Super Mario Draghi:

With China still on holidays in observance of Victory over Japan Day, we’re expecting a quiet Asian session in the lead up to Non-Farm Payrolls later tonight. Yesterday it was interesting to see markets such as the Australian SPI200 print a long red daily candle without having a Chinese lead to blame!

Last night saw ECB President Mario Draghi deliver a largely dovish press conference following the ECB’s board meeting. The Euro sold off hard as Draghi delivered some changes to the ECB’s quantitative easing program, expanding it slightly and ensuring the market that it would be continued into the near future. This was a tweak to the previous ECB rhetoric, hinting at a stronger willingness to prolong their bond purchasing program.

“Stimulus will continue until the end of September 2016. Or beyond if necessary.”

Europe hasn’t escaped the more subdued global outlook and Draghi spoke of a reduction in growth and deflation concerns, pushing the Euro back to swing lows.

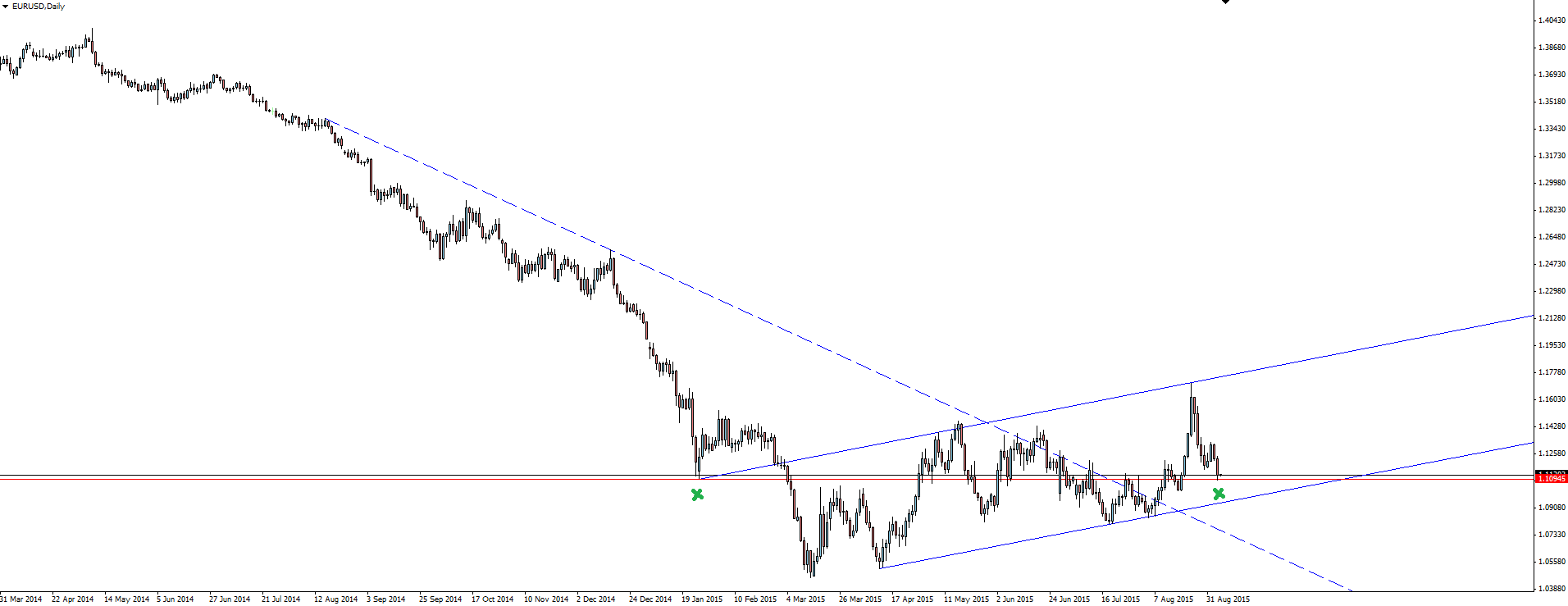

EUR/USD Daily:

From a technical viewpoint, EUR/USD sits at an important support level as it tries to move through a change of trend.

NFP Friday:

Looking at where price sits on the above chart and considering the global economic uncertainty surrounding the Fed right now, there is definitely more risk in playing for a drop. We also have to consider the possibility of a clear ‘no’ being signalled tonight before the NFP number has even been printed, with the Fed’s Lacker speaking 20 minutes before the NFP release in a speech titled ‘The case against further delay’. Sounds pretty ominous to me.

