FOMC Day:

The day has arrived. While economic factors have pushed back the earliest possible liftoff month to September or December, it’s the tone of tonight’s FOMC statement that will have the most significant impact on Forex markets.

With the odds of a rate hike in September now priced in at 50/50, I am of the opinion that they are more likely to move using a policy of stabilisation rather than being forced into hitting the market hard with multiple hikes clumped together. It’s all about beginning the normalisation process after rates have been at zero for so long and hiking early in September is conducive to this train of thought.

The fact that Yellen has persistently said that the Fed favours moving gradually over a longer period of time is pushing the point that September is in play.

Take a look at our Monday FOMC chart preview in the Technical Analysis section of the Vantage FX News Centre here.

Wheeler Speaks:

Reserve Bank of New Zealand Governor Wheeler this morning delivered a speech titled ‘Monetary policy supporting growth and inflation goal’ at the Tauranga Chamber of Commerce. The full transcript of his speech can be found here, with the few key points taken out below.

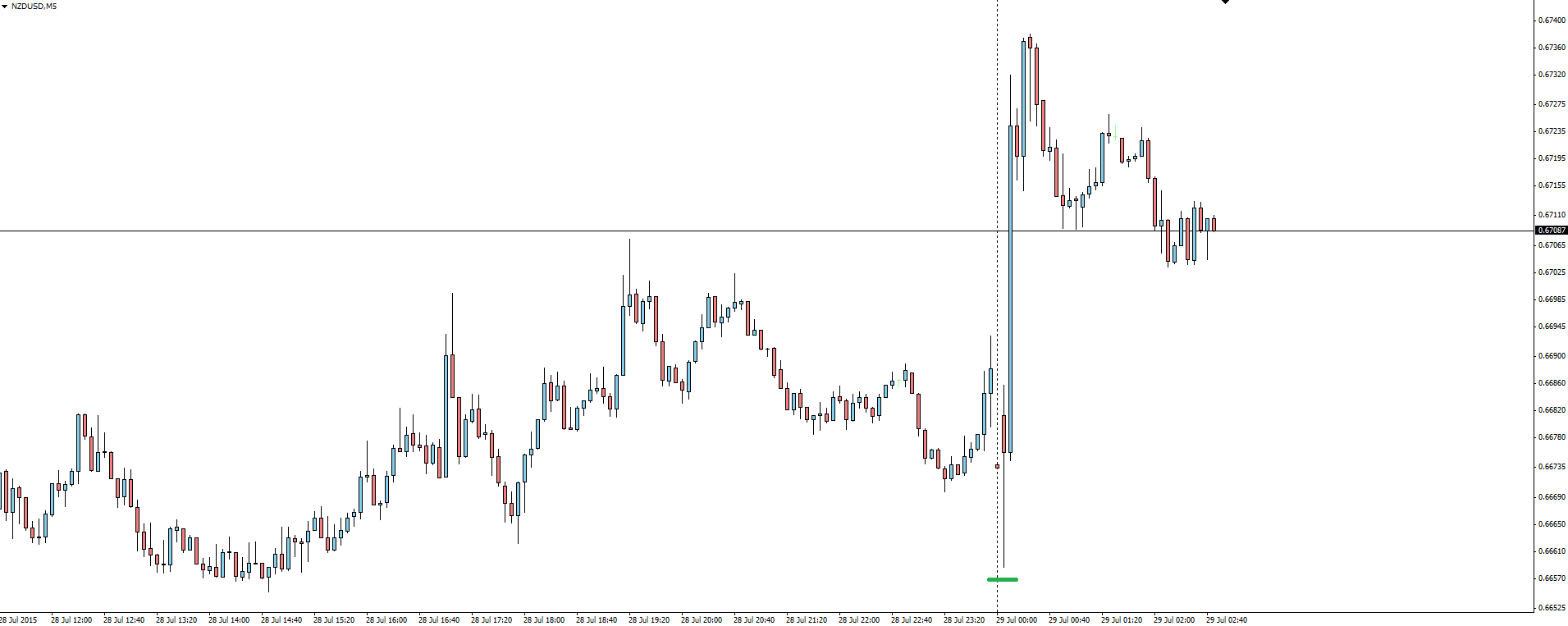

NZD/USD 15 Minute:

“Some further easing seems likely.”

