The GBP/USD pair recovered from the low of 1.4360 after the BOE minutes showed the policymakers still expect a gradual rate hike. However, the minutes did not hint at a specific time of the first rate hike. Also the minutes said the weak Pound may help ease disinflation. Consequently, the recovery ended at 1.4445 following which the pair fell back to end the day largely unchanged at 1.4409 levels.

Weak US retail sales could trigger recover in Cable

The pair managed to end the day above 1.4372 (76.4% of Jan 2009 low-July 2014 high) and formed a Doji on the daily charts. Hence, the odds of a technical correction are high. Consequently, a weak US retail sales figure could help the Cable close above 1.4460 levels.

The US retail sales growth is expected to have stalled in December, compared to a 0.2% rise seen in November. This is a bad news since it means the consumption remained depressed despite the festive appeal – Christmas holidays. The retail sales ex autos is seen rising 0.2%; compared to Nov’s 0.4% rise.

The US economy is already suffering from a recession in the manufacturing sector. We also have a fresh instability in the financial markets. Hence, a weaker-than-expected retail sales figure could reduce March rate hike bets and trigger a correction in the GBP/USD pair. If the data surprises markets on the positive side, the GBP/USD pair could see a break below 1.4340.

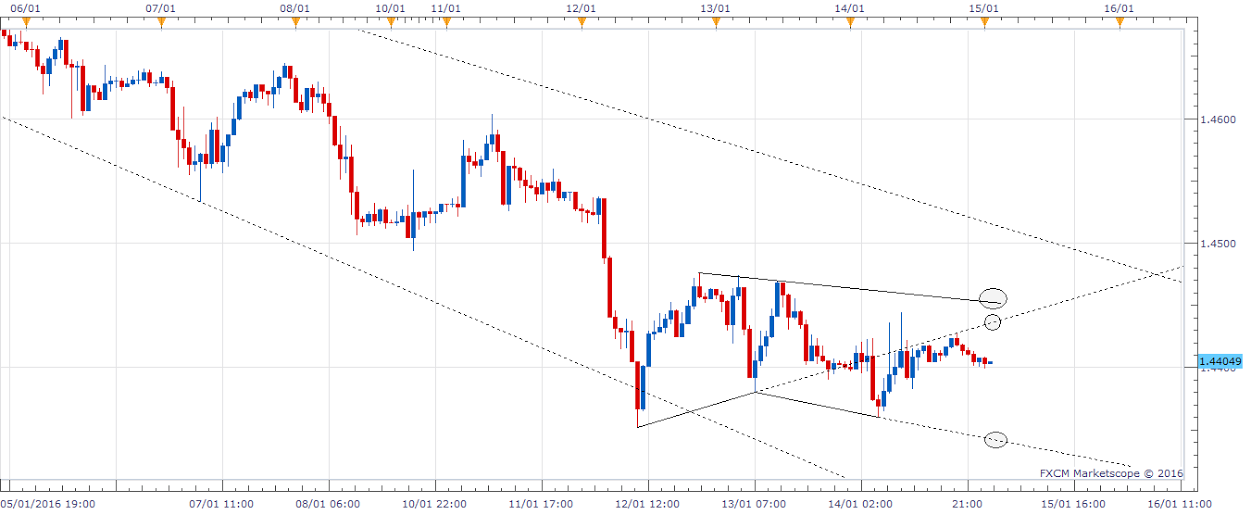

Technicals – Eyes 1.4460

Sterling’s daily close above 1.4372 (76.4% of Jan 2009 low-July 2014 high) coupled with oversold RSI indicates the currency is likely to target 1.4460 (support of the trend line drawn from July 2013 low – April 2015 low) levels today.

Ahead of 1.4460, minor resistance is seen at 1.4434 & 1.4454(trend line resistance on the hourly chart). A failure to sustain above 1.4434 would trigger a fresh sell-off to 1.4340 (channel support seen on the hourly chart).

EUR/USD Analysis: Falling channel intact, but could re-test 1.0940

The EUR/USD pair clocked a high of 1.0940 on the back of a serious risk aversion in the European equities before falling to a low of 1.0835 after the ECB minutes left the doors wide open for more deposit rate cuts in future. The uptick in the US equities also kept the EUR under pressure. The pair ended with minor losses at 1.0863 levels.

Focus on stocks and US data

The pair remains at the mercy of the action in the major European equity markets. The Asian equities dropped and the risk aversion helped the EUR/USD pair jump 20 odd pips to 1.0890. The pair could revisit 1.0940 if the risk aversion in Asia hits the European shorts.

If the European equities trade firm, the EUR/USD pair risks falling back to 1.0840-1.0830 levels ahead of the US data. In this case, it would take a horribly weak US retail sales number and risk aversion on Wall Street to push the pair back to 1.0940 levels. Meanwhile, a break below 1.0813 (50-DMA) would happen if the US retail sales surprise on the positive side and the US stocks rally.

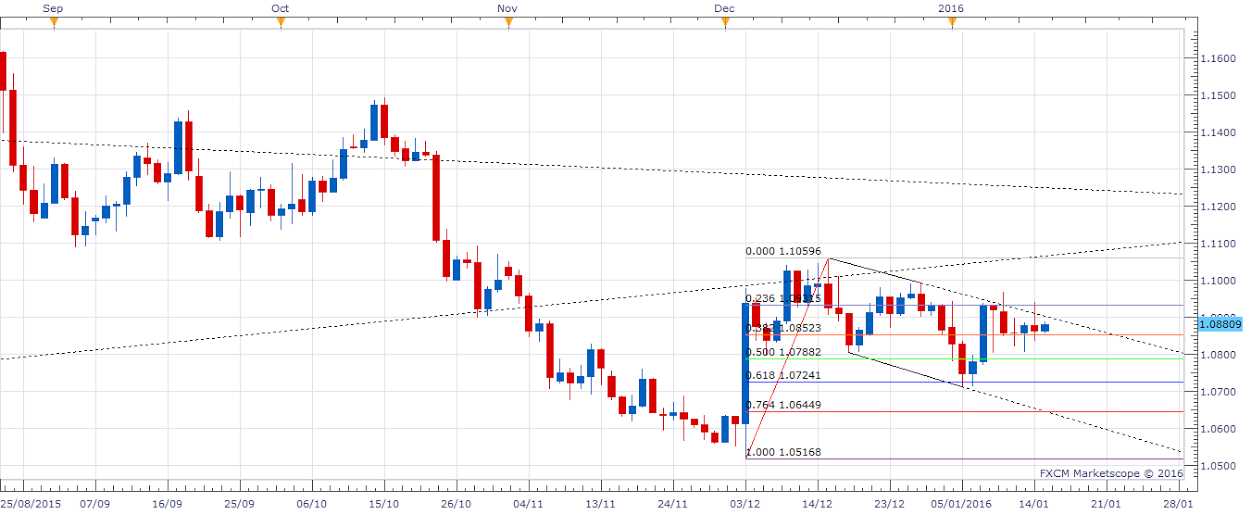

Technicals – Bullish break still possible

Euro’s negative closing on Thursday kept the falling channel formation intact, however the odds of a bullish break still exists since –

Euro has repeatedly bounced off from the 50-DMA and thus outlook would turn bullish once the 50-DMA support is breached.

Pair has bounced off 1.0852 (38.2% Fibo of 1.0517-1.1060) in Asia

Thus, a re-test of 1.0940 could be seen. A daily close above the falling channel resistance would mean the uptrend from the December low of 1.0517 has resumed.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.