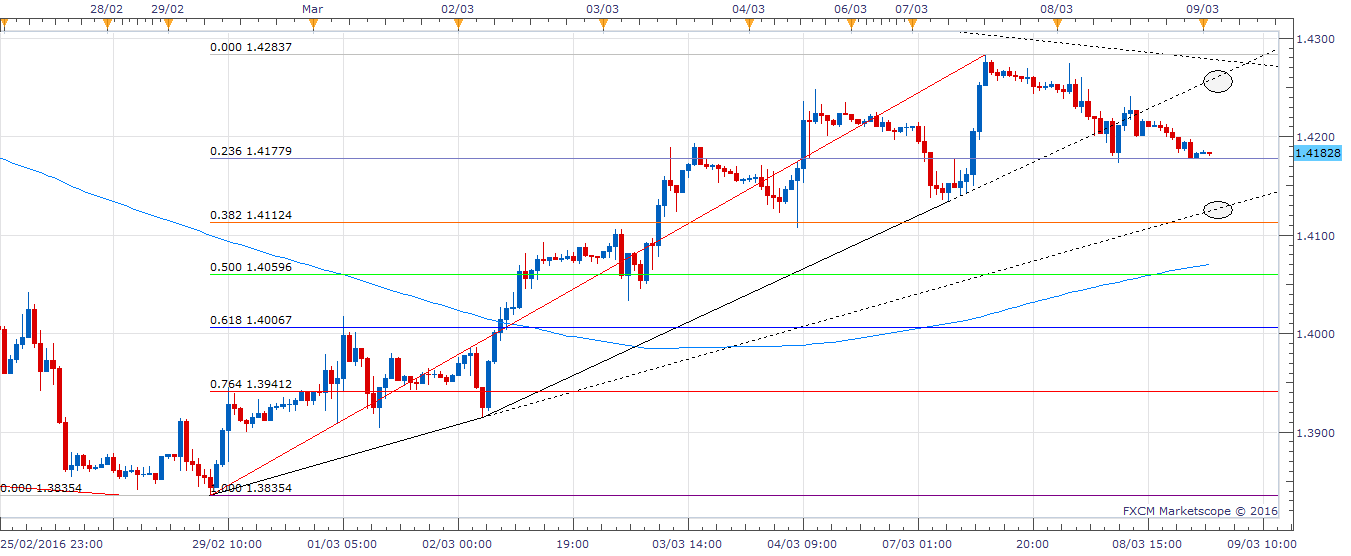

Consequently, odds of a better-than-expected manufacturing production figure are high. Given, the currency pair is finding support around 1.4178 (23.6% of 1.3835-1.4284), a better-than-expected UK data could trigger a rise to 1.4260 (rising trend line resistance).

Technicals – Strong resistance at 1.4330

Sterling’s failure to dip/sustain below 1.4178 (23.6% of 1.3835-1.4284) would open doors for a rally to 1.4260 (rising trend line resistance), which if penetrated would expose key hurdle at 1.4330 (23.6% of 1.5930-1.3835).

However, the currency pair needs to take out 1.4284 as it would signal failure of bearish price-RSI divergence noted yesterday on 4-hour chart. Only then, 1.4330 looks achievable.

On the other hand, a break below 1.4178 coupled with weak UK data could see the pair drift lower to next trend line support at 1.4128.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.