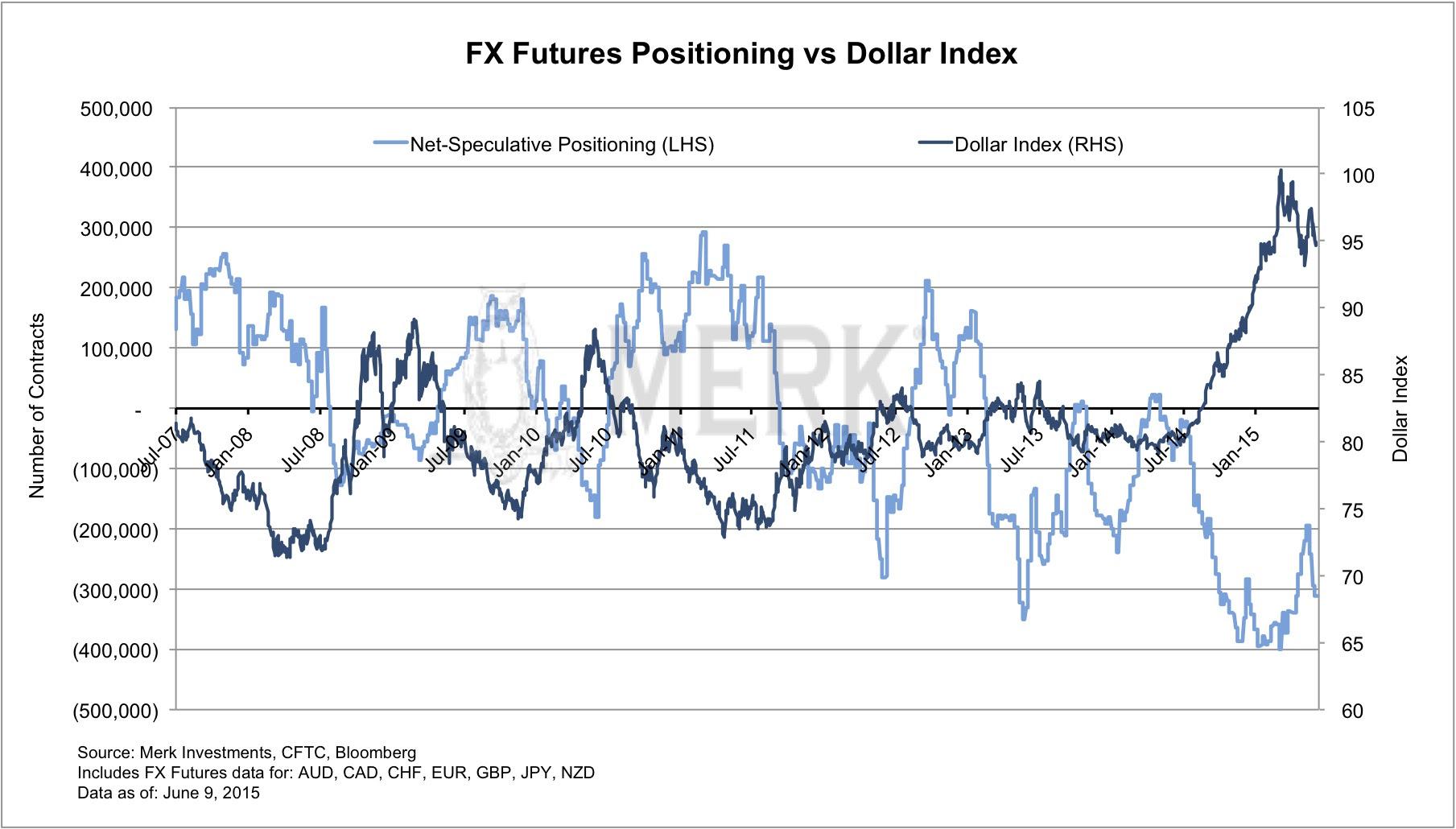

Positive sentiment on the dollar is very high (a potentially contrarian indicator)

The chart below shows net speculative positions based on CFTC data of the U.S. dollar versus other major currencies. While there's a long for every short in the futures market, the CFTC differentiates between "hedgers" and "speculators." The chart below suggests speculators are short currencies versus the U.S. dollar. "Net speculative positioning" aggregates contracts in the Australian Dollar (AUD), Canadian Dollar, Swiss Franc, Euro, Pound Sterling (GBP), Japanese Yen (JPY) and New Zealand Dollar (NZD). The dollar index is a measure of the value of the United States dollar relative to a static basket of currencies with Euro (EUR) 57.6% weight, Japanese yen (JPY) 13.6%, Pound Sterling (GBP) 11.9%, Canadian dollar (CAD) 9.1%, Swiss franc (CHF) 3.6% and Swedish krona (SEK) 4.2% weight. An investor cannot invest directly in an index.

