Market Brief

Yesterday was another rough day for global equities; especially European ones as Wall Street attempted a recovery rally in late session but was just able to limit the loses as the same story of fears about China growth outlook, slowing global economy and persistently low crude oil prices continued to weigh heavily on the investors’ mood. In Japan the Nikkei fell 2.31%, while the broader Topix index slid 3.02%. In Singapore the STI slip 2.14%, while in Australia and New Zealand equities were down 1.17% and 0.85% respectively. China markets are still closed for Lunar New Year holidays.

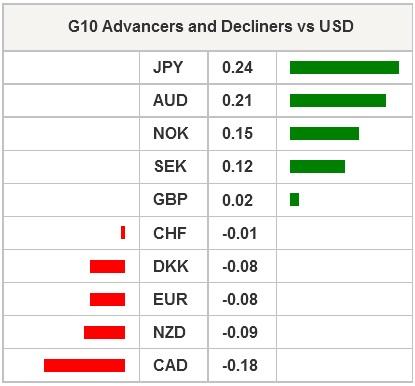

In the FX market, the Australian Dollar was able to consolidate yesterday gains and is currently testing the next resistance, which lies at $0.71. AUD/USD was up 0.21% in Sydney. The Japanese yen gained the most versus the dollar against the backdrop of renewed risk-off sentiment. USD/JPY broke the strong support at 115.57 (low from December 16, 2014) and is currently consolidating slightly below at around 114.90. The Japanese 10-year treasury yield have been trading shortly in negative territory, and reached -0.08%, before stabilising above the neutral mark.

This week economic calendar is a light one and traders will be focus on today’s testimony of Janet Yellen before the US congress. For now the market is pricing in no rate hike for 2016. However, the market is known for having a short sighted view and has the bad habit to overreact to short-term events. During her speech, Janet Yellen will likely put the emphasis on the continuous improvement in the job market and more specifically on the strong pick-up in wage growth. EUR/USD stabilised during the Asian session and is now trading above the 1.1250 threshold at around 1.1280. Given the arguments presented above, we believe that the risk remains on the upside for the greenback as Fed Chairwoman will likely put emphasis on the few bright spots of the US economy (job market and slight improvement in wage inflation) rather than on the amount of slack in the rest of the economy.

Emerging market currencies are broadly trading higher this morning as yesterday’s strong risk-off sentiment eased. The South African rand rose 0.85% against the US dollar, with USD/ZAR back below the 16.0 mark at around 15.9350. The Russian rouble took also advantage of this respite and gained 0.65% versus the greenback, which helped USD/RUB to edge lower to 79.10. Asian pairs also benefited from this environment as the South Korean won rose 0.74%, the Taiwanese dollar edged up 0.60%, while the Indian rupiah increased by 1.05%.

Today traders will be watching Janet Yellen’s testimony before the US congress, MBA mortgage application, budget statement; industrial and manufacturing production from France and the UK; CPI from Denmark and Norway; industrial production from Italy.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 15713.39 | -2.31 |

| FTSE futures | 5613 | 0.31 |

| DAX futures | 8952 | 0.51 |

| CAC futures | 4023.5 | 0.66 |

| SMI Futures | 7542 | 0.72 |

| S&P future | 1851.2 | 0.16 |

| DJIA futures | 16025 | 0.08 |

| Global Indexes | Current Level | % Change |

| Gold | 1188.8 | -0.03 |

| Silver | 15.22 | -0.16 |

| VIX | 26.54 | 2.08 |

| Crude wti | 28.58 | 2.29 |

| USD Index | 96.06 | -0.01 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| DE Jan CPI MoM | -0,40% | 0,00% | DKK/08:00 |

| DE Jan CPI YoY | 0,60% | 0,50% | DKK/08:00 |

| DE Jan CPI EU Harmonized MoM | -0,50% | 0,00% | DKK/08:00 |

| DE Jan CPI EU Harmonized YoY | 0,50% | 0,30% | DKK/08:00 |

| SP Dec House transactions YoY | - | 13,70% | EUR/08:00 |

| SW Dec Household Consumption (MoM) | -0,40% | 0,10% | SEK/08:30 |

| SW Dec Household Consumption (YoY) | - | 3,20% | SEK/08:30 |

| NO Jan CPI MoM | 0,00% | -0,40% | NOK/09:00 |

| NO Jan CPI YoY | 2,40% | 2,30% | NOK/09:00 |

| NO Jan CPI Underlying MoM | 0,00% | -0,20% | NOK/09:00 |

| NO Jan CPI Underlying YoY | 3,00% | 3,00% | NOK/09:00 |

| NO Jan PPI including Oil MoM | - | -4,50% | NOK/09:00 |

| NO Jan PPI including Oil YoY | - | -10,80% | NOK/09:00 |

| IT Dec Industrial Production MoM | 0,30% | -0,50% | EUR/09:00 |

| IT Dec Industrial Production WDA YoY | 1,40% | 0,90% | EUR/09:00 |

| IT Dec Industrial Production NSA YoY | - | 4,20% | EUR/09:00 |

| UK Dec Industrial Production MoM | -0,10% | -0,70% | GBP/09:30 |

| UK Dec Industrial Production YoY | 1,00% | 0,90% | GBP/09:30 |

| UK Dec Manufacturing Production MoM | 0,10% | -0,40% | GBP/09:30 |

| UK Dec Manufacturing Production YoY | -1,40% | -1,20% | GBP/09:30 |

| US Feb 5 MBA Mortgage Applications | - | -2,60% | USD/12:00 |

| RU Feb 8 CPI Weekly YTD | - | 0,90% | RUB/13:00 |

| RU Feb 8 CPI WoW | - | 0,20% | RUB/13:00 |

| BZ Central Bank Weekly Economists Survey (Table) | - | - | BRL/14:00 |

| EC ECB's Praet speaks in Washington | - | - | EUR/14:00 |

| UK Jan NIESR GDP Estimate | - | 0,60% | GBP/15:00 |

| US Fed's Yellen Appears Before House Financial Services panel | - | - | USD/15:00 |

| US Fed's Williams Speaks on Health and the Economy in LA | - | - | USD/18:30 |

| US Jan Monthly Budget Statement | $47.5b | -$17.5b | USD/19:00 |

| NZ Jan BusinessNZ Manufacturing PMI | - | 56,7 | NZD/21:30 |

| CH Jan Aggregate Financing CNY | 2200.0b | 1820.0b | CNY/23:00 |

| CH Jan Money Supply M0 YoY | 10,60% | 4,90% | CNY/23:00 |

| CH Jan Money Supply M1 YoY | 14,70% | 15,20% | CNY/23:00 |

| CH Jan Money Supply M2 YoY | 13,50% | 13,30% | CNY/23:00 |

| BZ ABPO Jan. Cardboard Sales | - | - | BRL/23:00 |

Currency Tech

EURUSD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1293

S 1: 1.0711

S 2: 1.0524

GBPUSD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4494

S 1: 1.4081

S 2: 1.3657

USDJPY

R 2: 125.86

R 1: 123.76

CURRENT: 114.56

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9724

S 1: 0.9476

S 2: 0.9072

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.