Currencies

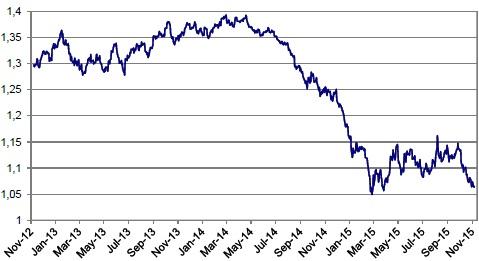

EUR/USD

EUR/USD started a new downleg in October as de ECB signalled more easing and as the Fed reopened the door for a December rate hike. The cycle low (1.0458) is coming within reach but no test occurred so far.

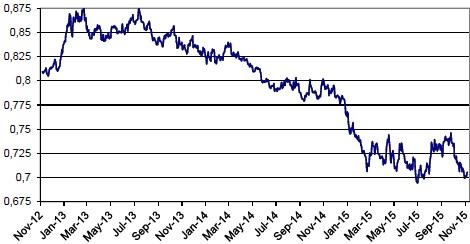

EUR/GBP

EUR/GBP to a large extent followed the price pattern of EUR/USD last month. However, the gains of sterling against the euro were far less as the BoE leaves markets in doubt on the timing of a first rate hike.

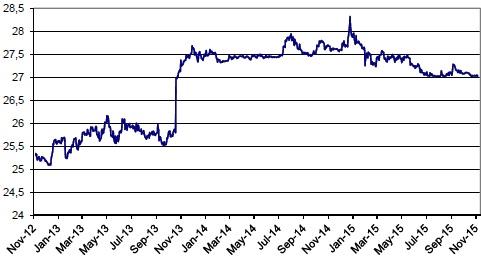

USD/JPY

USD/JPY jumped higher after a strong US payrolls report published early November. From there, the pair resumed sideways trading. The BoJ fended off calls for further easing, preventing further yen losses.

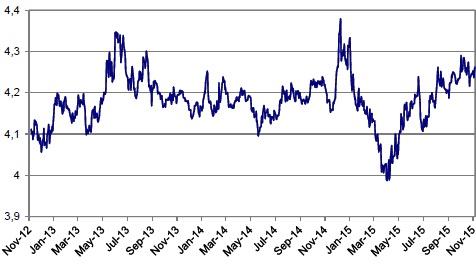

EUR/CZK

The Czech koruna settled close to the central bank’s (CNB) floor of EUR/CZK 27. The CNB probably intends to defend this barrier at least till the end of 2016.

EUR/PLN

The new Polish government is expected to run an expansive fiscal policy. At the same time, it tries to ‘convince’ the NBP to keep monetary policy accommodative. This potential ‘unorthodox‘ policy mix weighs on the zloty.

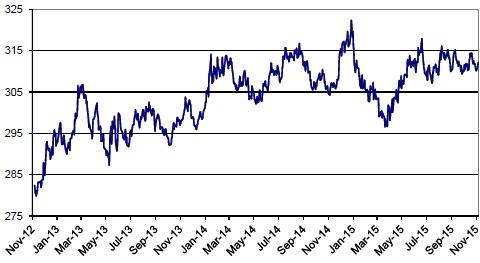

EUR/HUF

EUR/HUF found a new equilibrium in the 310/315 area. The NBH will keep its policy rate at current extremely low levels as long as possible to prevent a strengthening of the forint.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.