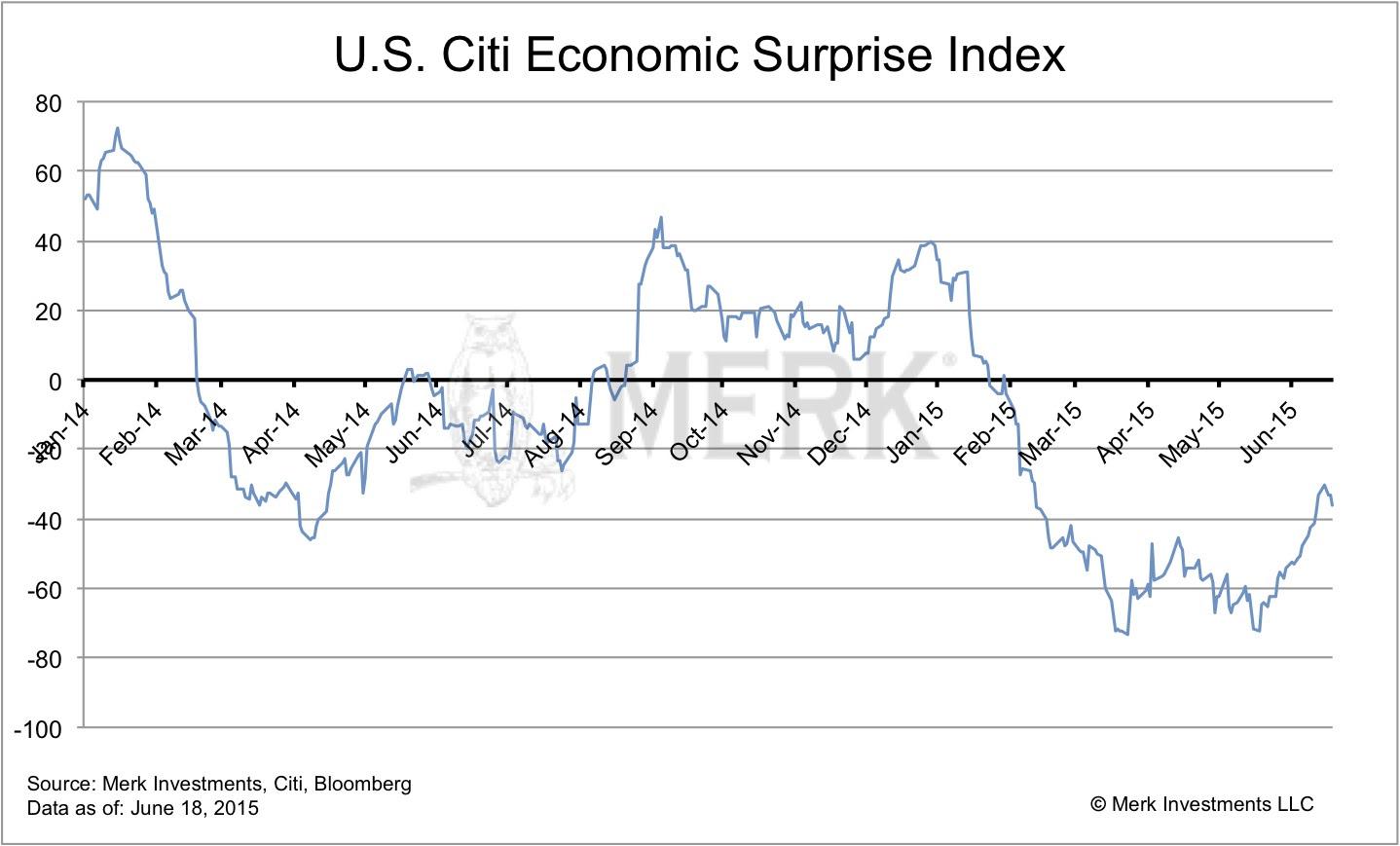

"Too much good news" may be priced into the U.S. Dollar

Please see the Citi economic surprise index for the U.S., an index showing how economic indicators have come in relative to expectations.

