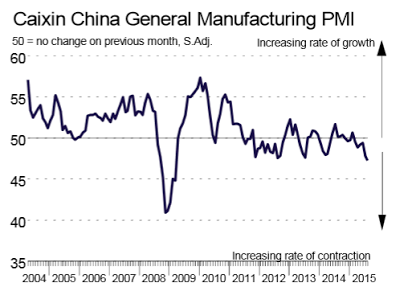

China manufacturing and services are both in contraction at the fastest rate since early 2009.

The Caixin China General Manufacturing PMI shows operating conditions deteriorate at fastest rate since March 2009.

Chinese manufacturers saw the quickest deterioration in operating conditions for over six years in August, according to latest business survey data. Total new orders and new export business both declined at sharper rates than in July, and contributed to the most marked contraction of output since November 2011. Lower production requirements prompted companies to reduce their purchasing activity at the fastest rate since March 2009, while weaker client demand led to the first rise in stocks of finished goods in six months. Meanwhile, softer demand conditions contributed to marked falls in both input costs and output charges in August.

Key Points

Output contracts at quickest rate in 45 months as new business falls solidly

Purchasing activity declines at sharpest rate since March 2009

Input costs and output charges both fall at marked rates

China Manufacturing PMI

Composite Contract Most Since February 2009

The bad news in China does not stop with manufacturing. Markit reports the Caixin China General Services PMI has the fastest contraction of output seen since February 2009.

Key points

Composite output and new orders both contract for the first time in 16 months

Job shedding intensifies at manufacturers, while employment rises only fractionally at service providers

Composite input costs and output charges continue to fall

By now it should be perfectly clear to everyone that the entire global economy is cooling and the US will not decouple from that slowdown. Nonetheless, most economists, including those at the Fed, still do not see the obvious.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.