Greferendum:

“OXI!”

The Greek people have spoken, with a landslide win to the ‘no’ side, voting against accepting the austerity terms that their Eurozone creditors have offered. But in reality, the vote and the result is still nothing but a complicated mess that throws up just as many questions as answers.

Tsipras and his Greek government got the ‘no’ outcome that they wanted. The angle here was that this was never a referendum on whether Greece wanted to stay in the Eurozone, but rather perceivably adding to the indebted nation’s bargaining power once the inevitable re-negotiations with creditors take place.

I say inevitable because the reality is that for both financial and political reasons, (led by Germany) they would prefer to do everything they can to keep Greece in the Euro. But how they can go back to the negotiating table after Greek Finance Minister labelled his creditors as ‘terrorists’ over the weekend, I have no idea.

Keep an eye on the Vantage FX News Centre today as we go over what is next for Greece and what each scenario could mean for EUR/USD.

One interesting angle that maybe hasn’t got the run that it deserves amongst all these headlines and panic trading is that uncertainty now brings the chance of September rate hike from the Fed down significantly.

On the Calendar Today: The only news on the calendar that matters today is of course the Greek Bailout Referendum. Mark the ISM Non-Manufacturing PMI as the major tier 1 data release later tonight during the US session.

Monday:

EUR Greek Bailout Vote

CAD Ivey PMI

USD ISM Non-Manufacturing PMI

Chart of the Day:

With a messy chart full of gaps to contend with, we take a look at EUR/USD from a technical point of view.

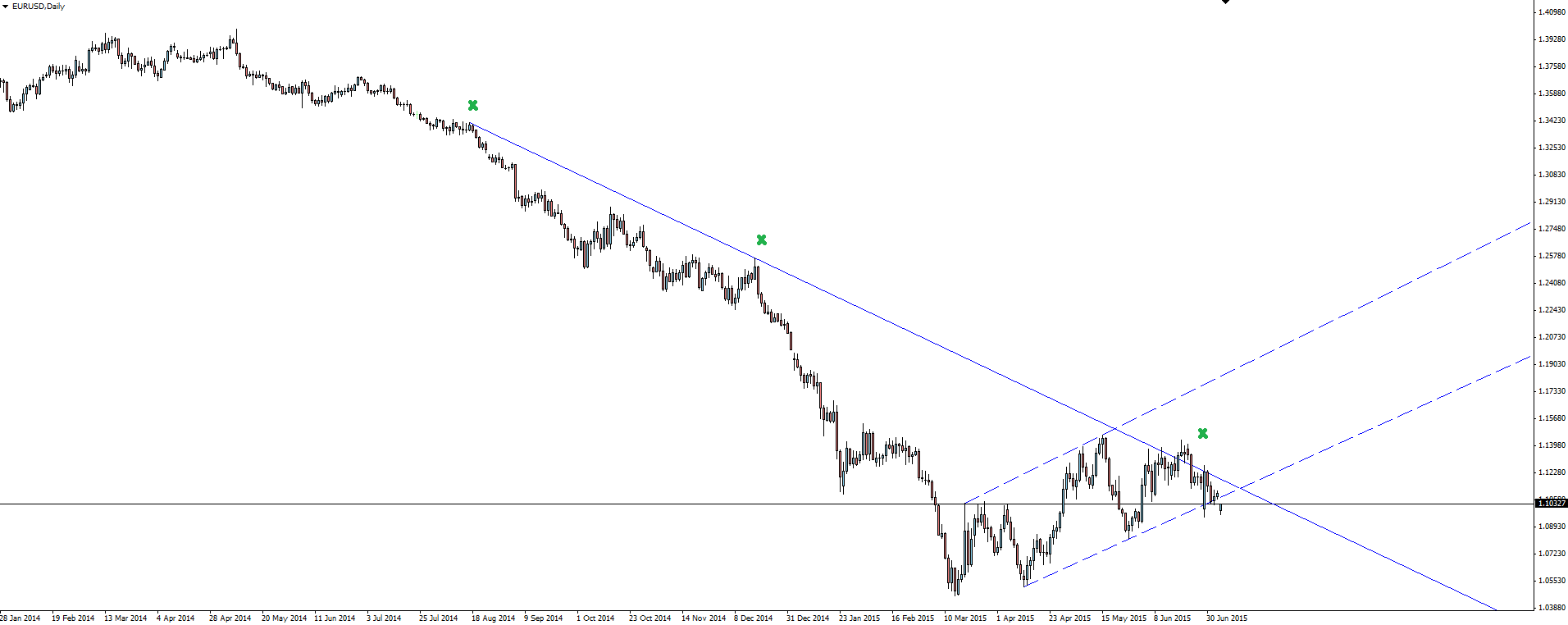

EUR/USD Daily:

