The GBP/USD pair rose to a high of 1.5124 in early Europe, followed by a drop to a low of 1.5050 on the back of a weaker-than-expected UK manufacturing PMI report. The pair recovered in the NY session to close at 1.5080 after the US ISM data showed the manufacturing activity contracted the most since 2009. Sterling met with offers at 1.5080 in Asia today and now trades around 1.5065.

Yellen could talk up US dollar

Fed chairwoman Yellen is scheduled to speak today and will be testifying before the Congressional Joint Economic Committee tomorrow. The Fed head is more likely to point out again that December Fed meeting is a “live event”. Despite the weak data in October, Yellen kept rate hike bets alive.

Moreover, the central bank’s decision to hike rates is more connected to labour market strength that any other factors; and the labour market continues to improve. The US ISM manufacturing PMI released yesterday was the weakest since 2009, but carrier a bright spot – the employment index ticked higher. The ADP employment report for November due later today could serve as an additional evidence of the labor market tightening. With December Fed just two weeks away and increasing signs of labour market strength, Yellen is likely to talk up the US dollar.

Sterling traders could adjust their positions ahead of the Yellen speech depending on the actual construction PMI print (previous 58.8, expected 58.2). Anything below estimates could weaken Sterling. On the other hand, a better-than-expected figure would open doors for a re-test of the previous session’s high of 1.5125.

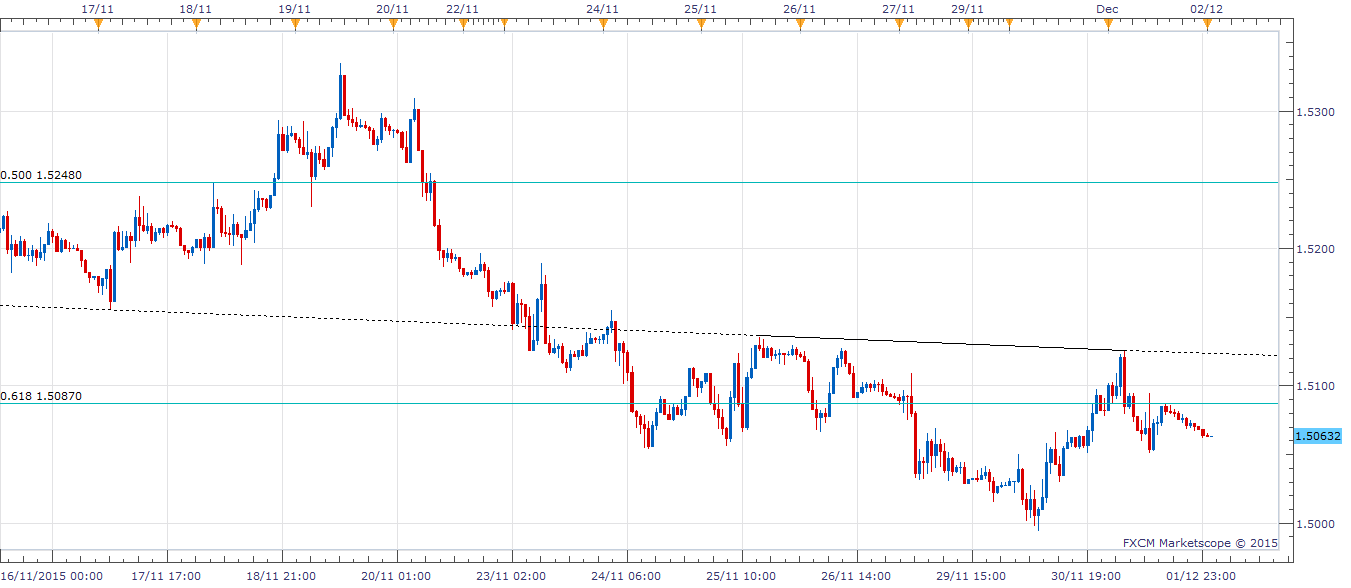

Technicals – Inverted head and shoulder on hourly chart

A rebound from 1.5050 in the NY session on Tuesday has increased odds of a inverted head and shoulder formation on the hourly chart with the neckline resistance at 1.5123.A rebound from 1.5050 in the NY session on Tuesday has increased odds of a inverted head and shoulder formation on the hourly chart with the neckline resistance at 1.5123.

A break above 1.5123 would open doors for a inverted head and shoulder target of 1.5253 (which is just above the major Fib hurdle of 1.5248 – 50% of Apr-Jun rally).

