The GBP/USD pair rose to an intraday high of 1.5214 before fresh offers pushed it back below 1.52 levels after the US ADP report showed the private sector in the US added 200K jobs compared to the expectation of 190K additions. Once again, the positive ADP report increased the possibility of an upbeat NFP report leading to USD strength. The cable eventually fell to a its lowest - 1.5107 – since May 5.

Focus on UK PMI – New export orders

All eyes are now on the UK manufacturing PMI (expected 51.3, previous 51.5) report. The cable has declined for 10 consecutive session and only an upbeat UK PMI report could lead to a meaningful technical correction today. Once again, the devil lies in the detail. Apart from the headline figure, the trading community would be interested to know if the new export orders continued to decline in September on the back of Sterling exchange rate.

For almost 6 months now, the PMI reports have been highlighted the disinflationary impact of the strong GBP. New export orders have dropped each month as well. Hence, it is hardly surprising if the BOE turns dovish, especially since the China slowdown and financial market turmoil have gathered pace off late. Furthermore, dovish Fed also means the BOE would delay its own rate hike.

Consequently, a weak PMI figure could spell disaster for Pound, sending it lower to 1.5 levels ahead of the Non-farm payrolls report due tomorrow. On the other hand, a much needed technical correction could be seen in case the PMI beats expectations. A corrective rally to 1.52-1.5248 could happen quickly.

Technicals – Downward channel on hourly chart

On the hourly chart, the spot is trading in the downward channel with indicators showing oversold conditions. Sterling’s ten day decline to a low of 1.5107 followed by a minor recovery in Asia today ahead of the UK PMI indicates the pair could re-test the channel resistance currently seen at 1.5165. Only an hourly close above 1.5165 would open doors for a rise towards 1.5248 (50% of Apr-Jun rally). On the downside, fresh offers are seen below the channel support currently seen at 1.51 levels. Break below 1.51 could lead to sell-off to 1.50 handle.

EUR/USD Analysis: Weak PMI could weigh over the EUR

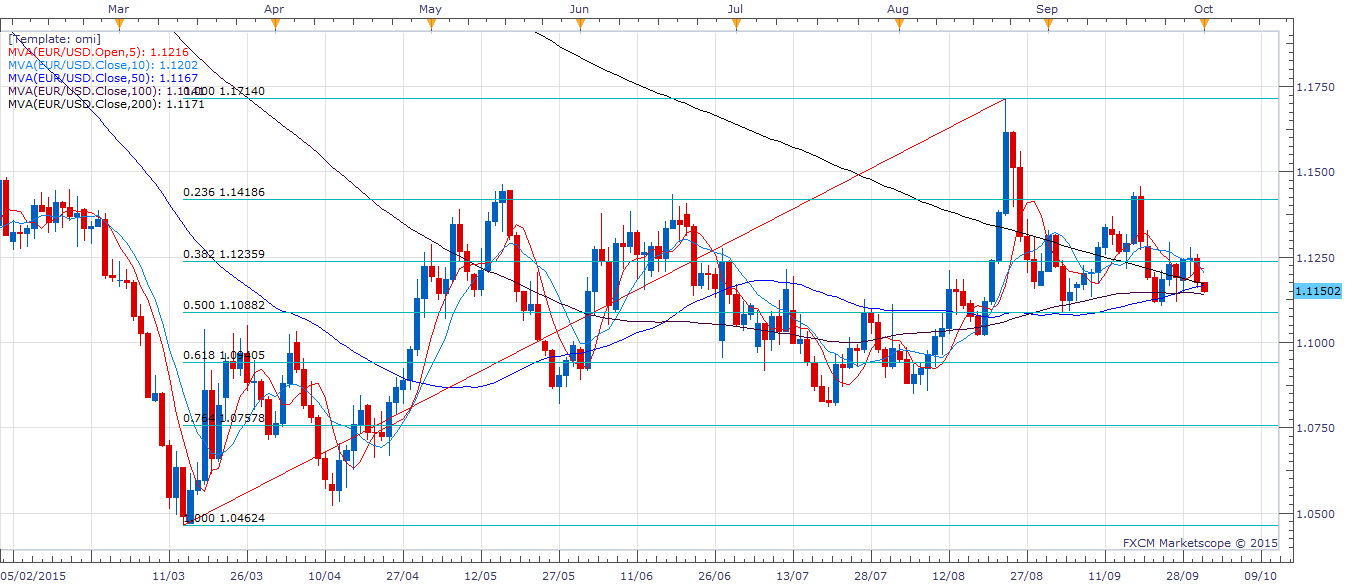

The EUR/USD pair dropped to its 200-DMa on Wednesday and extended losses today in Asia today to 1.1150 levels. The common currency came under pressure after the latest data from the Eurostat showed the 17-nation currency bloc fell back into deflation in September. Meanwhile, a better-than-expected US ADP number added to the USD’s strength. The rating agency S&P was also on the wires stating that the ECB could extend its QE program beyond September 2016.

Focus on EU PMIs

The fate of the EUR heading into the US session today depends on the quality of the EU PMI reports. A weaker print would add to speculation that the ECB would bolster its QE program and/or extend it beyond September 2016. Moreover, the inverse relationship between stocks and EUR may not come into play due to increased speculation of more monetary easing from the ECB and the overnight rally in the US and Asian stocks. Ahead in the US session, the focus would be on the US ISM manufacturing figure – Employment index. The EUR/USD pair could drop to 1.11-1.1080 levels in case of a weaker EU PMI report.

Technicals – Eyes 1.11

Euro’s failure to sustain above 1.1236 (38.2% of Mar-Aug rally) followed by a drop below its 200-MA located yesterday at 1.1177 indicated the pair is likely to take out its support at 1.1141 (100-DMA) and fall to 1.11 – 1.1088 (50% of Mar – Aug rally). On the higher side, only a break above 200-DMA could open doors for a re-test of 1.1236 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.