August has historically been a month of disappointment for employment numbers with economists overestimating the month’s NFP print over the past four years by an average of 50,000. The old August curse!

Keep in mind that this is also the final NFP print before the Fed’s September policy meeting. Bloomberg’s Michelle Jamrisko gives an excellent ‘Jobs Day Guide’ here.

On the Calendar Friday:

CNY Bank Holiday

USD FOMC Member Lacker Speaks

CAD Employment Change

CAD Unemployment Rate

USD Average Hourly Earnings m/m

USD Non-Farm Employment Change

USD Unemployment Rate

CAD Ivey PMI

Chart of the Day:

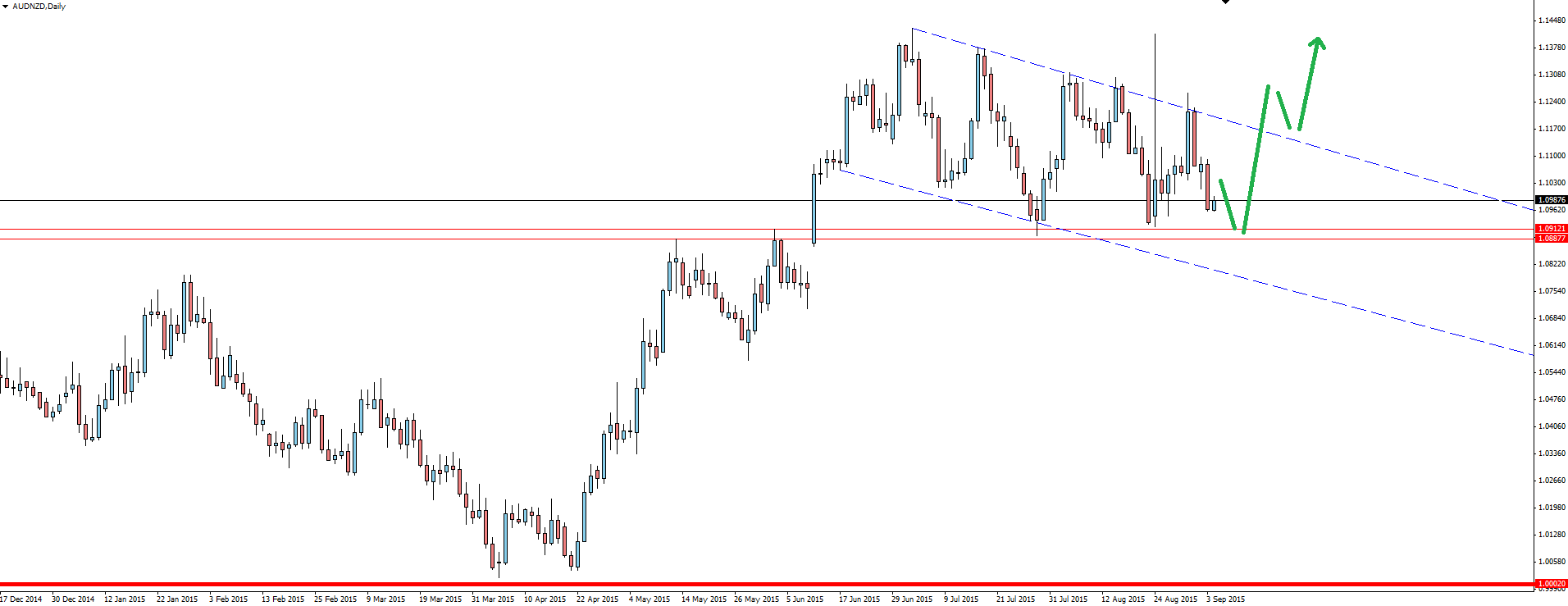

Today we head back to the world of Forex trading with a look at a flag pattern on the AUD/NZD daily chart. We also take a look at the how price reacts to previously significant levels after unnatural spikes.

AUD/NZD Daily:

The above chart shows a flag pattern forming with clear support at a retest of broken horizontal resistance that could possibly be retested as support. This level provides a clear area to manage your risk around and to play for the breakout to the upside.

When talking about how to draw trend lines, it’s worth noting how the market treated Black Monday’s spike from a technical point of view. The market treats unnatural spikes differently to regular rejections. Unnatural being thin liquidity such as Monday, unpredictable events and even some news candles.

As you can see, the Black Monday spike pushed through the upper trend line of our flag channel but the very next test obeyed the original line cleanly. Don’t ever remove trend lines or levels that have been breached by price action that could be deemed unnatural.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.