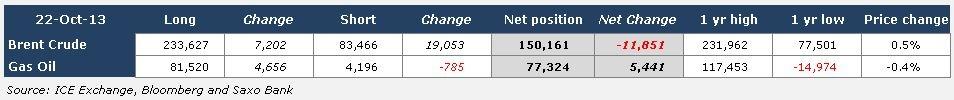

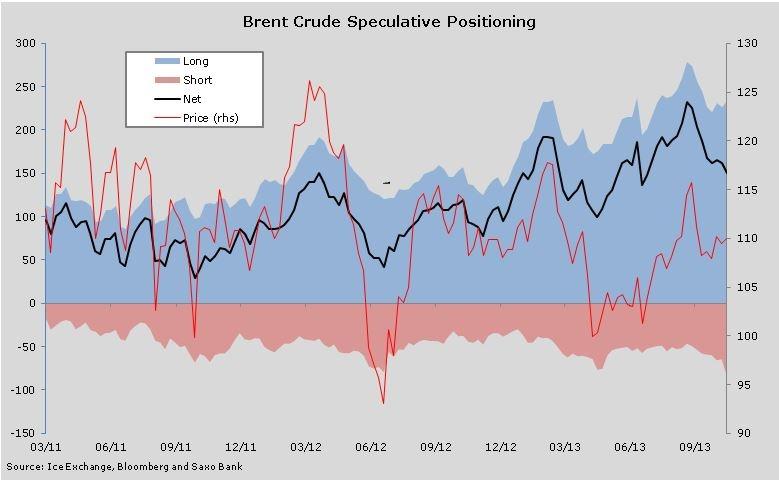

Hedge Funds cut their net-long exposure to Brent Crude by 11,851 contracts during the week ending October 22, according to the latest data from the ICE Europe Exchange. Speculative positions have now been reduced in seven out of the last eight weeks with the current net position of 150,161 some 35 percent below the record peak in August when the Syrian conflict and Libyan strikes lifted the price to USD 117.34/barrel.

Interestingly, both the gross long and short positions were increased, indicating some uncertainty about the near-term direction. This could help lift volatility from its current historically low levels of below 20 percent. The gross short actually reached 83,466 contracts, the highest since the exchange began reporting this data back in January 2011.

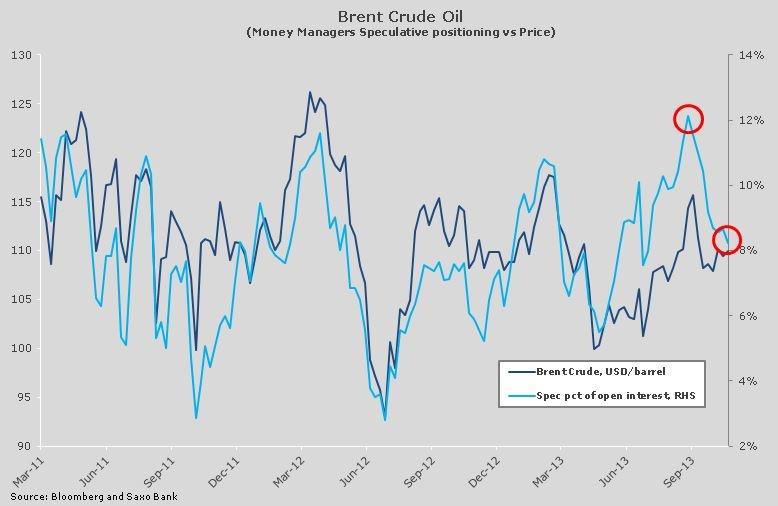

The speculative bubble which continued to inflate over the summer has now popped with the percentage of speculative net-long positionings compared with total open interest in Brent Crude now back down close to eight percent compared with 12.1 percent back on September 1. Compared with the previous big unwinds of speculative extended positions some further long liquidation can not be ruled out. However, the fact that both shorts and longs are rising has left the market less one-sided than just a few weeks ago.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.