“Further NZD depreciation necessary.”

“Several risks around inflation outlook.”

3 statements that have become fairly standard from the RBNZ. The market instead choosing to rally on the final, positive point.

“Several factors are supporting economic growth.”

NZD/USD Weekly:

Most interesting to me as a primarily technical trader, is that heading into the speech, the Kiwi bounced off the above weekly support zone. Very clean!

On the Calendar Wednesday:

NZD RBNZ Gov Wheeler Speaks

JPY Retail Sales

USD FOMC Statement

USD Federal Funds Rate

Chart of the Day:

As its FOMC week, we have been looking at the majors heading into tonight’s meeting. This morning we take a look at Cable and how its been behaving.

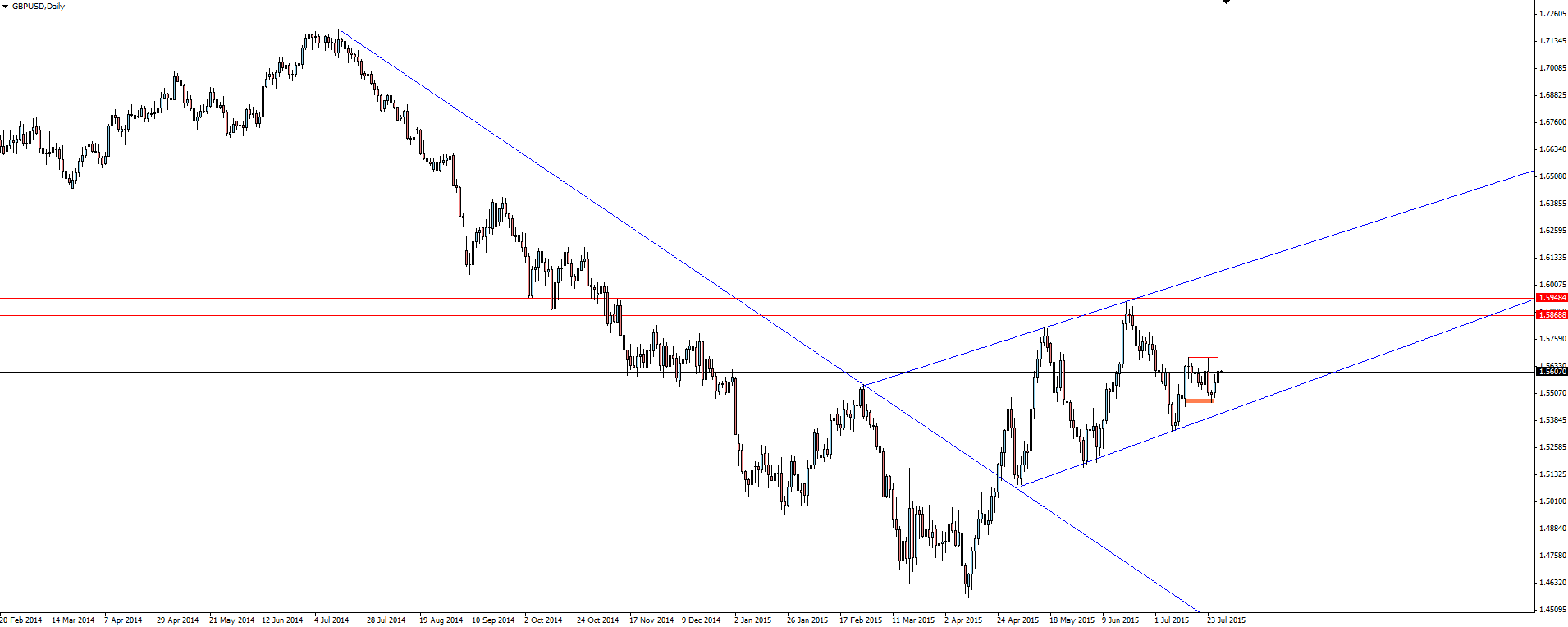

GBP/USD Daily:

The Cable daily chart shows the change in trend once price broke the major bearish trend line, settling into a short term bullish channel that has now taken a front seat.

