There’s a sense that everyone got out of bed the wrong side this morning and European stock markets have opened lower. There is also a risk off tone to the FX markets with the yen clawing back some recent losses and the Aussie and the Kiwi both sharply weaker. EURUSD has failed to stay above the 1.30 handle yet again, reinforcing the bearish bias, while GBPUSD has continued to remain in recovery mode today and is back above the crucial 1.50 mark.

Headline risk to the fore today

There have been three main fundamental drivers of markets so far today: 1, testimony from the new Bank of Japan governor 2, News from China that it was imposing stricter rules surrounding property transactions and 3, funding for lending data from the UK. On top of this there is a Eurogroup meeting today, Italy still doesn’t have a government, with the charismatic leader of the Five Star movement laying out his plans for an online referendum on the euro and potential Eurozone exit and also the US’s spending cuts will come into force from today after the US government failed to come up with a compromise before the 1st March deadline. This increases headline risk at the start of a big week for markets as it includes major central bank meetings and Non-Farm payrolls on Friday.

We have plenty of commentary on the major events coming out this week so here I will concentrate on two things: 1, funding for lending and 2, Japan’s new BOJ governor.

Failing Funding for Lending

Funding for Lending is the UK’s latest government/ Bank of England joint initiative to try and boost the flagging UK economy. The latest data about the take up and effectiveness of FLS was reported this morning and the results, so far, are less than spectacular. The BOE reported that in Q4 2012 11 banks borrowed GBP 9.5bn from the scheme, bringing the total amount that has been drawn down to date to GBP13.8billion. This is only a fraction of the GBP 70 billion available, and it’s hard to see how this will kick-start the UK’s belated economic recovery. The BOE made reference to this saying that in Q4 2012 lending growth was broadly flat; however, it also added that lending growth in Q4 is traditionally weak, before picking up in Q1.

What this means for the BOE meeting this week

This data is significant as the BOE meets this week to decide policy for March and its members may not be willing to risk relying too much on the FLS scheme as its impact on growth has been fairly weak so far. Thus, since the BOE’s foray into unconventional monetary policy has only had limited economic results, and with growth already showing deterioration at the start of 2013, the BOE may decide that it needs to take action as early as this week, with either a cut to the deposit rate (as deputy governor Paul Tucker hinted at last week) or a token increase in QE, say GBP 25bn, bringing the total programme to GBP 400bn. There is one more piece of the jigsaw on the current state of the UK economy and that is the service sector PMI. This data is released tomorrow at 0930 GMT, and if it follows the manufacturing and construction surveys and falls below 50.0 then we think there may be a good chance of policy action at this week’s BOE meeting.

What does this all mean for sterling?

After the pound’s sharp decline below 1.50 on Friday, it has been in recovery mode at the start of a new week. The market sold sterling aggressively after the weak manufacturing PMI survey because this survey has a traditionally close relationship with QE. Since the survey had fallen into contraction territory, this heightened the risk of another quarter of negative GDP, which would push the UK in to a triple dip recession. We tend to think that a lot of bad news is already priced into the pound, so the risk is that the service sector PMI survey actually surprises to the upside tomorrow and GBP’s recovery continues, although we still see GBPUSD sub 1.50 in the medium-term as the BOE is likely to engage in looser monetary policy. Right now 1.5050 is acting as stiff resistance in GBPUSD. In the short term, above 1.5030 – the daily pivot - the bias is higher. Above 1.5050 may see to 1.5065 then 1.5105.

Bank of Japan is dovish – so what’s new?

The Bank of Japan nominee Kuroda struck a notably dovish tone when he testified to parliament as part of his selection process. He advocated a range of new easing measures and suggested that the BOJ under his stewardship would move in a different, unorthodox direction. The key points from his testimony that FX traders (and bond traders) should note:

He would start open-ended asset purchases before the current BOJ target of 2014

He would increase the amount of JGBs the BOJ could hold and increase the maturity of these JGB’s, which is currently capped at 3-years. This would require a change to the Banknote rule.

Interestingly, he said the bank could boost its purchases of risky assets, but he said it would be difficult for the BOJ to buy foreign bonds due to global rules on this. This is considered one way to weaken the yen; however Kuroda may be playing the diplomatic card on this one in an attempt to deflect currency wars attention away from Tokyo.

What does this mean for the yen? So far today the yen has been clawing back losses after a sharp recovery in USDJPY at the end of last week. It is getting caught up around 93.50 and is still some way from the 94.70 highs from last week. Although Kuroda struck a dovish note in his speech, he didn’t tell us anything we don’t know already, thus we could see USDJPY meander into the payrolls report out of the US, which is likely to be the key medium-term driver for this pair going forward. In the short term the range to watch out for in USDJPY is 91.95 – 94.70.

