Gold saw some gains last week but ultimately failed to form a convincing trend and break free from its sideways channel. The metal closed the week up at 1239.99 but was prevented from testing the upper constraint of the channel by better than expected US ISM non-manufacturing PMI and unemployment results. However, a slew of US results coming out this week could certainly generate the requisite momentum to challenge the current channel constraints.

Gold’s recent uptick comes as a result of the successive tumble of the USD as shown in the USDX. As usual, the fall in the USDX to 94.20 made the USD denominated commodity a more attractive investment for many market participants. As a result, the small rally came from a mixture of the usual fear over the US economy and the relative increase in affordability of gold for some of the market. However, the fear component of the metal’s price increase was limited by the US posting a solid ISM non-manufacturing result of 54.5 and an unemployment claims result of 267K. Consequently, gold failed to test the upper constraint of its channel at 1270.76 which may have occurred in the absence of the two excellent results.

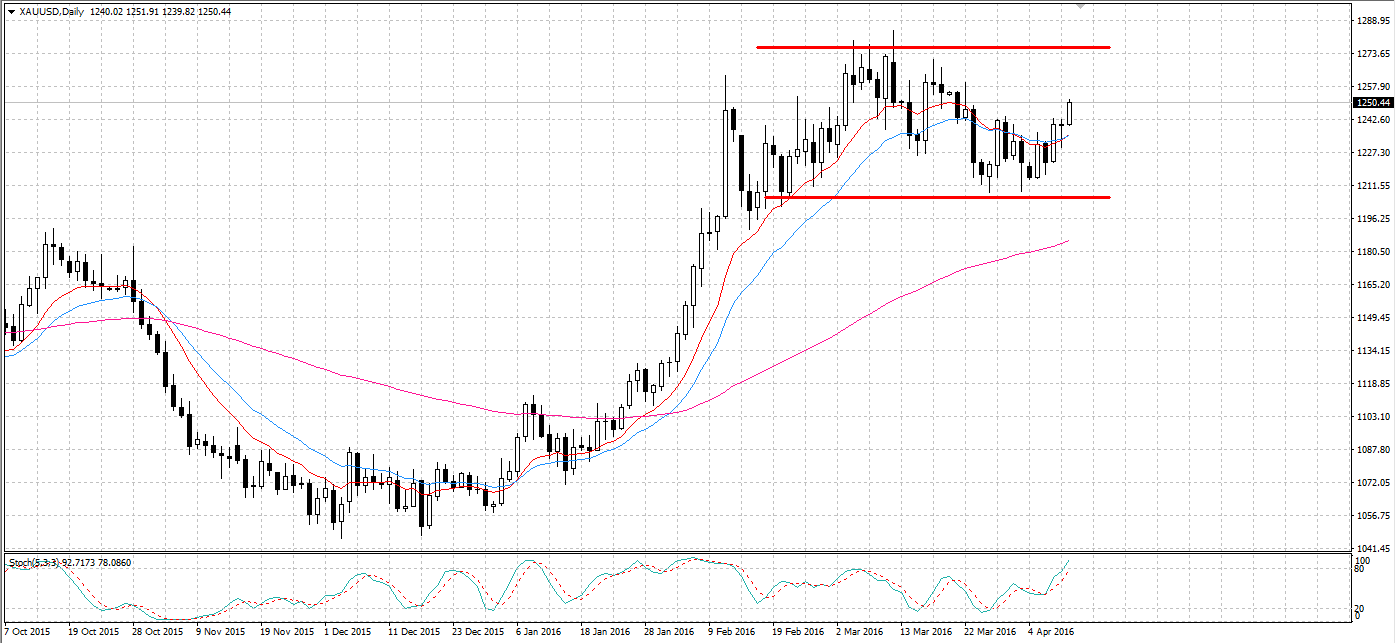

Looking to the technical analysis, we see that gold is still confined within a channel and will need some significant momentum to challenge the upper constraint. At the current price the metal is already becoming overbought as shown by the stochastic oscillator reading of 77.30. Additionally, the 12 and 20 day EMA’s are now converging which could signal a bearish reversal is about to occur. Evidently, it would appear that the metal is moving to challenge the downside of its channel rather than the upside.

Going ahead, the gold market will have a number of important indicators influencing its movements in the coming week. Specifically, this week will see results posted for US core retail sales, PPI, core CPI, and unemployment claims. Additionally, the impending Fed announcement is likely to inspire the usual bout of sentiment trading that seems to influence gold so heavily. Ultimately, there is significant scope for gold to challenge both the upside and downside constraints of its channel at 1270.76 and 1208.98 respectively. However, given the current technical readings it seems that the downside is much more likely to be broken than the upside. As a result, any strong US results should be watched closely as they could start a free fall in gold price.

Ultimately, gold can prove to be a difficult commodity to predict due to the undue influence the US Fed’s rhetoric has on the metal. However, the technical evidence seems to be hinting that a particularly good result on the fundamental front could finally trigger a downside breakout for gold. Additionally, if the Fed actually proves to be more hawkish than usual, we might see sentiment start to hammer the pair lower following their impending announcement.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.