Market Brief

In the minutes from its May meeting, the Reserve Bank of Australia (RBA) retained an easing bias, leaving open the possibility of further rate cut. During its May 5 meeting, the RBA cut interest rate by 25bps to a record low of 2%. First, the Aussie fell to 0.7957 against the dollar before returning above 0.80 in late Asian session. AUD/USD is moving closer to the bottom of its declining channel will find buying interest once the 0.7960-0.80 area has been cleared. On the upside, closest resistance stands at 0.8164 (high from May 14) while on the downside a strong support stands around 0.79.

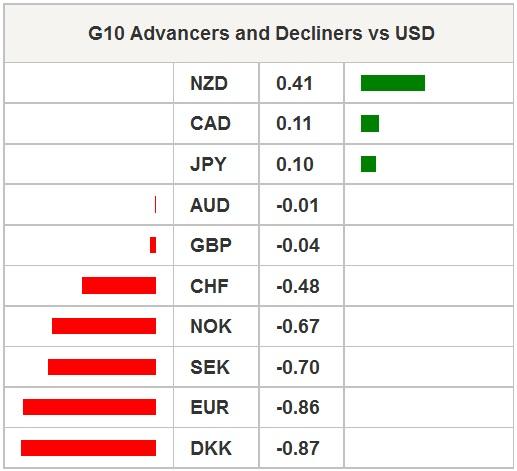

In New Zealand, the Kiwi jumped more than 1% against the greenback after 2Y inflation expectations rose from 1.80% in Q1 to 1.85% in Q2. NZD/USD tried to break its 50dma to the upside but was unable to turn it into a support. The Kiwi is now trading near the bottom of its 4-month range between 0.7740-0.7177.

Asian equity markets are broadly higher this morning, driven by strong performances of Chinese stocks. Shanghai composite printed a new all-time high at 2,131.7, up 2.32%. The Nikkei 225 is about to close in positive territory for the third day in a row, up 0.68% while the Hang Seng edges higher by 0.14%. In Australia, S&P/ASX is down -0.77%. USD/JPY broke the 119.74 resistance implied by the 38.2% Fibonacci on March sell-off. The 120.18-61 area needs to be cleared for fresh upside attempt. A strong support stands around 118.50 (previous lows). Japan’s Q1 GDP figures are due overnight and may provide some volatility. Preliminary estimates indicate that the Japanese economy is expected to have grown 1.6%q/q (annualised) during the first-quarter (1.5% prior).

The EUR/USD sell-off initiated yesterday continued in Tokyo overnight. The single currency retreated more than -1.50% since its high from last Friday. A couple of economic data from the US are due today: April’s Housing Starts are expected at 1015k (926k prior) while Building Permits are expected to rise to 1064k from 1039k in March. We expected the numbers to be in line with expectations. A significant surprise on the upside may awake dollar bulls and accelerate the rise of the greenback. However, it is more likely that Fed’s minutes release tomorrow and inflation figures due on Friday will move the market. German ZEW expectations (49 exp, 53.3 prior) and Eurozone’s final inflation (0%y/y exp, 0% prior).

In UK, CPI figures are due this morning and are expected to come in flat in April. GBP/USD retreated to 1.5660, affected by the strength of the dollar. The cable will find support at 1.55 (psychological level and previous highs) and resistance at 1.58. EUR/GBP was on sell in Asia and will find some support at 0.7120 (previous low).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.