Technical Analysis Position and Developments

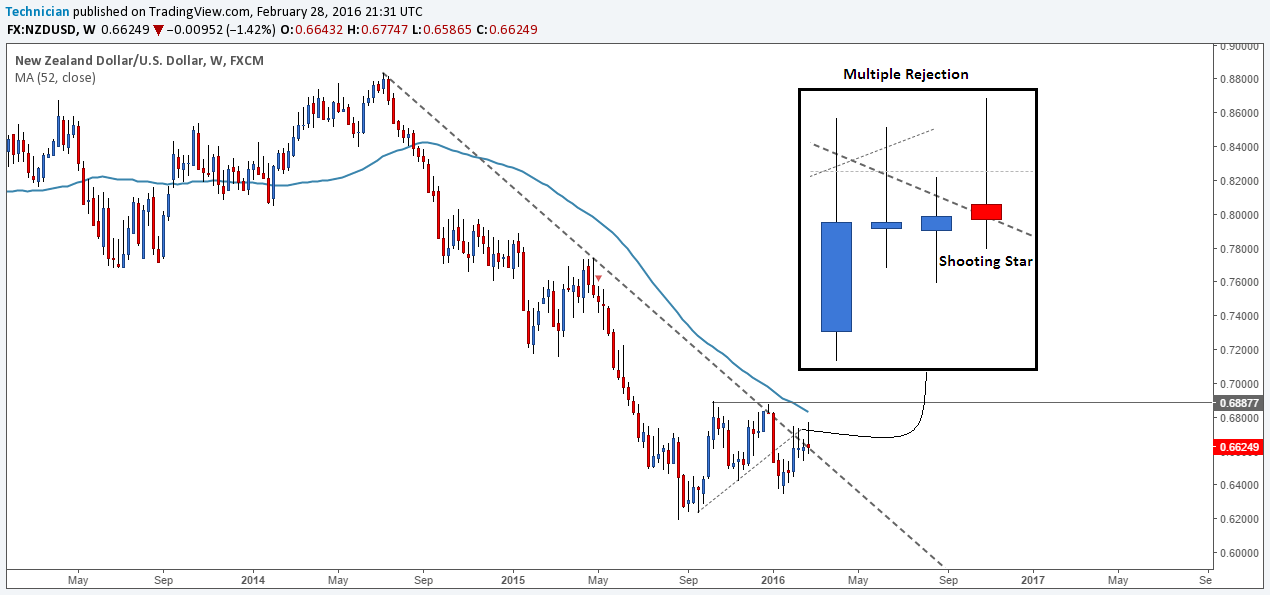

Starting from the higher time frame, the price has retested a major long-term trend line for the overall bearish trend. The NZDUSD has retested this trend line several times in the past weeks, but failed to break and hold above. Last week test was also rejected, where the price formed a shooting star candlestick pattern.

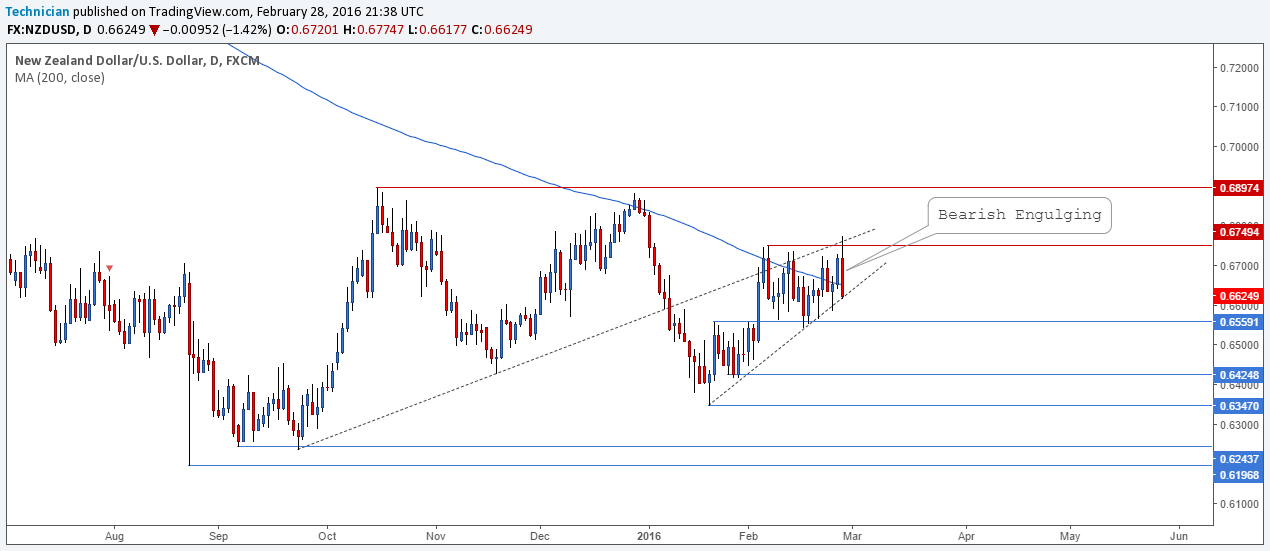

On the daily chart, the pair has retested the latest swing highs at 0.6750 but failed to break. Meantime, the latest rally completed a retest to the previously broken rising trend line shown on chart.

The price has formed a bearish engulfing candlestick pattern on Friday, to close the week back below the 200-days simple moving average.

Trade Levels: Short at: 0.6650 // Target 1: 0.6540 // Target 2: 06430 // Stop loss : 0.6750. Average risk-reward for the trade is approximately 1.65.

Make sure to read the trading rules below:

1. Maximum risk per trade is 3% of capital. Typically around 2%.

2. Trades are taken in two units.

3. Two targets for each trade. First unit would be closed at first target .

4. After closing first unit at first target, Stop loss will be moved to entry point for the second unit.

5. Second unit would be closed at second target.

6. If first target is reached without triggering entry I cancel the trade.

7. If first target is reached I move stop loss to break-even.

8. Remember: Losing is a main part of the game.

Disclaimer: All trade ideas are hypothetical and only for illustration and educational purposes.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. thefxchannel.com and the Authors will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.