The GBP/USD pair fell to an intraday low of 1.5045, before ending the day on a weak note at 1.5054. The economic calendar in the UK and US was empty and hence pair was the mercy of the overall demand for the US dollars, which spiked in Europe as traders priced-in an increased possibility of the Fed liftoff following Friday’s upbeat NFP report.

Awaits UK industrial and manufacturing production data

UK industrial and manufacturing output numbers is scheduled for release today at 09.30GMT. Both, the industrial production and manufacturing production, are expected to stall in October. In annualised terms a minor improvement is expected.

Manufacturing accounts for about a tenth of the economy. Of late, both manufacturing and service sector PMIs have cooled significantly. However, the manufacturing PMI had spiked in October an acceleration in output growth and an increase in new orders. The headline figure in October was the best since June 2014. Hence, there is a possibility of a better-than-expected manufacturing production number hitting the wires today.

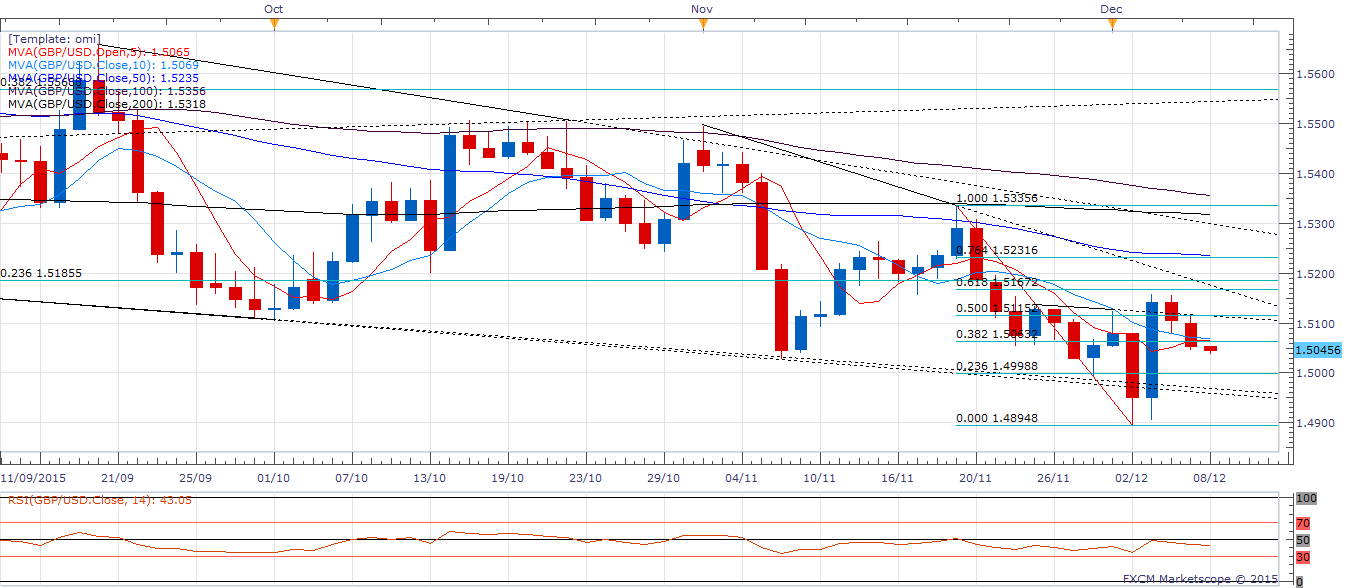

Technicals – Increased odds of a bullish move

Sterling’s 250-pip rally from Wednesday’s bottom, followed by a minor 100-120 pip correction (stalling near 50% fib retracement of the 250-pip rally at 1.5027 in Asia today) indicates the GBP bulls may make a comeback in Europe and take the pair higher to 1.51-1.5115 (50% of 1.5336-1.4895). A break higher could see the pair test 1.5159 (Thursday’s high). On the other hand, only a break below 1.5027 (50% of 1.4895-1.5159) would shift risk in favour of a break below 1.50 and re-test of 1.4957 (76.4% Of 1.4895-1.5159).

EUR/USD Analysis: China-led risk off could support EUR

The EUR/USD pair dipped to an intraday low of 1.0796 on Monday as the USD advanced across the board as Friday’s upbeat NFP convinced markets that the Fed would rate rates at its December 16th meeting. The rally in the European stocks also added to the bearish pressure on the EUR in Europe. However, the sharp drop in crude prices to fresh multi-year lows and the resulting losses in the US equities helped the EUR/USD pair trim losses to close at 1.0837. The pair now trades at 1.0855 levels.

Weak China could rattle European stocks and support EUR

The Asian stock markets turned risk averse after the data in China showed exports fell by a more-than-expected 6.8% in November from a year earlier, their fifth straight month of decline. However, the drop in exports will not be cause for a risk-off in Europe.

The European economies need healthy consumption in China, but, the import side in China is equally weak. Imports fell 8.7% and that is expected to rattle the European equities. The commodities rout has already deepened following China data and that could weigh over the mining heavy UK’s FTSE. The German economy (with its 10% of total exports exposure to China) is equally vulnerable. DAX could weaken as well. The risk aversion in the markets could see the EUR/USD strengthen.

Technicals – Bullish above 1.0808

Euro’s recovery above 1.0808 (July 20 low) on Monday has opened doors for a re-test of 1.0890 (38.2% of 1.1495-1.0517). A failure to take out the same would open doors for a re-test of 1.0808 levels. On the other hand, a break above 1.0890 would expose 50-DMA at 1.0960. Overall, the pair could re-test 1.0808 levels today,followed by a rebound, leading to a break above 1.0890 and re-test of 50-DMA at 1.0960.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.