Default:

With Eurozone finance ministers refusing to budge on any last minute extensions of the Greek bailout program, Greece this morning became the first ‘advanced economy’ to default and is the first country to miss an IMF loan payment since Zimbabwe in 2001. Not exactly illustrious company there.

From The Associated Press this morning:

“BREAKING: Greece’s international bailout formally expires, country loses access to existing financing.”

“BREAKING: IMF confirms debt due by Greece has not been paid, Greece officially in arrears.”

“MORE: IMF: Greece misses $1.8 billion payment, becomes first advanced economy to default on IMF loan.”

Ratings agency Fitch, slashed Greece’s already junk status from CCC to CC. With some debate and questions still about on what officially constitutes an official ‘default’, this CC rating is only a single notch above the level where the ratings agency says default is inevitable.

“The breakdown of the negotiations between the Greek government and its creditors has significantly increased the risk that Greece will not be able to honour its debt obligations in the coming months, including bonds held by the private sector.”

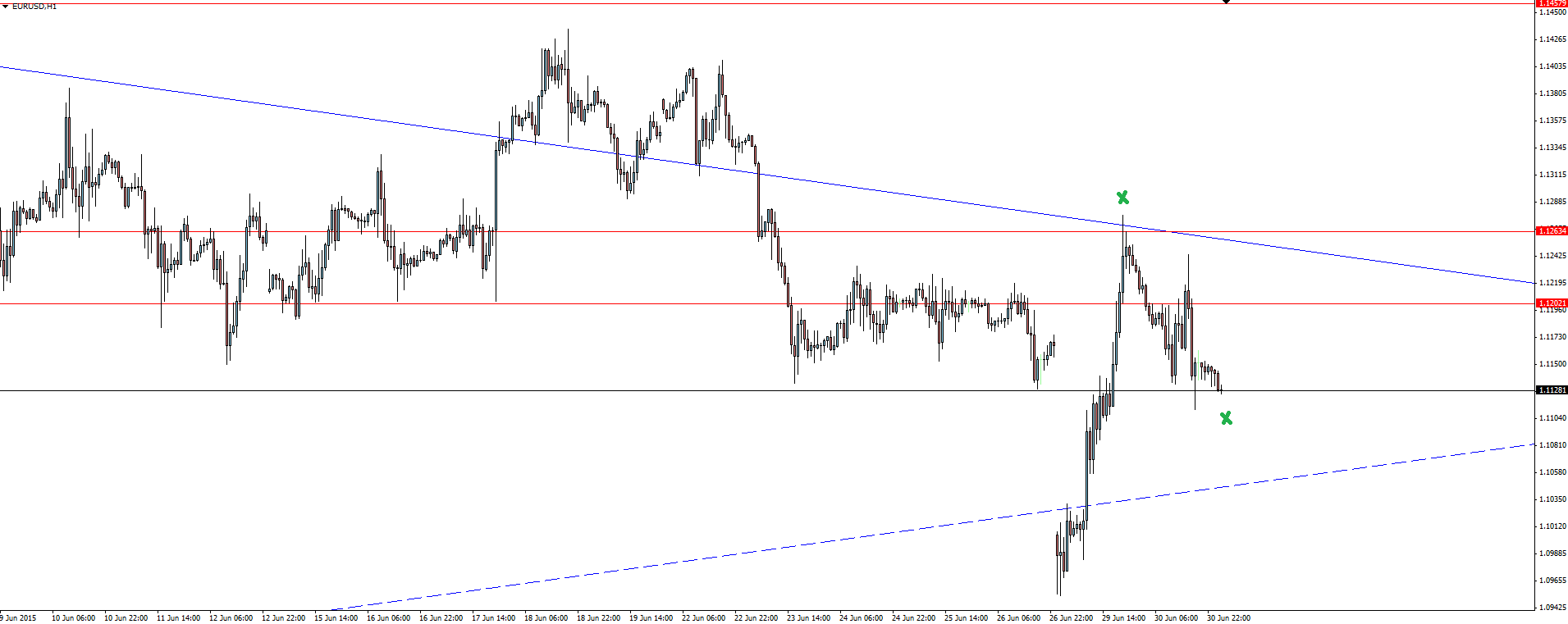

EUR/USD Hourly:

The Euro received an injection of end of month short covering after it’s questionable rally to open the week, pulling back to the 50% fib level of the move. I still think that this could have more to run on the long side but I can’t play it with conviction so I’ll step aside again.