On the other hand, a failure to sustain above 1.5062 (hourly 50-MA) would open doors for a re-test of 1.50 handle. Meanwhile, a failure to take out the inverted head and shoulder neckline at 1.5123 could trigger a fresh sell-off that may take the pair well below 1.50 handle.

EUR/USD Analysis: A rebound from 1.06 levels could be bullish

The EUR/USD pair finally witnessed respite on Tuesday after the weak US ISM manufacturing figure triggered a liquidation of the US dollar. The pair clocked a high of 1.0637 in the NY session before falling to 1.0610 levels in Asia today. The USD index fell below 100.00 levels on softer treasury yields following the weak ISM data. However, the employment sub index ticked higher and that has restricted losses kept the USD index closer to three figures.

Focus on EZ Core CPI and Fed’s Yellen

The preliminary Eurozone core CPI in November is seen at 1.0%, compared to Oct’s 1.1%. A weaker-than-expected core CPI ahead of Thursday’s ECB meeting could be enough to send the EUR below the support zone of 1.055-1.0580 levels. Meanwhile, Yellen and Co. is likely to reiterate that the December Fed is a live event and the labor market is strong enough to move rates. The ADP report due ahead of Yellen is expected to show stronger job growth.

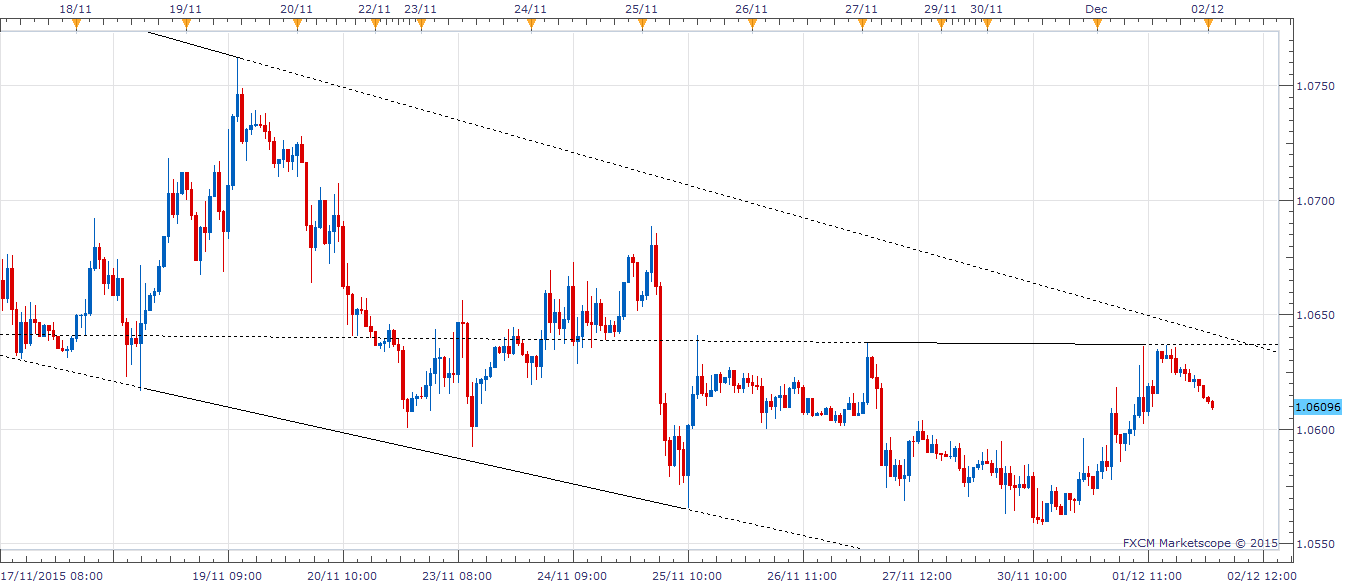

Technicals – Inverted head & shoulder in falling channel

Euro’s rebound from 1.06 levels today would result in an inverted head and shoulder formation in a falling channel. Interestingly, the neckline resistance coincides with the falling channel resistance at 1.0636 levels.

A rebound from 1.06 is more likely to result in a break above 1.0636, thereby opening doors for 1.0689 (Nov 25 high) – 1.07 levels.

On the other hand, a break below 1.06 could see the pair re-test Monday’s low at 1.0558.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.