One to Watch: AUD

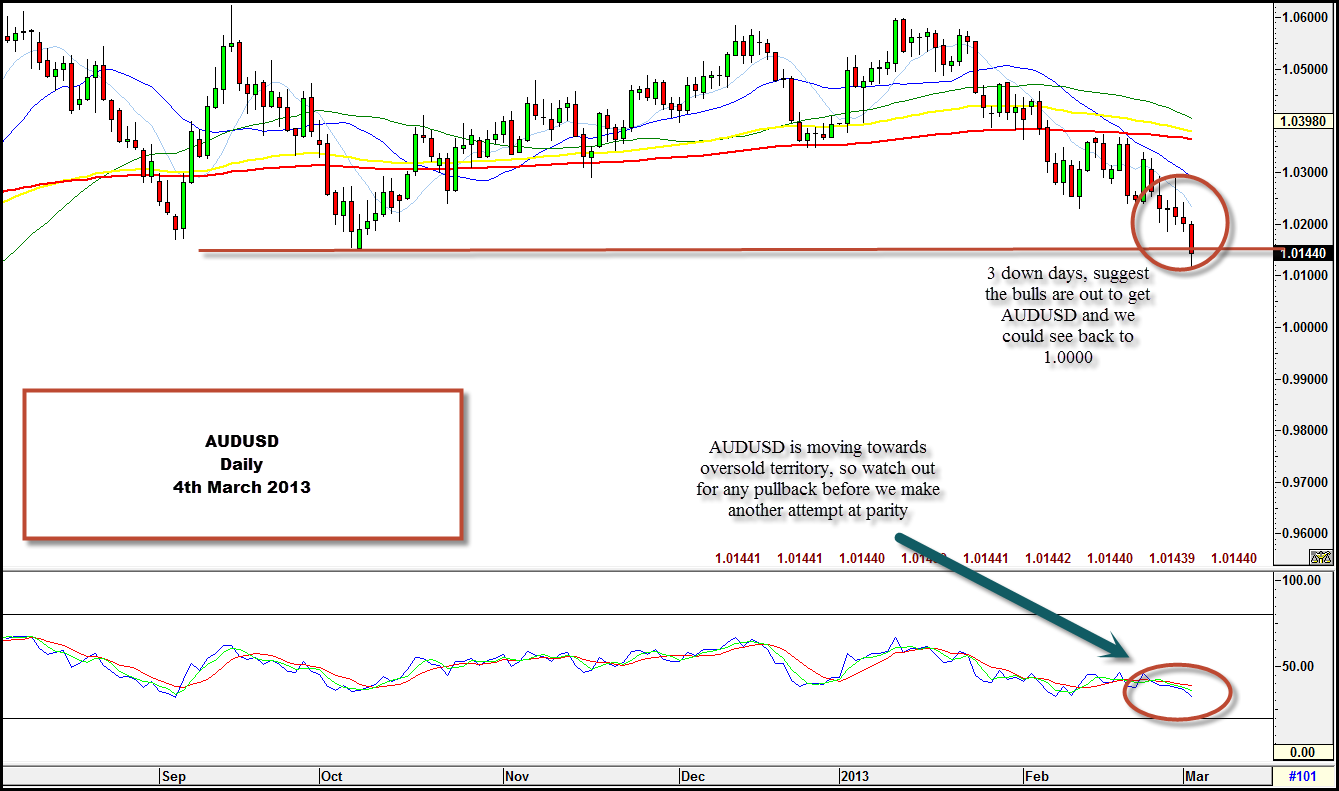

Elsewhere, the Aussie took a battering this morning after China applied tighter rules to its property market in another attempt to limit overheating. This spooked investors as there have been some concern of an asset bubble forming in China that could cause a wave of defaults and bad loans… AUDUSD declined to an 8-month low below 1.0150, a key support level. This opens the way for a sharper decline to parity in the medium-term. However, the near term direction of the Aussie will depend on domestic factors, in our view. Firstly, the RBA meeting tomorrow at 0330 GMT. No change in rates is expected, although we expect the RBA to remain cautious. On Wednesday we get Q4 GDP, which is expected to show a healthy 0.6% rate of growth. Any upward surprise could help the Aussie to recover; likewise, a cautiously optimistic tone from the RBA could also help a short term recovery in AUDUSD, back towards 1.0195 then to 1.0250 in the short –term. Added to that the AUDUSD daily RSI is starting to move into oversold territory, which supports a ST pullback.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.