All we can now do is wait for the Greek referendum on their presence in the Eurozone and go from there.

On the Calendar Today:

A busy one on the data front today with a flood of news releases throughout the 3 major sessions.

Also wishing a happy Canada Day to all our Canadian traders out there. Enjoy your day off!

Wednesday:

CNY Manufacturing PMI

AUD Building Approvals

CNY HSBC Final Manufacturing PMI

EUR Eurogroup Meetings

GBP Manufacturing PMI GBP BOE Gov Carney Speaks

CAD Bank Holiday

USD ADP Non-Farm Employment Change

USD ISM Manufacturing PMI

Chart of the Day:

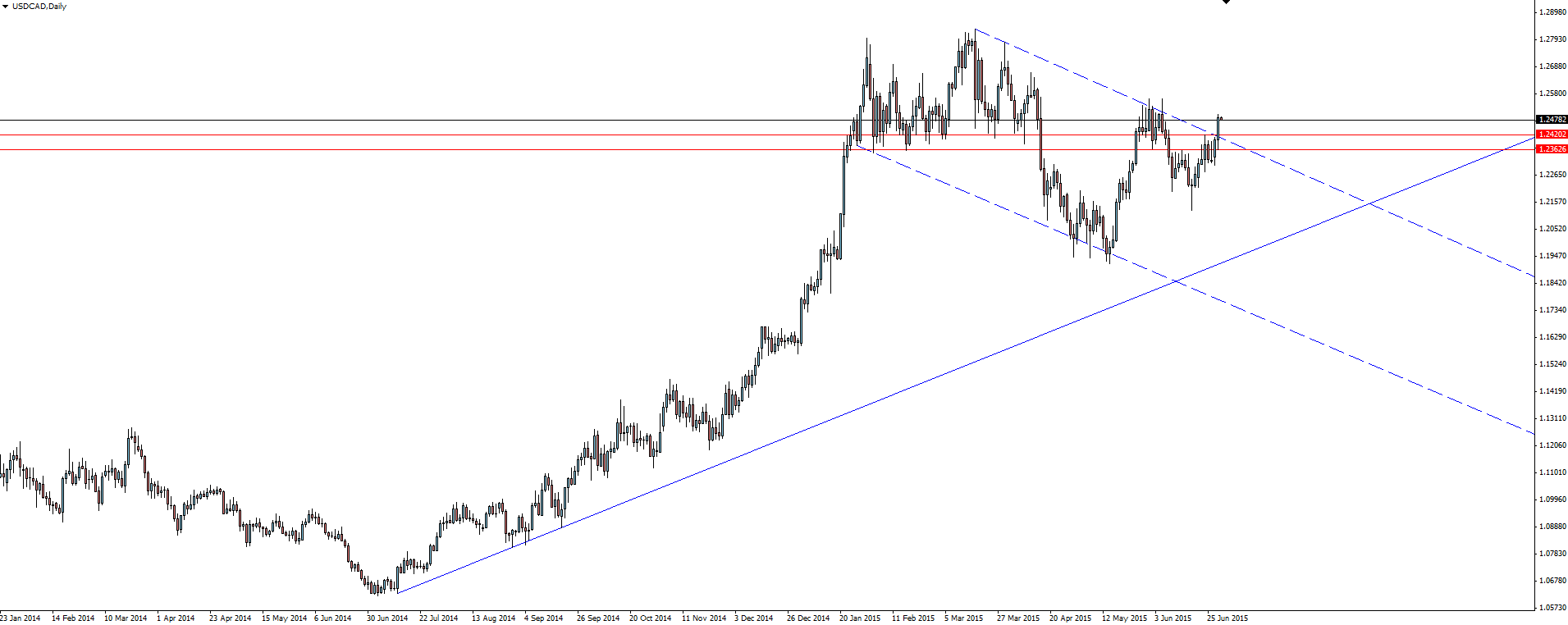

We couldn’t pass up having a look at USD/CAD on Canada day, could we?

