Currencies

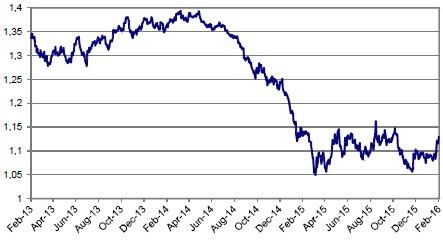

EUR/USD

EUR/USD settled in the 1.07/10 area after the Fed lift‐off. China turmoil had initially only a moderate impact. Finally, global uncertainty reduced interest rate support for the dollar and pushed EUR/USD back to the 1.13 area.

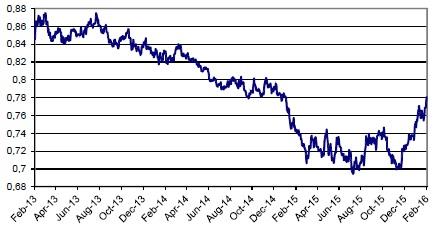

EUR/GBP

Sterling weakness persists. The combination of global uncertainty, a decline in the oil price, disappointing UK eco data and uncertainty on Brexit all conspire to protracted sterling weakness.

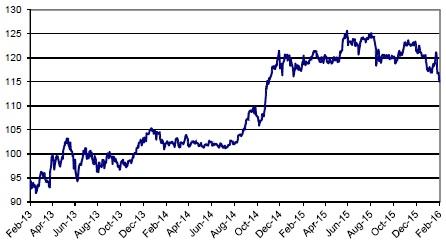

USD/JPY

In January, the yen profited from the global risk‐off sentiment. The BOJ cutting interest rates into negative territory didn’t prevent further yen strength. USD/JPY dropped below the key 115.98 support.

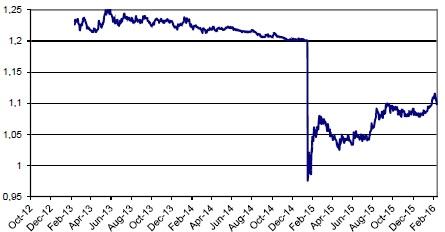

EUR/CHF

The Swiss franc declined in January and early February even as global sentiment turned outright negative. ‘Selective’ SNB action apparently prevented safe haven flows running to the Swiss franc .

EUR/PLN

The decline of the zloty in the wake of the formation of a new government slowed. Markets gradually embrace the idea that a change in monetary policy might be less aggressive than previously assumed.

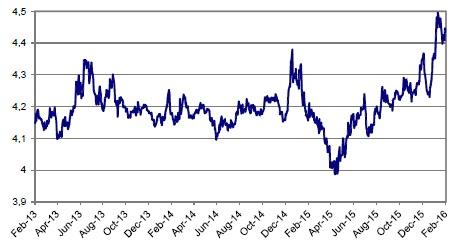

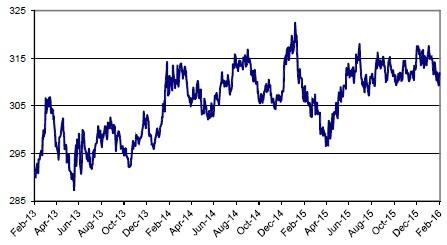

EUR/HUF

The forint is holding stable in a sideways range between 308 and 318. Global uncertainty hardly affected the forint. A further improvement in economic fundamentals gives the forint downside protection.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.