Market Brief

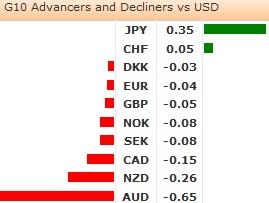

The Reserve Bank of Australia cut its official cash rate to the record low 2.75% to boost the Australian growth still below the trend. Aussie dropped to 1.0178 - its lowest level since March 4th, while ASX 200 retreated 0.24% despite the better-than-expected trade surplus in March. The market news on George Soros selling AUD clearly helped to push the AUD-complex further down. AUDJPY traded to 100.841, while AUDNZD crossed below 1.20 for the first time in almost four years. The sentiment in AUD remains solidly bearish.

In Japan, the FinMin Aso stated that the monetary policy alone cannot fix the Japanese economy and announced that the fiscal reform plan is scheduled by mid-year. USDJPY and JPY crosses were offered in Tokyo. USDJPY remained capped by solid offers towards 99.50 and higher. Japanese exporters sales helped to push the Yen-complex lower. USDJPY is still subject to very strong option resistance around 100-area.

The Asian equity markets were dominated by the Japanese stocks’ rally. The Nikkei 225 rushed 3.55%, Hang Seng and Shanghai’s Composite added 0.22% and 0.05%, while Taiex and Kospi index dropped 0.07% and 0.36%.

Dovish comments from the ECB President Draghi sent the Euro a leg down yesterday afternoon. EURUSD sank as Draghi stated that the ECB is ready to act again if needed. The downside remained well supported at 1.3054. Demand came from Asian sovereign names overnight. EURUSD advanced to 1.3095, yet opened the day on negative sentiment in Europe. EURCHF spiked down to 1.2255 while USDCHF sold-off to 0.9370. The unemployment rate in Switzerland remained unchanged at 3.1% in April while the consumer confidence did not show the expected improvement.

Back from Holidays, the sterling opened the week on the downside in UK. Cable was seen below its 100-day MA (1.5536) this morning, while EURGBP stabilized at 0.8410/20 area after yesterday’s heavy sell-off to 0.8400.

Today, the focus is on the Swiss Foreign Currency Reserves in April, French March Industrial and Manufacturing Production m/m & y/y, Swedish March Industrial Production, German March Factory Orders m/m & y/y and US May IBD/TIPP Economic Optimism.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.