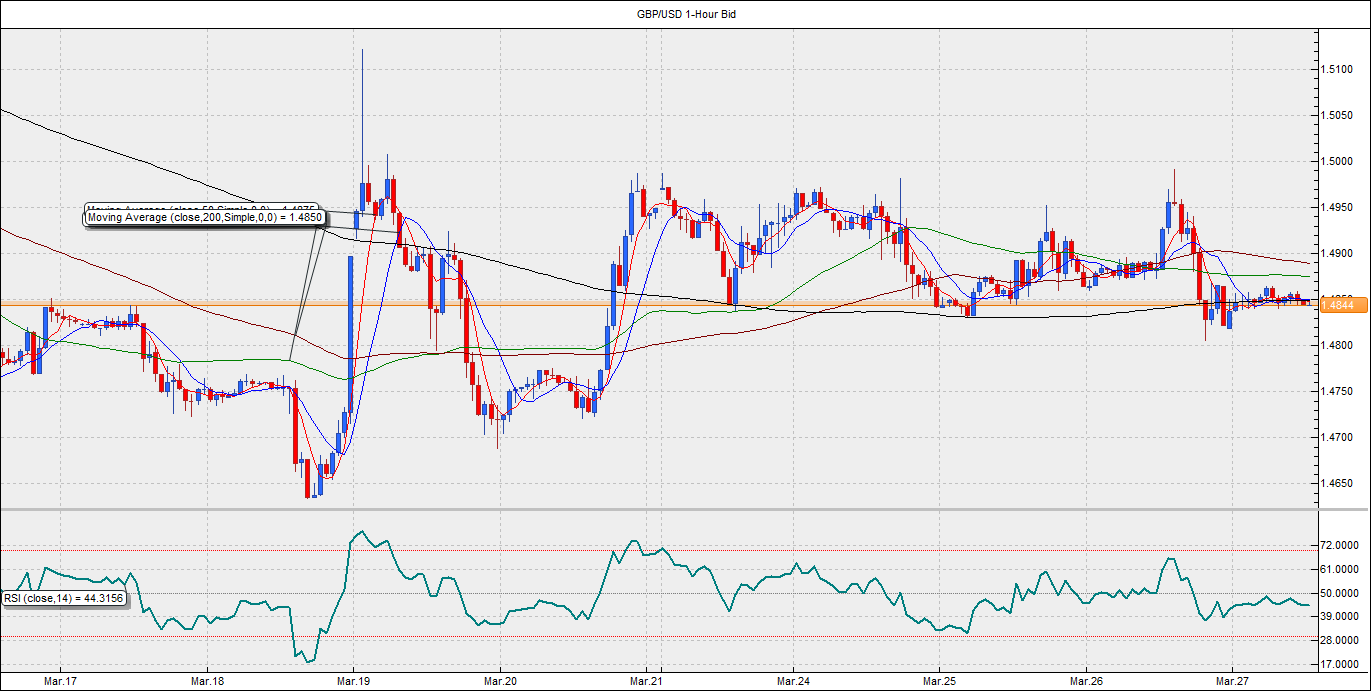

The GBP/USD pair failed once again around 1.5 levels despite the release of a better-than-expected UK data on Thursday. Retail sales rose 0.7%, compared to the market's 0.4% forecast. The prior figure report was also revised higher to 0.1% from -0.3%. The pair rose to a high of 1.4992, but failed to sustain gains. I had mentioned in the previous day’s report that it is essential that the pair ends above the channel resistance at 1.4976, failure to do so could be bearish. Consequently, a strong US data triggered a wave of selling, that pushed the pair down to a low of 1.4805. The pair now trades at 1.4846

On the hourly charts, we see the pair finally broke below the hourly 200-MA at 1.4850 in the previous session, and continues to trade below the same today. Moreover, the hourly chart shows, the pair has breached triple top formation with the hourly 200-MA acting as a neckline. This opens door for a technical target of 1.47-1.4720. However, the immediate losses could be capped around 1.48, under which the sell-off could be intense. On the other hand, a weaker-than-expected US Q4 GDP could push the pair higher to 1.4890 (hourly 100-MA).

