The GBP/USD pair witnessed a bearish break from the daily charts on Wednesday. The first blow to Sterling came in the form of the construction PMI, which printed at multi-month lows. The cable fell to 1.50 levels and extended losses further to a session low of 1.4895 levels on the back of a stellar US ADP private sector employment report and hawkish comments from the Fed’s Yellen. Profit taking helped the pair recover off lows to end the day at 1.4950.

Focus on UK services PMI

The third and most important PMI – services, is due for release today. Both the manufacturing PMI and construction PMI were weaker and carried dismal new work inflow and employment details with them. Services activity accounts for a major part of the UK economy and thus a weaker-than-expected print would be the final nail in the coffin for the Sterling bulls. The services PMI for November is seen largely unchanged at 55.00 compared to Oct’s 54.9.

As said earlier, the pair has already suffered a bearish break from the falling channel on the daily. So a weaker-than-expected services PMI would be enough to send the pair well below 1.49 handle.

On the other hand, anything above 55.00 could trigger a minor technical correction, since the pair is oversold on the intraday charts. The magnitude of the technical correction would depend on the positive gap between the actual PMI figure and the expected PMI figure.

Ahead of the PMI report and after the effect of the UK PMI has played out, the action in the EUR/GBP (ahead of the ECB rate decision) could influence the GBP/USD pair.

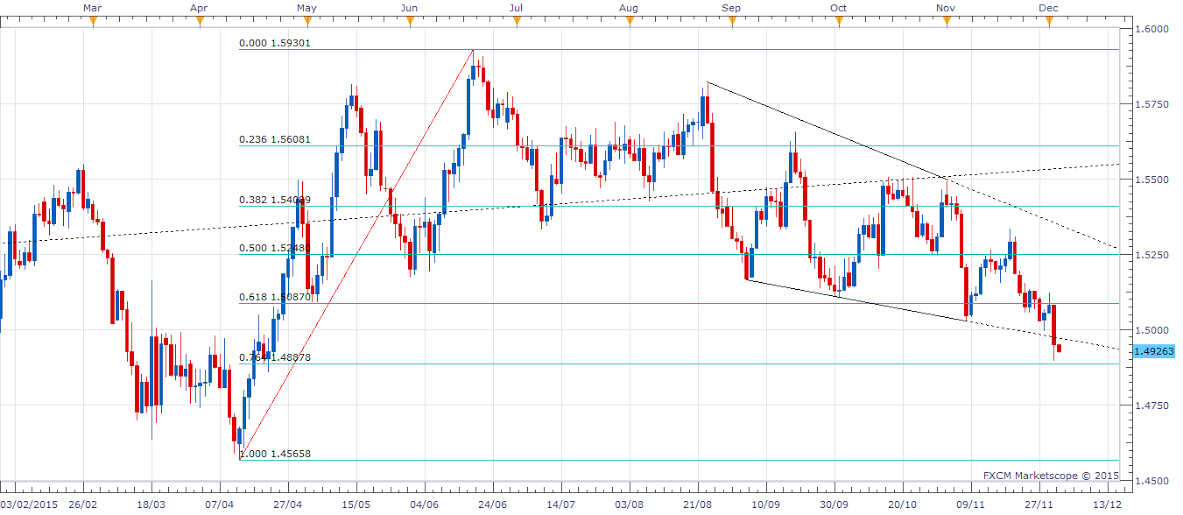

Technicals - Bearish break, but oversold on intraday charts

Sterling’s sharp fall from the Nov 19 high of 1.5336 to a low of 1.4895 has left the currency oversold on the intraday charts.

The currency pair could witness a minor technical correction to 1.4972 (falling channel resistance). A failure to take out/sustain above the same would keep the risk of a sell-off to sub- 1.4888 (76.4% of Apr-Jun rally) level intact. Under the same, the pair could test 1.4856 (Apr 21 low).

Only a surprisingly strong UK PMI report could ensure the pair sustains above 1.4972 and extends gains to 1.50 handle.

EUR/USD analysis: Risk of short-unwind, the ECB may undershoot expectations

The EUR/USD pair fell to a low of 1.0551 on Wednesday on the back of a weaker-than-expected annualised core CPI and headline CPI and due to a stellar US ADP report. However, the common currency witnessed a short covering rally to 1.0618 in the NY session, but fell again in Asia today to 1.0590 levels.

All eyes on ECB, services PMI could be non-event

The services PMI reports are due for release across the Eurozone. The EUR/USD pair may move few pips here and there after services PMI release, but the major action is likely to be seen after the ECB rate decision. As discussed here (), a case of unwinding of the EUR shorts appears compelling.

The odds of the ECB undershooting the expectations inched higher after the Bloomberg report released yesterday said the bank is unlikely to announce a major change in its economic forecasts; which also indicates a low probability of the aggressive action.

It is worth noting that the ECB has often let out it its major policy decisions a day before the official announcement.

Bloomberg carried a report detailing the OMT announcement ahead of the Sep 6 2012 meeting

Bloomberg was also out with a report detailing the ECB’s action a day before the January 2015 meeting.

On both the occasions, ECB’s actions were in line with the Bloomberg reports released a day earlier. So it is quite possible that the ECB may keep its economic forecasts largely unchanged and refrain from announcing aggressive measures except what is already priced-in – deposit rate cut and a minor tweak in the QE program.

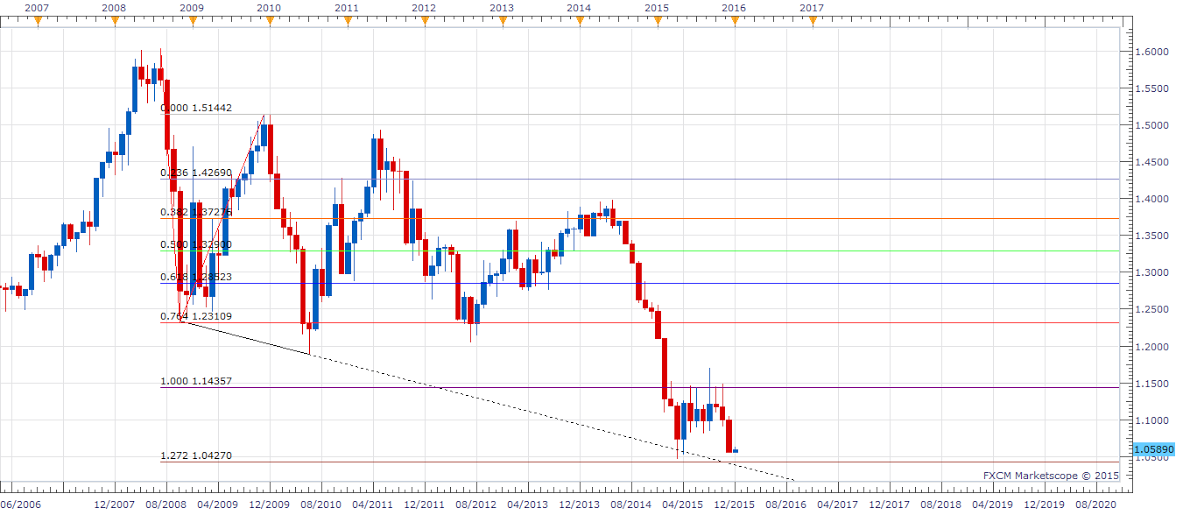

Technicals – Broader range – 1.0808-1.0390

Euro could spike to 1.0808 (July 2015 low) in case the ECB undershoots expectations. On the other hand, aggressive ECB action could send the pair down to the trend line support at 1.0390.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.