USD/CAD Daily:

The daily chart has price testing and at least starting to break out of it’s short term flag and possibly resuming it’s major bullish trend. I say starting to break out because the long wicks at the previous test of this level shows that sellers will look to take back control in this zone.

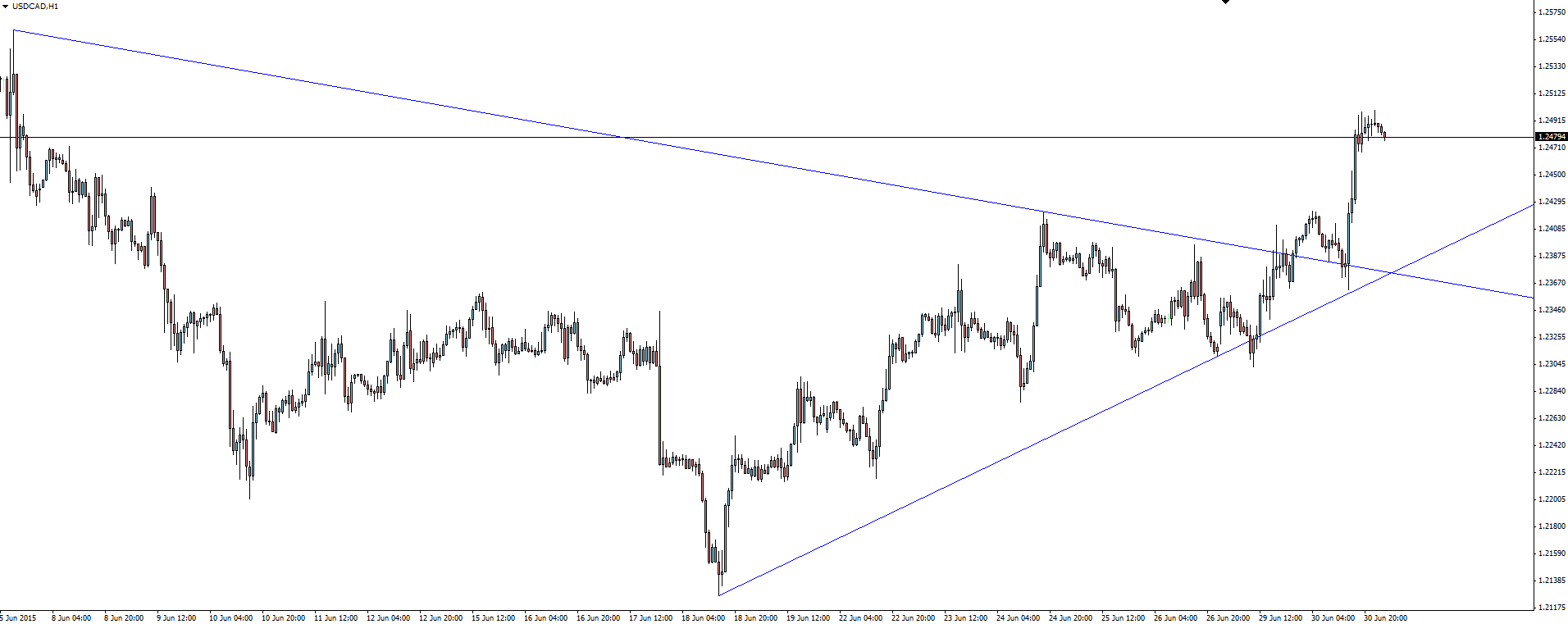

USD/CAD Hourly:

Drilling down to the hourly chart, the short term structure of the break out was very textbook with a break out of resistance followed by a retest of previous resistance as support before price took off.

At this stage, it’s a setup to add to your trading journal and a pattern to keep an eye on for next time.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.