Market Brief

The geopolitical tensions in Israel/Gaza and Ukraine/Russia continue occupying the headlines. The UN Security Council called for immediate end of conflict in Gaza. The gold remains in demand; XAU/USD holds ground above $1,300 with most investors thinking it is not the right time to play short. Another critical resistance stand at $1,285/86 (June 16th high/200-dma).

In Japan, USD/JPY and JPY crosses traded soggy as Nikkei was closed. USD/JPY traded in the tight range of 101.20/39. Trend and momentum indicators remain marginally bearish. Support is seen pre-101.00, then 100.76 (2014 low). Decent option barriers are eyed at 101.50 up to 102.00. EUR/JPY tests 136.75 (Fibonacci 38.2%% on Nov-Dec’14 rally). The key support zone is placed at 136.00/23 (March-July downtrend channel bottom/2014 low).

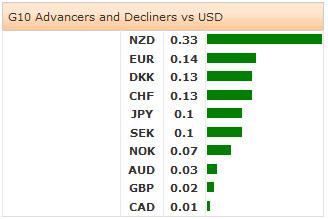

EUR/USD made a bullish start to the week after trading down to 1.3491 in New York last Friday. The pair broke below 1.3503 for the first time since June 5th ECB meeting; bids at 1.3477/1.3503 lifted the pair to 1.3524 before the closing bell. Trend and momentum indicators remain comfortably bearish; with July 15th CFTC data confirming the extension of speculative short EUR positions. Resistance is seen solid at 1.3550/1.3600. EUR/GBP corrects last week weakness (down to 0.78888); we remain sellers on rallies as long as resistance at 21-dma (0.79564) holds.

The Cable is in the bearish consolidation zone, deeper correction is eyed with technicals pointing downwards. Option bids are seen above 1.7075, offers dominate below 1.7050 (30-day mid-Bollinger band). The critical support zone stands at 1.6875/1.6950 (year-to-date uptrend bottom/50-dma).

NZD/USD traded back to 0.8720 (July 17th high) on thin volumes. The RBNZ verdict is due on July 24th, markets expect additional 25 bp hike. However the speculations on less hawkish accompanying statement keep the appetite limited. AUD/USD tests 0.9400 resistance, option bets for today expiry are mixed at this area, offers are solid pre -0.9505 (year-to-date high).

Released on Friday, the Canadian inflation accelerated at the faster pace of 2.4% year-to-June (vs. 2.3% expected & last). The faster growing consumer prices revived BoC-hawks, questioning how true Poloz’s lower inflation outlook is. USD/CAD sold-off to 1.0721 as knee-jerk reaction, resistance should now strengthen pre- 1.0800/20 region (optionality/200-dma) and keep the Loonie ranged within 1.0550/1.0800 band.

The economic calendar of the day is light, traders watch German June PPI m/m & y/y, Swiss June M3 Money Supply, Italian May Industrial Sales and Orders m/m & y/y and Chicago Fed June National Activity Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.