The main data release today was US retail sales for February, and although they may have battled through the snow, the US consumer did what it does best – shop. Sales rose 1.1%, more than the 0.5% expected, but the real shocker was the sales ex autos and gas, which also surprised to the upside and rose by a healthy 0.4% last month. This is significant as it suggests a resilience and confidence in the US consumer that the markets were worried would be lost after the expiry of the payroll tax cut at the start of the year and rising gas prices at the pump.

While sales in gas stations were strong, up 5% on the month, there were also encouraging gains for building materials (feeding into the housing rebound theme) and food and beverages. Furniture sales fell 1.6% on the month, but that may be down to seasonal effects. Overall, this is a strong report that suggests the better tone to labour market data of late has helped to boost consumer confidence. For investors in US stocks and the dollar it is another prong to the US economic recovery story, which feeds into the dollar as a growth currency and also stronger stock markets, at least in the short term.

A short squeeze in GBP prior to the Budget?

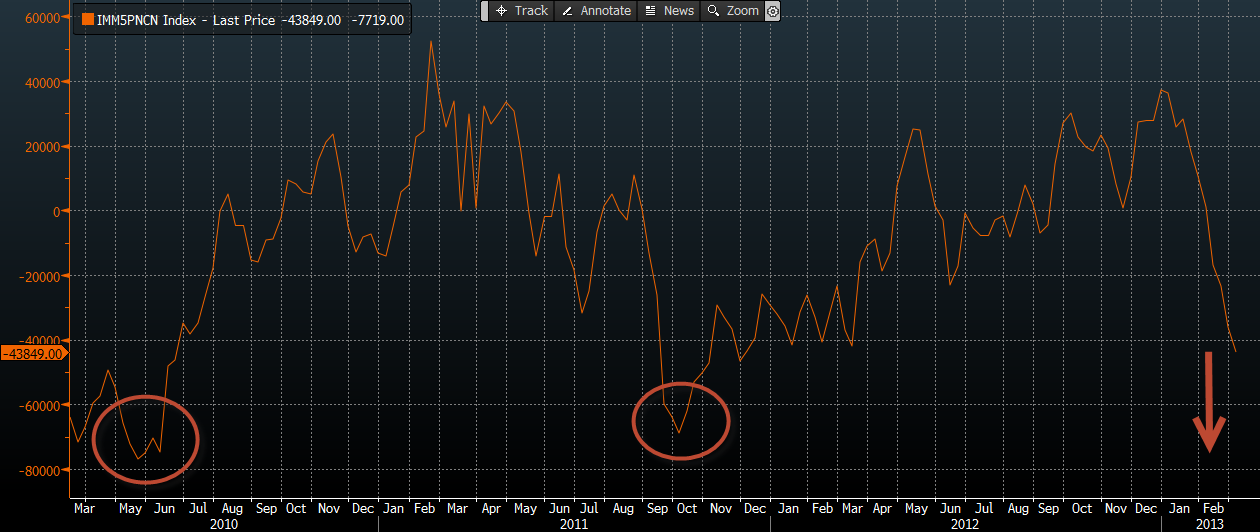

For the first time in a long time the pound was one of the strongest performers in the G10 space this morning. It appears that yesterday’s sell off in GBP on the back of weak industrial and production data could have been over-done. The data itself told us nothing we don’t know already – the medium-term outlook for the UK economy remains bleak and GBP can probably keep weakening from here. Some have urged a note of caution as GBP shorts start to look stretched on the downside, however according to the CFTC IMM data that measures positioning in the speculative community, GBPUSD shorts have only recently reached their lows of the last 12 months, and remain above the lows from October 2011 and June 2010. This suggests that if sentiment continues to decline then we may see further short interest in the pound going forward.

The pullback we are experiencing today may be some short-covering or hedging by GBP bears, it may also be a short-squeeze as we lead up to next week’s Budget. There is a lot of pressure on the Chancellor – from his colleagues in Parliament, and from the media – to loosen the fiscal strings. Although Osborne pledged to stick to his plan A when it comes to fiscal consolidation there is a chance he could capitulate. We think any signs of fiscal easing could boost the pound as it may improve the growth outlook. Sterling is incredibly sensitive to the UK’s domestic fundamentals and the large moves lower we have seen in the pound in recent months have generally come from data misses, thus a good news growth story could have a similar impact on the upside, at least in the short term. The bias is higher in GBPUSD above 1.4950, above here resistance levels to watch include 1.5005 then 1.5040.

EURUSD – losing the battle to stay above 1.30

A fairly lacklustre Italian bond auction threatened to push EURUSD below 1.30; however, it ended up being the US retail sales figures that lent the decisive blow. A daily close below 1.2980 could see a return to 1.2880. Rome managed to sell EUR 5.32 billon of 3 and 15-year government bonds earlier; however it had to sell them at the highest yields since December. The 3-year yield was 2.48%, versus 2.3% at an auction last month. While still relatively stable, it’s the pace of change in yields that are the problem, and it is a keen reminder that political woes could cause another sovereign crisis in the region’s third largest economy. Italian political problems could come to a head this week for two reasons: 1, Italy’s government is due to sit in Parliament, for the first time since the elections, tomorrow as they need to elect a new President. However, with no party having a large enough mandate to govern, it looks increasingly unlikely that new elections will have to take place. Thus is likely to increase the uncertainty as the charismatic leader of the Five Star Movement Beppe Grillo said earlier that Italy is already “de-facto out of the euro”. 2, The EU summit at the end of this week could highlight tensions between the pro-austerity and the pro-growth factions in the currency bloc. It doesn’t look like Germany will back down; Finance Minister Schaeuble said today that the stability and growth pact is of “central importance” at the EU summit and that the German budget shows that you can cut spending and grow. This is not euro positive in the medium-term.

Fears that Japan’s Prime Minister Abe’s nominations for the Bank of Japan could fail to secure enough support from the rest of the Japanese parliament have evaporated today and it looks like the uber-doves, led by BOJ governor nominee Kuroda, will be able to build their nest at the Japanese central bank after all. This could limit the recent yen strength we have seen of late. In the short term, 95.50 is key support, while a break above 96.25 could open the way for a move back towards 97.00.

It’s also worth watching the RBNZ meeting later tonight at 2000 GMT. Please see the One to Watch in yesterday’s London Session report for our thoughts on this.

One to Watch: GBPUSD

CFTC IMM data – GBP shorts are not as stretched as they were in October 2011 and June 2010.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.