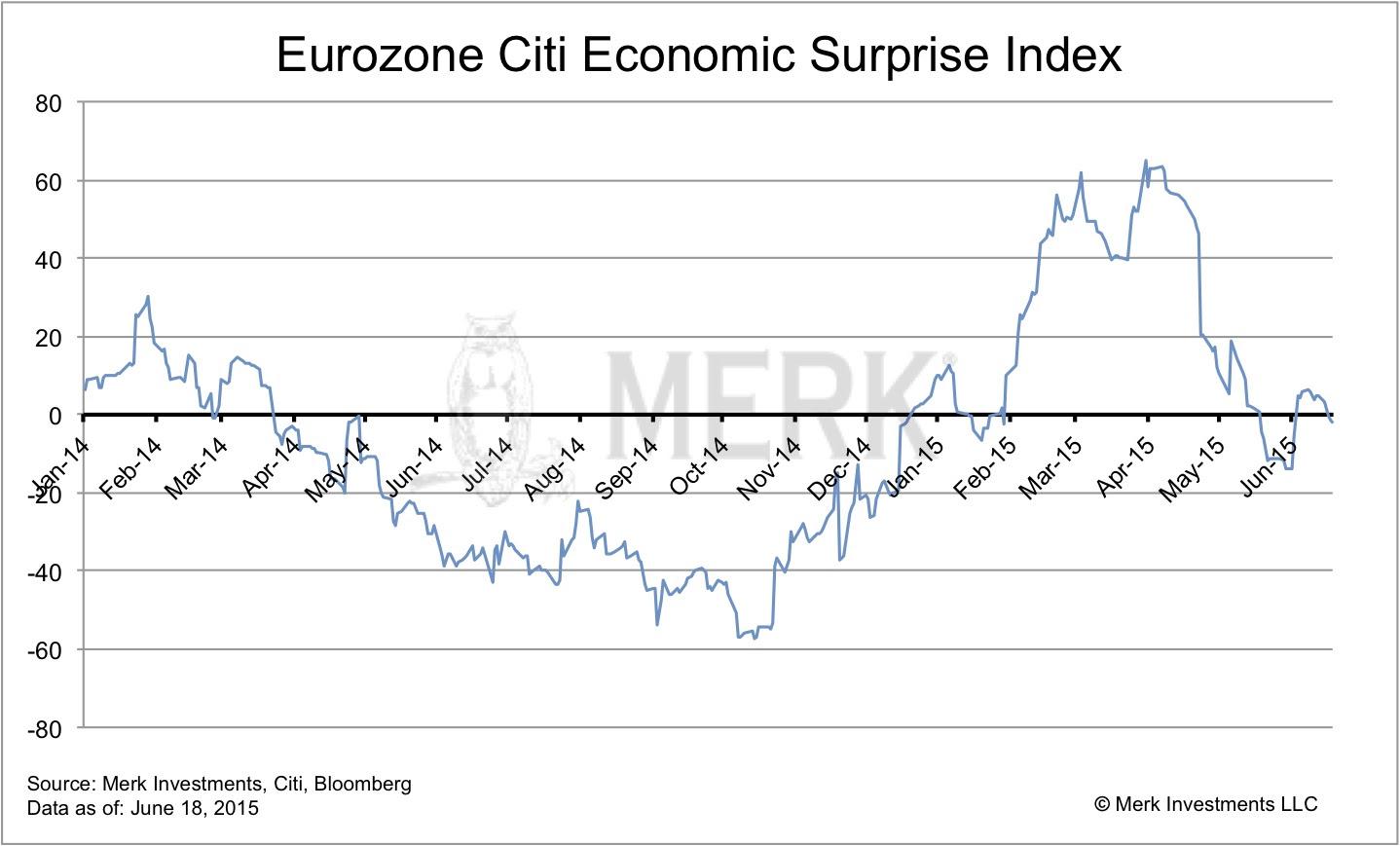

"Too much bad news" may be priced into hard currencies

As an example, please see the Citi economic surprise index for the Eurozone, an index showing how economic indicators have come in relative to expectations.

The Fed all but promises to be "behind the curve"

The Federal Open Market Committee (FOMC) has used the following sentence in their Statements since March 2014: "The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run." We interpret this as a commitment to be "behind the curve," i.e. to be late in raising rates relative to what would be warranted.Central banks, such as the Sweden's Riksbank may have to do a U-turn on their ultra-loose monetary policy

Many central banks outside of the U.S. put a heavier emphasis on headline rather than core inflation. Headline inflation includes food and energy prices. The plunge in energy prices was cited by various central banks as a reason interest rates were lowered. Starting in a few months, the year-over-year comparison on energy prices may no longer show deflationary pressures. As a result, some central banks may be inclined to reverse their highly accommodative policy, i.e. raise interest rates or reduce/eliminate quantitative easing.We define hard currencies as currencies backed by sound monetary policy. We define sound monetary policy as providing an environment fostering long-term price stability. We consider gold to be the only currency with intrinsic value and, as such, qualifying as a hard currency.

Since the Funds primarily invest in foreign currencies, changes in currency exchange rates affect the value of what the Funds own and the price of the Funds’ shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, emerging market risk, and relatively illiquid markets. The Funds are subject to interest rate risk, which is the risk that debt securities in the Funds’ portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities, such as forward contracts, which can be volatile and involve various types and degrees of risk. If the U.S. dollar fluctuates in value against currencies the Funds are exposed to, your investment may also fluctuate in value.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.