EUR/USD Forecast: Could dip to 38.2% Fib level

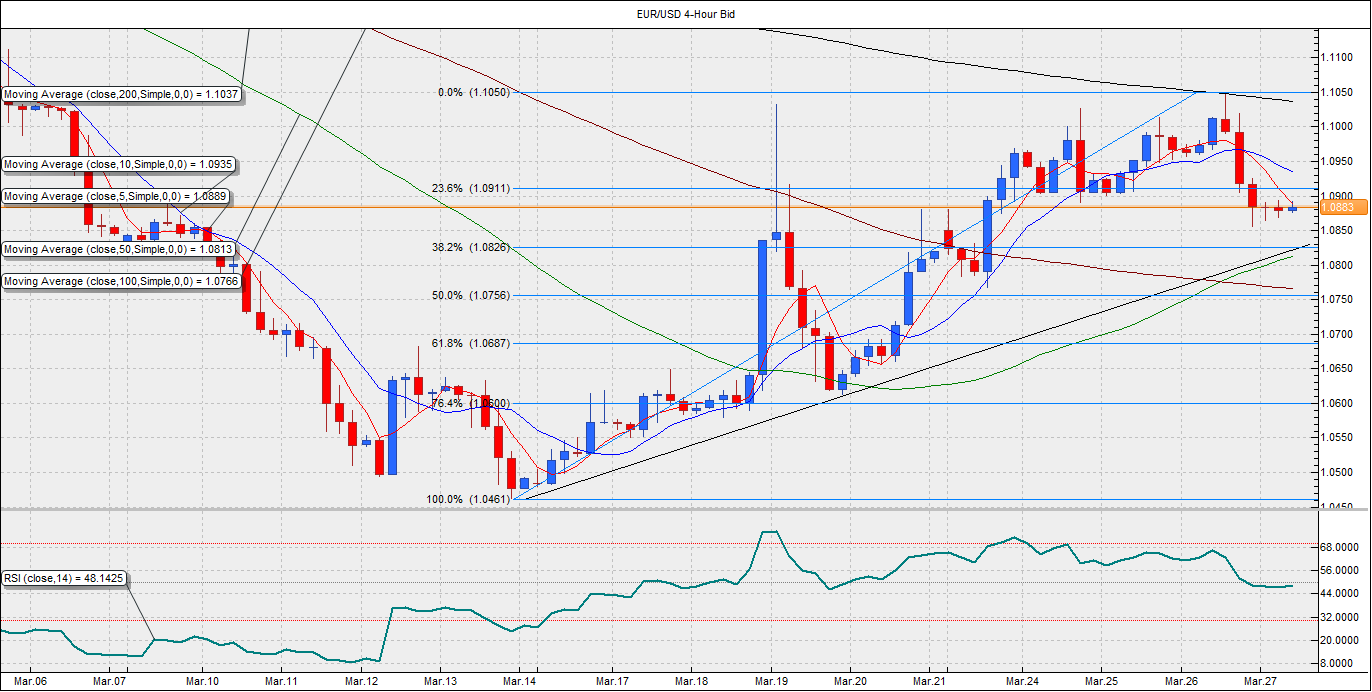

The EUR/USD pair rose to a high of 1.1050 before falling back below 1.09 levels on a better-than-expected US data and reversal in equity markets. No major Eurozone data was released, while nothing new came out of Draghi’s speech in Italian parliament. However, a dip in the US weekly jobless claims to six-week low and a better-than-expected services PMI pushed the EUR/USD pair back below 1.10 levels. Moreover, it marked a third failure to sustain above 1.10 this week, which also brought technical selling pressure, which pushed the pair to a low of 1.0855. Euro could catch a bid wave in the European session, although significant gains are ruled out since the markets are favoring the USD ahead of the final US Q4 GDP print.

On the charts, the pair, currently at 1.0883, trades below 1.0911 (23.6% Fib retracement of 1.0461-1.1049). The daily RSI has also been pushed below 50.00 levels, indicating further room for a decline in the pair. The pair is also struggling to rise above 5-MA on the 4-hour chart. The RSI is also bearish on the hourly and 4-hour time frame. Thus, we could see the pair drop to 1.0826 (38.2% Fib retracement of 1.0461-1.1051). On the other hand, a rise above 1.0911, could see the pair re-test 1.0960-1.0970.

