The GBP/USD rose to an intraday high of 1.5671 before turning lower to 1.5590 after the data showed UK retail sales in June unexpectedly contracted. The weak tone on the GBP strengthened further in the US session after the weekly jobless claims in the US printed at four-decade low. The pair dropped to a low of 1.5502 and continues to trade in the sideways manner around 1.5510 in the Asian session today.

GBP hurt by weak UK retail sales

The drop in the retail sales, though an unexpected one, contradicts the biggest increase in total pay over a three-month period in June since April 2010. The UK CPI also fell back to 0% in June from 0.2% in May. Core CPI slipped back to 0.8% year-on-year, compared to the previous month’s figure of 0.9%. Moreover, the British Pound did not witness a sharp sell-off after the drop in CPI was reported earlier this month, since the markets were optimistic that it would have resulted in higher consumption. However, with a fall in retail consumption reported yesterday, the British Pound appears vulnerable.

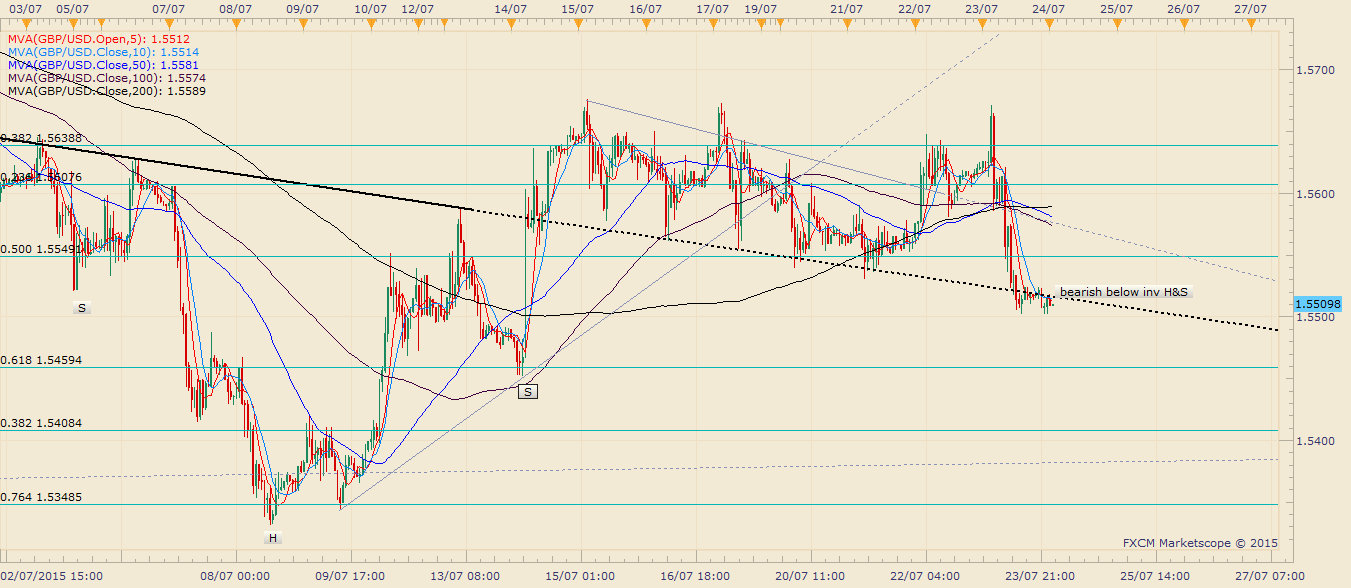

Technicals – Bearish below inverted head & shoulder neckline support

The spot suffered a bearish close on the 4-hour and hourly chart below the inverted head and shoulder neckline (extended) support. The price attempted to break above the same located at 1.5516, but failed. The sell-off also pushed the daily RSI below 50.00, opening doors for further weakness. A break below 1.55 could push the pair lower to 1.5459 (61.8% of June rally). On the other hand, a corrective move to 1.5549 (50% of June rally) cannot be ruled out, but fresh bids could be seen only in case the spot witnesses a hourly close above the same.

EUR/USD Analysis: Weak PMIs could lead to a break below 1.0963

The EUR/USD was volatile on Thursday, rising from 1.0923 in European morning breaching Tuesday's high at 1.0969 to 1.1019 in New York morning as the Greek parliament approved a second set of reforms required to start negotiations with creditors. However, the pair later fell back to 1.0952 after upbeat US jobless claims printed at four-decade low. The renewed buying lifted the pair to 1.1016 near New York close, but once again ran into offers and fell back to 1.0964 levels in the Asian session today.

Focus on Eurozone PMIs

The latest preliminary Eurozone PMI survey’s are due for release today. The markets are curious to see if the Grexit uncertainty has negatively impacted the private sector activity. A weaker-than-expected Eurozone and German PMI figures could lead to a break below the crucial support at 1.0963. On the other hand, better-than-expected data could lead to a re-test of 1.1120.

Technicals – Double top at 1.1010-1.1020

The hourly chart shows a double top formation with the neckline support at 1.0963 (76.4% of May-June rally). A break below the same could open doors for a sell-off to 1.0921 (hourly 200-MA). Meanwhile, repeated failure to take out the support at 1.0963 may see the spot re-test 1.1020. It is a break above 1.1020 could push the pair to 1.1053 (61.8% Fib of May-June rally). However, the likelihood of the spot breaking below 1.0963 would increase in case the spot fails to take out 1.10 (100-DMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.