Market Brief

Euro remains under pressure, The US Equities maintained its gains

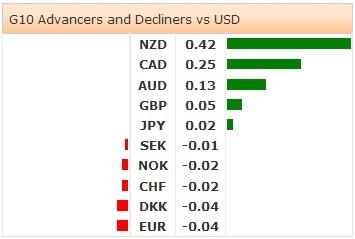

Once again, Euro remains under pressure, indicating to the fact that the fluctuations of the Euro were not considered as direct action, however Euro reacted to the USD strength as the USD gained in the last few days. The current level of Euro reflects the sociopolitical conditions in Euro Zone. Politically speaking, The Ukrainian – Russian talks in Belarus yesterday didn’t come out with a result. From economic perspective, the Euro zone economy hasn’t improved, especially the negative German figures two days earlier. Euro has been affected by Draghi’s speech, he said that the ECB will be ready to step forward and support the economy. The European stock indexes gained in the last two days , Euro retreated by -0.07% edging lower to $1.3157 today in Asia. The European equities increased yesterday, German DAX 0.82%, Swiss 0.72% and UK FTSE 0.70%. It will be important to watch the German consumer confidence survey later today, however the expectations indicate to stability. The investors must be careful as the German figures could surprise the markets, and go downside. It is important to say that the current weakness of Euro doesn’t terrify the European policymakers, but the sluggish economic performance and the high unemployment matter.

In the US, the economic figures were positive enough to lead the gains in the US equities. The US durable goods orders increased by 22.6% in July, the housing price index improved by 0.4% from 0.2% and the US consumer confidence rallied to 92.4 from 90.3 in July , the highest in six years. Generally speaking, the US economic figures excited the investors who rushed to buy the US equities, and bet on the USD strength. The US equities had massive gains in the last few sessions; S&P had a record at 2000.02 yesterday, Dow Jones 0.17% and NASDAQ 0.29%. In Japan, the Japanese government didn’t change the economic assessment saying that the Japanese economy has a moderate recovery; however Japan’s government seemed more cautious than before. The Japanese stock indexes had no major changes today, Nikkei 0.03%, Topix -0.03%, while the USDJPY remains almost stable at 104.03 today morning, as the Yen increased only by 0.2%.The foreign bond investment, and the foreign investments in the Japanese stocks will be released later today. It’s good to say that the continuous purchasing of the foreign bonds by the Japanese investors will lead to weaker Yen. Japan has now deep discussions about the current level of the sales tax, and many policy makers warned of higher tax in the next coming years. In the meantime, the Japanese banks cut mortgage rates to enhance the growth in real estate sector.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.