Market Brief

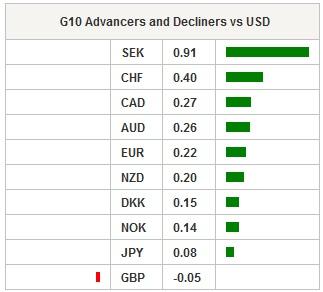

In the FX markets the USD was broadly weaker as traders square shorts. Yesterday, US inflation data provided support for the hawks as core CPI came in slightly stronger than expected, although headline reading fell sharply. In addition, Durable Goods Order surprised to the upside. Throw in some comments from hawkish FOMC non-voting member Bullard and your have all the makings of a strong USD rally. After a short period of consolidation, we anticipate the USD will begin to head higher (supported by uptick in yields). In Asia, trading was subdued as the Nikkei was up 0.06%, the Shanghai composite rose 0.36% and the Hang Seng increased 0.10%. European stocks are mixed but DAX index reached a new record high. EURUSD climbed slowly to 1.1217 as traders continued to square shorts following yesterday massive plunge. Despite the current USD weaknesses yesterday EURUSD downside breakout turns the focus on 1.1098 support. USDJPY reverse earlier loss at 119.12 as US yields rebounded and expectations of Fed tightening increased. USDJPY needs to break above 119.96 to see an extension of bullish rally to barrier resistance at 120.50. Australia’s private sector credit increased 0.6%m/m in January just above expectations and prior increase of 0.5% in December. AUDUSD regained earlier loses, rallying to 0.7825. With markets expectations for RBA easing next week rising focus will be on a retest of 0.7780. New Zealand’s building permits fell 3.8% m/m in January while ANZ business confidence was upgraded by 4 points to 34.4 in February. NZDUSD traded in a sideways pattern between 0.7536 and 0.7558 for most of the Asian session.

In an overwhelming majority, German lawmakers signaled that they would agree to the extension of Greece’s bailout plan. However, there is a substantial concern that Athens will fail to live up to their new reform plan. Elsewhere, Bank of Greece Governor Yannis Stournaras said that Athens must quickly reached a final agreement with creditors and reforms to carry on. Stournaras went on to say that should the uncertainty get lifted the Greece economy could remain on path for positive growth this year. Perhaps playing-up the "mediator" a bit in a speech to Bank of Greece shareholders he stated “in order to make the most of this window of opportunity, negotiations with our partners must continue in a spirit of cooperation and trust so that we can soon reach a final agreement that will be mutually beneficial.” We are deep concern with the ability of the new Greek government to move forward with reform measures and expect European will be in the same position in four months. This political uncertainty combined with policy divergence underpins our bearish expectations for EURUSD.

Wealth of data was released from Japan. Japan’s industrial production jumped 4.0%m/m in January stronger then expected growth of 2.7%, and previous 0.8% rise in December. This was the fastest acceleration since mid-2011. On the other hand retail sales fell -2.0%y/y in January again expected fall -1.2%. On the inflation front, Japan’s CPI rose 2.4%y/y in line with expectations, while annual core inflation was up 2.2% in January falling from 2.5% in December. CPI excluding food and energy rose 2.1%yoy in January. Tokyo’s CPI rose 2.3%y/y against market expectations of 2.2% rise. Inflation trend is now moving downwards indicating that by September we should see BoJ move forward with additional QQE.

On the docket today we have flash German HICP inflation, Swedish Q4 GDP, Norwegian unemployment, US Q4 GDP, Consumer Sentiment, and plenty of Fed speakers. Participating at Monetary Policy forum, Fed Vice Chairman Fischer, NY Fed President Dudley and Cleveland Fed President Mester.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.