The GBP/USD pair rose to an intraday high of 1.5596 in the NY session as markets turned a blind eye towards an upbeat US durable goods report. The US dollar was offered across the board as markets speculated that the Fed could put more emphasis on the overseas turbulence (rout in Chinese equities) in its policy statement on Wednesday, indirectly hinting at a possible delay in the rate hike. The resulting weakness in the US Treasury yields weighed over the USD. Meanwhile, a rise in Gold prices in the Asian session on Monday also helped GBP and other European currencies began the week on a positive note.

Focus on UK GDP data

Second quarter GDP numbers are scheduled for release on Tuesday and growth is expected to have accelerated at a faster pace.

UK GDP YoY Q2: expected 2.6%, previous 2.9%

UK GDP QoQ Q2: expected 0.7%, previous 0.4%

A marked improvement in the economy is expected, mainly on account of low interest rates, a decisive General Election result and rising incomes. The trade deficit also narrowed in May, which further lends support to the GDP number. The GBP may could rally to 1.5590-1.56 levels in anticipation of the upbeat GDP number. Consequently, a break above 1.56 could happen only if the GDP number is higher than the estimates. With no positive surprises, the GBP/USD pair is more likely to fall back to 1.5550 levels.

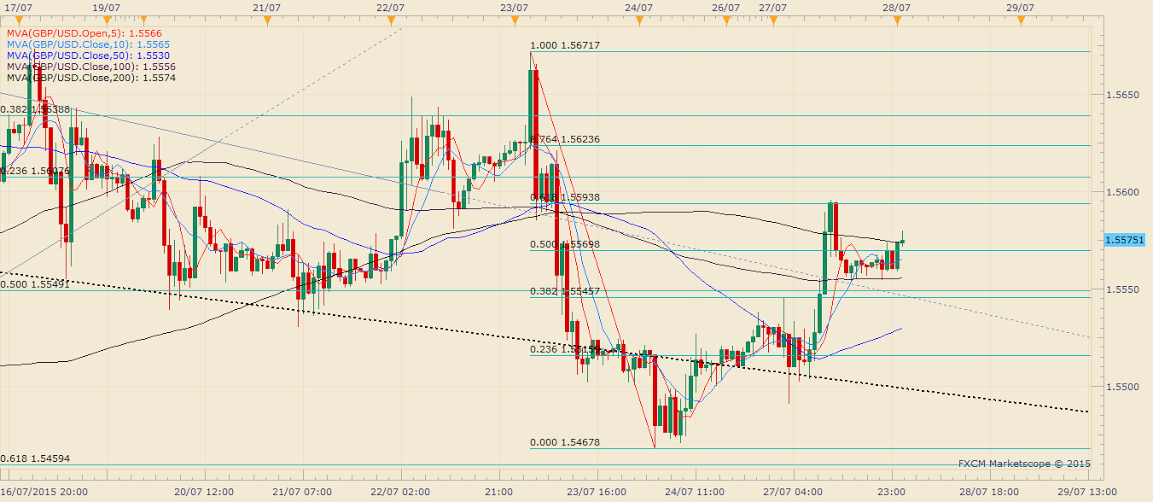

Technicals – Failure to sustain above 1.5568 could be bearish

The spot struggled to extend gains above 1.5593 (61.8% Fib R of 1.5671-1.5467) in the previous session and closed below 1.5568 (38.2% Fib R of 1.7191-1.4563). At the moment, the spot is trading around 1.5575. Fresh bids are seen only above 1.5593. On the other hand, failure to sustain above 1.5568 could bring in fresh offers and drive the spot below its 50-DMA at 1.5550 towards 1.55 levels. In case, the UK GDP fails to provide a positive surprise we could see the spot drop below 1.5568 and extend losses towards 1.55 levels. On the other hand, a break above 1.5593 could send the spot higher to 1.5650-1.5670 levels.

EUR/USD Analysis: EUR once again rises on risk aversion in stocks

The EUR/USD pair rose to an intraday high of 1.1128 on Monday amid the sell-off in stock markets across the globe. The previous session added to the growing evidence that the EUR is increasingly being used as a funding currency, and thus, strengthens during risk aversion in the equity markets. The EUR strength may have also been due to markets speculating that the fed may delay its rate hike due to turbulence in the overseas markets (China stock market rout).

EUR unlikely to spike as Asian stocks and US index futures stabilise

The Chinese equity markets have extended Monday’s drop by another 1%. However, the US index futures are still holding pretty well in the positive territory. Gold prices are struggling as well, trading around USD 1195/Oz levels. Consequently, the EUR is unlikely to witness a sharp jump as it did in the early European session on Monday.

Technicals – stuck at 50-DMA

The spot clocked a high of 1.1128 but closed below the 50-DMA currently located at 1.11 handle. The prices witnessed an upside breakout from the rising channel on the hourly chart, but the momentum stalled at 1.1126 (50% of May-June rally). The spot is now back inside the rising channel with immediate resistance at 1.1089. Failure to rise above the same, followed by a drop below 1.1083 could lead to an minor head and shoulder neckline seen on the hourly chart at 1.1075. A break below the same could open doors for 1.1030 (hourly 50-MA). On the higher side, fresh bids are seen only above 1.1126.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.