The GBP/USD pair ended slightly higher on Tuesday on the back of a better-than-expected UK trade deficit data and a favorable UK-US 10-year yield spread. A strong intraday 100-pip recovery was seen in the Nort American session on comments from UK foreign secretary Hammond that there is no way the UK would become a part of currency union.

The pair rose to a high of 1.5431 in the Asian session today after BOJ’s Kuroda’s comments about little scope for further weakness in the Yen REER triggered a broad based USD sell-off. Ahead in the day, we have the UK industrial production due for release. The data is expected to show a slowdown in the activity in April. month-on-month figure is seen at 0.1%, prev 0.5%, while year-on-year is seen at 0.4% from 1.1%. However, the election uncertainty in April may be behind the weak expectations. Consequently, the markets may not pay much attention to the weak number until and unless it shows outright drop in negative territory. Thus, GBP/USD is unlikely to feel a significant heat from a weak data. However, in such a case more time would be spend to take out 1.5439-1.5450. Meanwhile, there is always a possibility of a positive surprise in the form of a better-than-expected GDP data, thereby leading to a quickfire rally towards 1.5490.

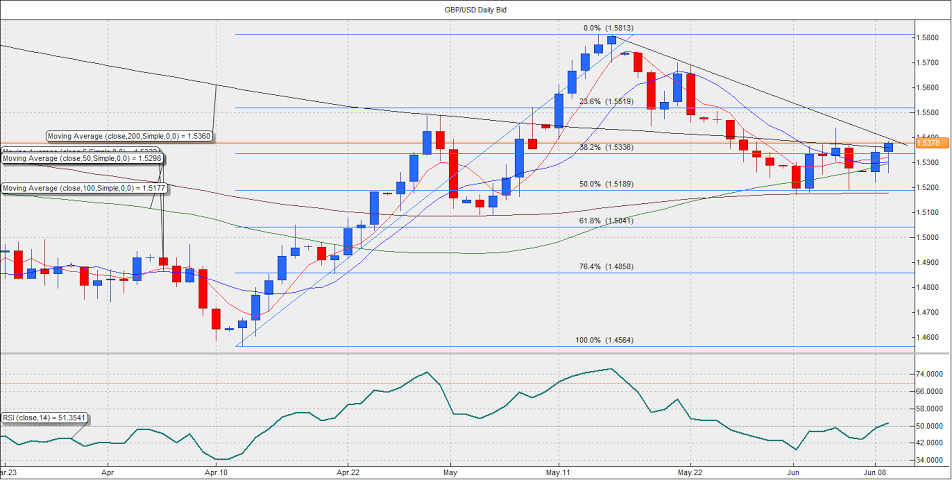

On the charts, we see the pair recovered smartly in the previous session above 1.5336 (38.2% Fib R of 1.4564-1.5813) and its 200-MA located at 1.5356. The pair also managed to score a daily close above the said levels, thereby opening doors for 1.5439 (June. 4 high). The pair has also taken out the falling trend line resistance on the daily chart in the Asian session today. Given the sharp rebound above key levels in the previous session, the pair is likely to extend gains to 1.5490 today. On the other hand, a fresh failure to take out 1.5439 could push the pair back to 1.5356 (200-DMA). The short-term outlook stays bullish so long as the pair trades above 200-DMA.

EUR/USD Analysis: Sell on Rise?

The shared currency witnessed another volatile session, as the EUR/USD pair printed an intraday high and low of 1.1344 and 1.1212 before finishing the day at 1.1291 levels. The markets ignored the US-German 10-year Bund yield spread, which narrowed to 148 basis points from 152 basis points seen on Monday. The technical factors appeared to overshadow fundamental ones, as the pair ran into offers below 1.1293 (23.6% Fib R of 1.3991-1.0461).

Given the absence of a major market moving data release in the Eurozone today, the EUR/USD pair is likely to be influenced by the movement in the EUR/GBP cross, markets appetite for the US dollars and the US-German 10-year yield spread.

The pair once again failed to score a daily close above 1.1293 (23.6% Fib R of 1.3991-1.0461) on Tuesday. At the moment, the spot is trading at 1.1330 with the daily RSI indicating more upside to come. A rise to 1.1378 could be seen in case the pair manages to take out offers in the range of 1.1344-1.1350. On the flip side, a failure to sustain above 1.1293 could see the pair target 1.1228 levels. Given the repeated failure to see a daily close above 1.1293, the pair is likely to be offered on rise.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.