This chart shows the divergent monetary policies between the Bank of England who are looking to hike and for example the Reserve Bank of Australia or the ECB who are still easing or maintaining an easing bias, with Cable the only major pair that is now in a bullish trend.

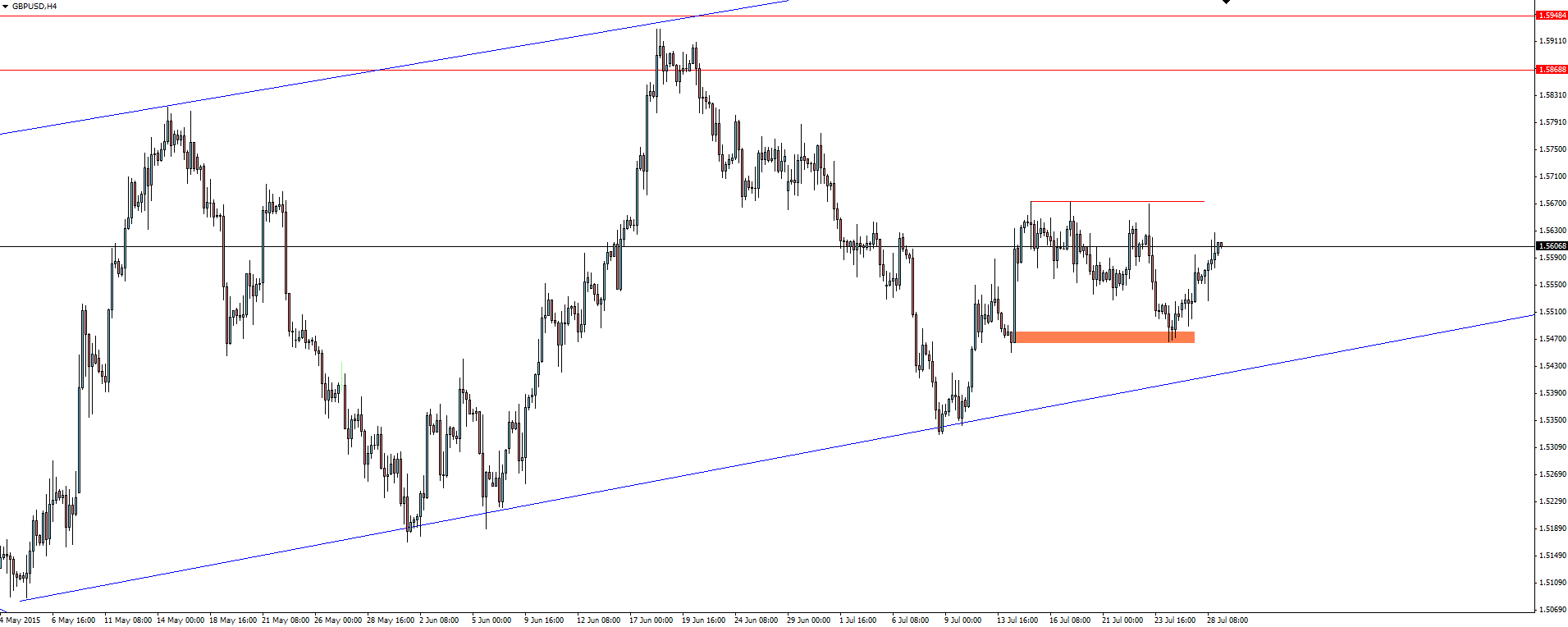

GBP/USD 4 Hourly:

Looking a little closer on the 4 hour chart, going with the trend you can see that price pulled back into a demand zone where price had previously kicked out of, touching it with wicks and moving higher. The fact that it was with the trend and its proximity to channel support provided traders who want a wider stop a bit more breathing room.

From here, stops above the short term resistance at 1.56700 are in play. It will be interesting to see if they act as a magnet heading into FOMC.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.