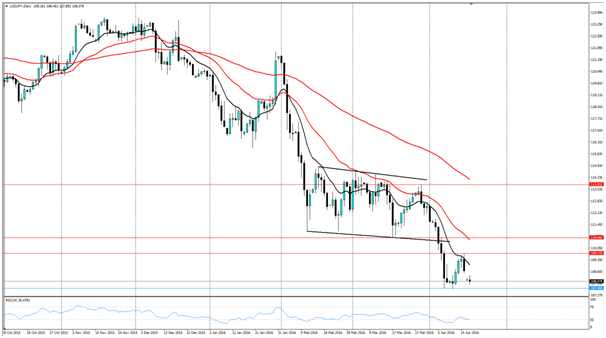

The USDJPY is facing the ultimate cross roads, as sellers start to line up against the pair ahead of trading this week, and the risk of a collapse towards the key 105.00 handle now becomes likely. However, the looming risk factor is the Bank of Japan, and whether the central bank intends to intervene within the market.

The week remained a difficult one for the USDJPY as the pair initially managed a small rally to 109.40 before falling sharply to close the week out around the 108.70 mark. The short term rally was largely cut short by a broad sentiment swing towards the US Dollar late on Friday which erased any chance of the pair staging a move above the 110.00 handle. In addition, the BoJ has been largely attempting to jawbone a weaker Yen by suggesting that nothing within the current G20 agreement restricts them from a short term currency intervention. Regardless, the move appears to have failed and the pair gave back nearly half of the gains.

Looking ahead, markets will largely be awaiting the US Unemployment Claims and JPY Tertiary Industry Activity results for the short term trend. In particular, an increase to US Unemployment Claims could see the pair again plunge to challenge the 107.00 handle. However, there is a risk that further USD depreciation could bring the Bank of Japan to the table in the form of an intervention. Subsequently, watch for the central bank ringing around to obtain currency quotes from dealers.

From a technical perspective, the USDJPY remains largely bearish as the pair fails to break through the 12 EMA. In addition, it appears that there is some strong support between 110.00 and 111.00 which would make any bullish move difficult. However, our bias remains neutral given the current oversold status of the RSI oscillator. Look for the pair to consolidate before attempting a break of the 107.00 handle in the week ahead. Support is currently in place for the pair at 107.66, and 106.63.

Ultimately, there is likely to be plenty of pain for the Yen moving forward both technically and fundamentally. However, despite the largely bearish forward view, everything could turn on a dime if the Bank of Japan enters the market to depreciate the yen. At what level that is likely to occur is anyone’s guess, but I would suggest that the 105.00 handle might very well turn out to be a key level in the very near future.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.