The USD selling ran out of steam in the NY session, courtesy of which the GBP/USD pair drifted lower to 1.4154 (38.2% of 1.4669-1.3835). The spot clocked a high of 1.4194 levels on broad based USD weakness.

Cable had dropped in Europe after the data in the UK showed the seasonally adjusted Markit/CIPS UK Services PMI fell to 52.7 in February, from 55.6 in January. The reading was the lowest since March 2013. However, the spot rebounded from 1.4032, which was a confluence of 23.6% of 1.4669-1.3835 and 10-DMA. Consequently, the bid tone strengthened further in early US session.

The main event for the day is the US non-farm payrolls release and its possible effect on GBP/USD pair is discussed here (Macro Scan).

Technicals – Bearish below 1.4154

Sterling’s failure to sustain above 1.4154 (38.2% of 1.4669-1.3835) coupled with overbought RSI on the 4-hour chart and bearish daily RSI could see the currency drop to 1.4079 (Jan 21 low).

A break lower would expose 5-DMA 1.4053-1.4032 (23.6% of 1.4669-1.3835).

On the other hand, a rebound from 1.4154, followed by a rise above 1.4179 (daily high) would open doors for a rise to 1.4252 (50% of 1.4669-1.3835).

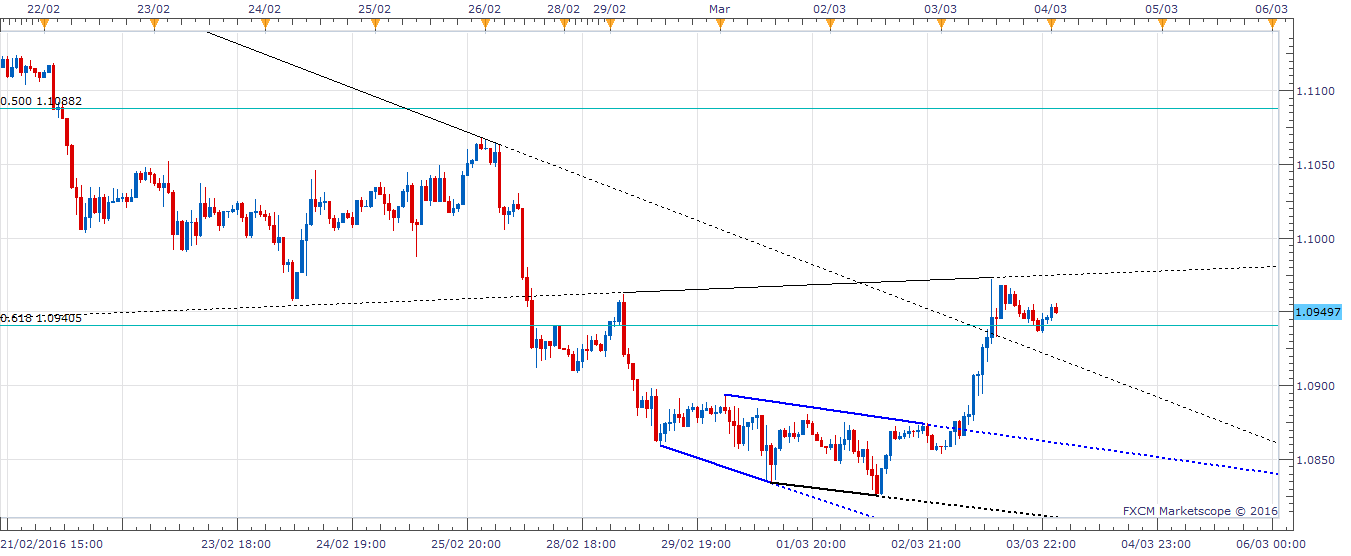

EUR/USD Analysis: Falling trend line breached

The EUR/USD pair spiked to 1.0973 levels on the back of broad based USD selling in the NY session. The Eurozone business conditions, as represented by the PMI indices, had one of the worst months in February. Deflationary pressures continued to strengthen as well. This solidifies expectations for further monetary policy easing.

As for today, the focus is entirely on the US non-farm payrolls release. The impact on the EUR/USD pair is discussed in detail here (Nonfarm Payrolls Forecast).

Technicals – Is it forming Inverse head and shoulder?

Euro breached the falling trend line on the hourly chart and currently sits above 1.0940 (61.8% of Mar 15 low-Aug high).

The hourly chart shows, the pair could form an inverse head and shoulder pattern if it dips to around 1.09 levels and rebounds. In such a case, the neckline resistance is seen at 1.0975.

Bear grip would strengthen if the spot takes out falling trend line support at 1.09, in which case the prices could drift lower to 1.0860.

An inverted head and shoulder breakout would open doors for a rise to 1.1125 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.