This week, Ms. Yellen came spoke and did not disappoint anyone – handover from one Fed head to another completed. For the time being the US Fed game plan is to follow the "Bernanke way. However, some recent disappointing reports have a few analysts rethinking the depth of their bullishness for the US economy. On Thursday, US January retail sales slipped lower (-0.4%), m/m; well below expectations and adding insult was the December result being also revised into negative territory.

The headline print was the steepest one-month decline in 18-months for sales. Ex-autos, January sales were flat, while core-sales (ex-autos, gas and building materials) came in down -0.3%, having been expected up +0.2%. The reason for the slip: icy weather. The biggest burden on the report was sagging auto sales, which was abundantly clear in US January sales numbers out of the major auto manufacturers last week. Add the weather-impacted report to the miss in the January PMI manufacturing and the monthly job numbers, is reason enough to consider revising US growth rates. Many analysts are beginning to cut US Q4 and Q1 growth forecasts given the recent multitude of disappointing data – Q1 is tracking at +0.9% vs. +1.9% while Q4 is pared to +2.5% from +2.8%.

The US economy is the "beacon for capital markets." However, the present global economic recovery has currently six "unusual" characteristics, which distinguishes it from recoveries of the past and is altering the strength of "the" recovery. This will obviously have a knock on effect on financial markets and monetary policies – indictors that need to be taken into consideration when looking at the "big" picture.

Global trade continues to lag

Credit is not picking up and continues to languish

Long-term interest rates are not rallying – a flatter US yield curve

Inflation is benign or continues to fall – Euro-zone is concerned about deflation

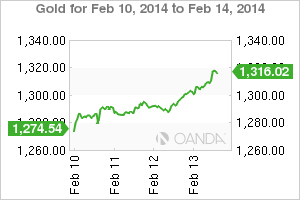

Commodity prices remain on the "back-foot"

Finally, when considering US employment, notice the participation rate – it continues to decline – not a good sign

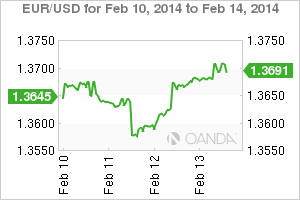

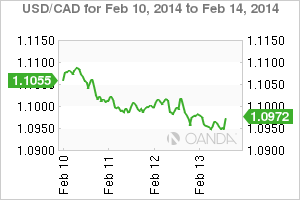

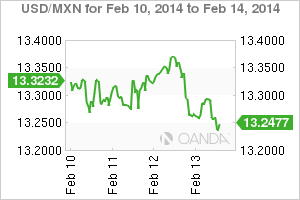

One needs to be looking beyond weather to grasp a clearer picture. The lack of volatility in forex can be blamed on G10 monetary policy – with the lack of deviation in interest rates, central bank rhetoric is doing most of the currency price guidance for now.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.