Market Brief

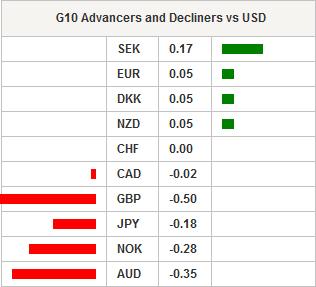

US 2-year Treasury yield dropped 8bps, the 10-year 11bps while the dollar lost almost 1% versus the euro, 0.50% versus the CHF and 0.70% against the NZD. In New York yesterday the S&P 500 paired losses and retreated -0.83% while the Nasdaq fell -0.80% and the Dow Jones -0.93%. There is no doubt, September-rate-hike-enthusiasts did not like the minutes of the last FOMC meeting. Fed members “judged that the conditions for policy firming had not yet been achieved, but they noted that conditions were approaching that point”, adding that “the Committee's communications around the time of the first rate increase should emphasize that the expected path for policy, not the initial increase, would be the most important determinant of financial conditions and should acknowledge that policy would continue to be accommodative”. Fed members seem to be pretty comfortable with the labour market while some are still concerned about low inflation and wage pressure. In our opinion, a September rate hike cannot be ruled out but it’s not a coin flip anymore, December is appearing more and more likely.

In Asia, regional equity markets continue to lose ground as China weighs. Japanese Nikkei is down 0.94%, Hong Kong’s Hang Seng -1.82%, Shanghai Composite -1.16% and Shenzhen Composite -0.71%. The yuan continues to gain strength against the dollar as the PBoC raised its reference rate for fifth straight day to 6.3915. USD/JPY found a strong resistance at 123.78 (Fib 61.8% on June-July debasement) and is bouncing back toward 124.50 as the dollar regains strengthen in post-FOMC minutes trading. In Australia, the S&P/ASX is down -1.70% while AUD/USD erased previous losses, back around $0.7310. The Kiwi consolidates gains against the dollar and is currently trading above the 0.66 threshold.

In Europe, equity futures follow Wall Street and Tokyo’s lead as they trade into negative territory. The Footsie is down -0.60%, the DAX -0.62%, the CAC -0.23% while the SMI is down -0.24%. After having reached 1.0960, EUR/CHF is heading toward 1.07 despite disappointing trade data. July trade balance printed at CHF3.74bn compared to a previous figure downwardly revised to CHF3.51bn. Exports contracted -1.7%m/m compared to -0.7% a month earlier while imports fell 2.5%m/m versus +2.5% previous month.

In UK, retail sales are due later today and are expected to have strengthen in July with median forecast of 0.4% versus -0.2%m/m in June. Overall, we remain bullish GBP as monetary policy divergence will remain the main driver. GBP/USD is trying to escape the 1.5450-1.5650 range and is currently trading above 1.5660. EUR/GBP remains our favourite currency pair to play the UK strong economic data and upcoming rate hike.

Today will be a busy day of economic data with unemployment rate from Sweden; GDP from Norway; retail sales from UK; unemployment rate from Brazil; initial jobless claims, Bloomberg consumer comfort, existing home sales, Philadelphia Fed business outlook and finally, leading index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.