The confluence of resistance at the major bearish trend line we have been posting for a while has well and truly held and price has now broken through short term flag support. The problem with this break is that it’s a messy gap down through the level, something that we saw only last week which highlighted the lack of respect for technical levels during times of panic.

EUR/USD Hourly:

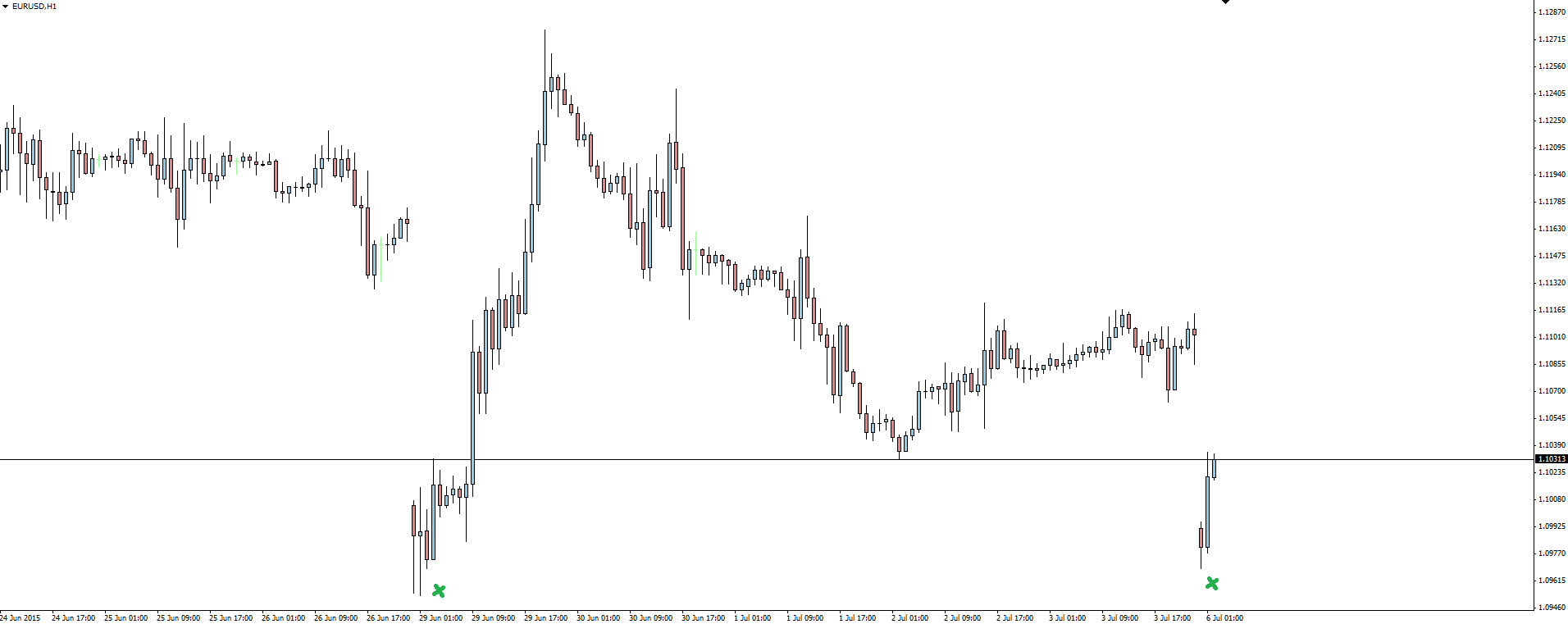

If it seems like we’ve been here before, then it’s because we have. Last Monday on Greek rumours of a Eurozone exit, price actually pushed lower than where we have opened today after the actual referendum result.

With Europe still closed for the weekend, I can’t do anything with confidence but sit on the fence today. We really are into uncharted territory and I just don’t know which theme the market is going to interpret as the most important in determining the direction it takes. Stay safe out there!

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.