USD/JPY Forecast: Awaits US GDP

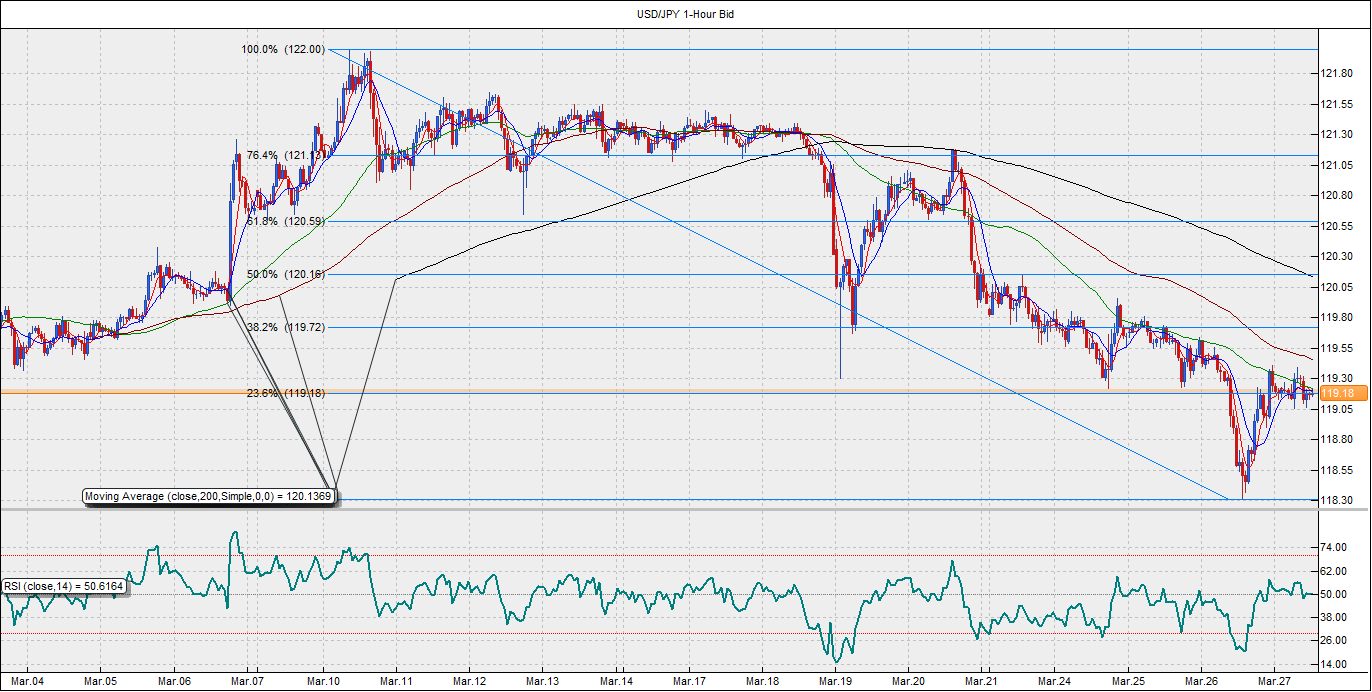

The Japanese Yen turned out to be the biggest beneficiary of the safe haven flows ahead of the US session on Thursday. However, the gains in the Yen were quickly erased after an upbeat US weekly jobless claims data and services PMI data pushed the 10-year yield to 2.00%. The USD/JPY pair recovered from the low of 118.31 to 119.18. The pair also received support from fed’s Lockhart, who said the rates could be hiked in June, July or September. The pair now awaits final Q4 US GDP numbers, scheduled for released today along with revisions to the University of Michigan Consumer Sentiment Index.

The pair currently trades at 119.19; below the 100-MA located at 119.23. So far for the day, we see a Doji candle on the daily chart, which can be expected ahead of a critical US data release. A break above 119.19 (23.6% of 122.00-118.31), could see the pair re-test the 50-DMA located at 119.46. On the other hand, a failure to rise above 119.19, could push he pair back to 118.61. The pair is likely to remain stuck in the range of 119.46-118.61 levels ahead of the Q4 GDP report in the US.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.