Market Brief

The latest batch of economic data from the US came in mostly on the soft side yesterday, casting a shadow over the country’s economic outlook. Durable orders rebounded less than expected in March, suggesting that the contraction in the factory sector is not over. The indicator rose 0.8%m/m in March, missing median forecasts of 1.9%, while the previous month’s reading was downwardly revised to 3.1%. After stripping out demand for transportation goods, new orders shrank -0.2% versus an expected increase of 0.5%. On the release, EUR/USD jumped 0.60% to 1.1340 before consolidating at around 1.13 amid a slight improvement in both the Composite and Service PMIs. The first printed at 51.7 in April from 51.3 in March, while the latter rose to 52.1 from 51.3. The bottom line is that we do not yet have a clear sign of recovery yet as most US sectors continue to surprise significantly to the downside. The Fed’s statement will therefore emphasise the weak US outlook.

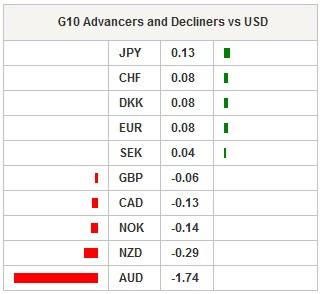

With the exception of the Australian dollar, which was literally hammered, it was a relatively quiet trading session in Asia with most G10 currencies trading sideways. AUD/USD fell 2% to 0.76 after headline inflation collapsed to the lowest level since the fourth quarter of 2008, printing at -0.2% versus +0.2% expected. Core inflation (excluding the most volatile components) printed at +0.2% versus 0.5% expected, down from 0.6% in the previous quarter. We expect the Aussie to continue moving lower as sellers rush to the market and push the Australian dollar lower in anticipation that the Reserve Bank of Australia will step in and lower its key interest rate in an attempt to boost inflation.

In New Zealand, the trade balance came in on the soft side, printing at NZ$117m versus NZ$401m median forecast, as exports fell more than expected. The slump in the values of primary produce exports has widened the annual trade deficit. The export of dairy products shrank another 12.2% in March after a contraction of 5.7% in the previous month. Similarly, meat products’ exports fell 10.9% after a negative figure of 8.3% in February. Only crude oil prices and fruits export values increased over the period and helped to limit the damage. Indeed, this is the largest trade deficit since April 2009. In such an environment, NZD/USD fell 0.50% in Wellington. Moreover, tonight’s RBNZ’s rate decision will likely serve to remind investors of the central bank’s continued dovish bias and that it does not look favourably upon the recent Kiwi appreciation.

Today traders will be watching retails sales from Spain; the economic tendency survey and trade balance from Sweden; consumer confidence, business confidence and economic sentiment from Italy; GDP figures from the UK; MBA mortgage application, pending home sales and FOMC rate decision from the US; RBNZ rate decision and Brazil rate decision.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 17290.49 | -0.36 |

| Hang Seng Index | 21364.79 | -0.2 |

| Shanghai Index | 2953.671 | -0.37 |

| FTSE futures | 6230.5 | -0.15 |

| DAX futures | 10326 | 0.24 |

| SMI Futures | 8046 | 0.12 |

| S&P future | 2082.2 | -0.3 |

| Global Indexes | Current Level | % Change |

| Gold | 1246.6 | 0.25 |

| Silver | 17.33 | 0.96 |

| VIX | 13.96 | -0.85 |

| Crude wti | 44.58 | 1.23 |

| USD Index | 94.33 | -0.26 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SP Mar Retail Sales YoY | - | 7,40% | EUR/07:00 |

| SP Mar Retail Sales SA YoY | 3,40% | 3,90% | EUR/07:00 |

| SP Feb Total Mortgage Lending YoY | - | 15,40% | EUR/07:00 |

| SP Feb House Mortgage Approvals YoY | - | 10,60% | EUR/07:00 |

| UK BOE FPC Member Kohn Speaks in Frankfurt | - | - | GBP/07:00 |

| SW Apr Consumer Confidence | 99 | 99,7 | SEK/07:00 |

| SW Apr Manufacturing Confidence s.a. | 111,7 | 112,5 | SEK/07:00 |

| SW Apr Economic Tendency Survey | 106,1 | 106,6 | SEK/07:00 |

| SW Mar Trade Balance | 1.7b | -0.2b | SEK/07:30 |

| SW Mar Household Lending YoY | - | 7,50% | SEK/07:30 |

| SW LO Union Economic Forecasts | - | - | SEK/07:30 |

| EC Mar M3 Money Supply YoY | 5,00% | 5,00% | EUR/08:00 |

| IT Apr Consumer Confidence Index | 115 | 115 | EUR/08:00 |

| IT Apr Business Confidence | 102,5 | 102,2 | EUR/08:00 |

| IT Apr Economic Sentiment | - | 100,1 | EUR/08:00 |

| BZ Apr 22 FIPE CPI - Weekly | 0,65% | 0,75% | BRL/08:00 |

| UK 1Q A GDP QoQ | 0,40% | 0,60% | GBP/08:30 |

| UK 1Q A GDP YoY | 2,00% | 2,10% | GBP/08:30 |

| UK Feb Index of Services MoM | 0,20% | 0,20% | GBP/08:30 |

| UK Feb Index of Services 3M/3M | 0,80% | 0,90% | GBP/08:30 |

| RU Bank of Russia 1st Dep. Governor Shvetsov participates in MoEx | - | - | RUB/09:00 |

| UK Apr CBI Retailing Reported Sales | 13 | 7 | GBP/10:00 |

| UK Apr CBI Total Dist. Reported Sales | - | 20 | GBP/10:00 |

| US Apr 22 MBA Mortgage Applications | - | 1,30% | USD/11:00 |

| US Mar Advance Goods Trade Balance | -$62.8b | -$62.9b | USD/12:30 |

| RU Apr 25 CPI Weekly YTD | - | 2,40% | RUB/13:00 |

| RU Apr 25 CPI WoW | - | 0,20% | RUB/13:00 |

| US Mar Pending Home Sales MoM | 0,50% | 3,50% | USD/14:00 |

| US Mar Pending Home Sales NSA YoY | 0,80% | 5,10% | USD/14:00 |

| US Apr 22 DOE U.S. Crude Oil Inventories | 1750k | 2080k | USD/14:30 |

| US Apr 22 DOE Cushing OK Crude Inventory | 235k | -248k | USD/14:30 |

| BZ Currency Flows Weekly | - | - | BRL/15:30 |

| US Apr 27 FOMC Rate Decision (Upper Bound) | 0,50% | 0,50% | USD/18:00 |

| US Apr 27 FOMC Rate Decision (Lower Bound) | 0,25% | 0,25% | USD/18:00 |

| US Federal Open Market Committee Announces Decision on Rates | - | - | USD/18:00 |

| NZ Apr 28 RBNZ Official Cash Rate | 2,25% | 2,25% | NZD/21:00 |

| BZ Apr 27 Selic Rate | 14,25% | 14,25% | BRL/20:00 |

| IN Mar Eight Infrastructure Industries | - | 5,70% | INR/22:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1326

S 1: 1.1144

S 2: 1.1058

GBPUSD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4609

S 1: 1.4284

S 2: 1.4132

USDJPY

R 2: 113.80

R 1: 112.68

CURRENT: 111.79

S 1: 107.63

S 2: 105.23

USDCHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9718

S 1: 0.9476

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.