Market Brief

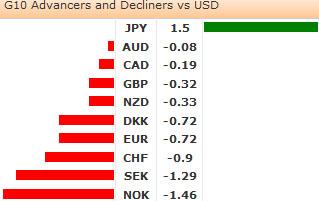

The risk appetite decreased in the Asian stock markets, as the World Bank revised its Japanese and US growth forecasts to the downside, and predicted a second year of contraction in the Euro-Zone. Overnight, the Australian monthly consumer confidence improved to 0.6% from -4.1% previously. In Japan, yearly domestic CGPI increased to -0.6% (exp. -0.7%, prev. -0.9%), while November monthly and yearly machine orders surprised to the upside (m/m 3.9%, exp. 0.3%, prev. 2.6% & y/y 0.3%, exp. -7.3%, prev. 1.2%). Despite the suppportive economic data, the Nikkei 225 index slumped by 2.56%, as Yen extended gains versus all of its major counterparts for the second consecutive day. USDJPY slipped down to 88.00 level early in the session, while EURJPY tested 116.80 / 117.00 week-low. The World Bank halved its forecast for the Japanese growth, while the Chinese direct investment saw its first full-year decline since 2009. As cautious investors are focused on crucial economic data from China later this week, Hang Seng retreated 0.48%, Shanghai’s Composite lost 0.82%, while Kospi and Taiex index fell by 0.32% and 0.83% respectively. In US, the Empire Manufacturing disappointed by decreasing to -7.78 (vs. the revised -7.30, and the expected 0.00), while Advance December Retail Sales increased to 0.5% (vs. 0.2% exp. % 0.3% prev). The monthly PPI recovered to -0.2% from -0.8%, while the PPI ex-Food & Energy remained unchanged at 0.1%, indicating that the food and energy prices were the main drivers in December producer price differential. In reaction to the economic data, the S&P500 advanced by 0.11%, while Dow Jones industrial index and Nasdaq’s Composite index added 0.20% and 0.31% respectively. The US Dollar outperformed all of its major peers except Yen, while Gold and Silver surged to 1,685, and 31.50, January highs. In Europe, Juncker stated that the single currency is “dangerously high”. This is just further evidence that global policymakers are preparing for a broader “currency war”. We are seeing a clear trend of developed markets following the Emerging markets in attempting to control their exchange rate. At next week’s BoJ meeting we could see Japan bring a bazooka to the fight. While EURUSD retreated to 1.3264, EURCHF tested 1.2400 (highest quote since December 2011) , yet failed to advance further. Today’s agenda consists of Italian November Trade Balance, Euro-Zone m/m and y/y CPI, US Mortgage Applications, US m/m and y/y CPI, and US m/m and y/y CPI Ex-Food & Energy, the US Total Net TIC flows, the US Net Long-term TIC flows, US December Industrial Production and the US December Capacity Utilization.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.