Market Brief

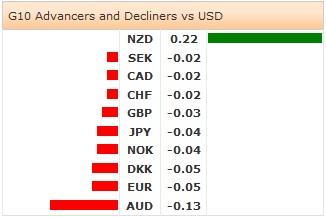

The Fed kept its policy rates steady and reduced the pace of its monthly asset purchases by an additional (regular) 10 billion dollars. The accompanying statement remains highly accommodative for considerable time after the end of the asset purchases program. The only distinction has been the inflation moving “closer to long-run target”, versus “below” the objective at last meeting. Data-wise, the US second quarter GDP surprised greatly on the upside in yesterday’s advance release. According to advance estimates, the second quarter annualized growth should recover to 4.0% (vs. 3.0% exp. & -2.9% in Q1). The ADP employment report however came in softer than expected. The US economy added 218’000 new private jobs in July (versus 230K exp. & 281K last). The US 10-year yields rallied to 2.5642% post-FOMC, the DXY index spiked to its highest levels since September 2013 (81.500+). The July unemployment rate and nonfarm payrolls are due on Friday. The consensus stands at 231K versus 288K printed a month ago.

USD/JPY rallied to 103.09 alongside with the US yields post-FOMC. Solid resistance pushed the pair back to 102.73/88 band in Tokyo. The positive trend gains momentum, option bets are mixed at 103.00, bids abound at 103.25/103.50/104.00 for today expiry. Talks on 2.0% corporate tax cut by April 2015 should sustain the upmove. EUR/JPY tests the 21-dma (137.63), yet the bullish attempts should remain capped by decent selling pressures in EUR. Solid offers are eyed at 138.00/50.

The broad based USD demand pulled EUR/USD down to 1.3367 in New York. Corrective bids jumped in to push the pair back toward 1.3400 given the oversold conditions. The bias remains comfortably negative, option barriers trail above 1.3400+. The first target stands at 1.3296 (November 2013 low). EURGBP remains offered at 21-dma (0.79241). More resistance is eyed at 0.79541 (June-July downtrend top).

In Australia, the import and exports prices slumped more-than-expected in 2Q (import prices -3.0% vs. -1.5% exp. & 3.2% last, exports prices -7.9% vs. -4.0% exp. & 3.6% last), while building approvals contracted by 5.5% in month to June. Combined to broad USD strength, AUD/USD advances towards 0.9300 (lowest since June 5th), pulling out support at 100-dma (0.9322). Bids are seen at 0.9300+. The key support is placed at distant 0.9200/09 (Fibonacci 50% on Oct’13 – Jan’14 drop).

After hitting 0.8453 in New York, NZD/USD quickly recovers above 0.8500. The oversold conditions suggest more upside correction at the current levels. Option related bids should keep the downside safe above 0.8450/75 area.

In Argentina, no agreement has been reached on 539 million dollar interest payments missed on yesterday deadline; Argentina is just a couple of hours away from defaulting. This will be the second default in 13 years. The economic calendar of the day is German June Retail Sales m/m & y/y, French June Consumer Spending and PPI m/m & y/y, German July Unemployment Rate, Italian July (Prelim) CPI m/m & y/y , Italian June (Prelim) Unemployment Rate and Italian June PPI m/m & y/y, Euro-Zone July CPI y/y estimate and Core CPI y/y preliminary reading, Euro-Zone June Unemployment Rate, Canadian May GDP m/m & y/y, US July 26th Initial Jobless Claims & July 19th Continuing Claims, US July ISM Milwaukee and US July Chicago Purchasing Manager.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.