For those looking forward for a permanent recovery in oil prices don’t hold your breath. With recent gains made after the FOMC meeting and increased fear mongering from OPEC, the news seems to be signalling quiet optimism in a recovery. I think it’s worth having a somewhat more pessimistic view of the whole affair.

Ever since the announcement of potential production freezes, oil has been making some steady gains. Buying pressure for the commodity is coming almost entirely from hopes that OPEC will freeze production this April. The market seems to be betting that OPEC will follow through with what has ultimately been a decent round of fear mongering. Adding fuel to the recent price gains has been the reaction to the FOMC meeting. Fed rates were held steady as Yellen continues to remain dovish in the face of current global conditions; as a result the USD took an absolute pummelling. As a USD dominated commodity, oil shot up as the gain in purchasing power made oil a more attractive prospect for foreign buyers.

Increasing oil prices as a result of temporary loses in the USDX is not a good enough basis to be optimistic about oil price recovery. For example, the recently released Philadelphia Federal Manufacturing Index reported a 12.4 increase. This might move traders to re-evaluate the strength of the USD and reverse some of the damage caused by the FOMC meeting. Does this mean demand or supply for oil has shifted greatly? No, it just means the temporary price advantage some traders had has now evaporated with an appreciation of the USD. Furthermore, it’s notas though the USD will never recover. It is true that the USD may currently be at a relative low point in the prevailing sideways trend. However,it will take more than a dovish Fed announcement for the index to take a true downturn to 2014 levels.

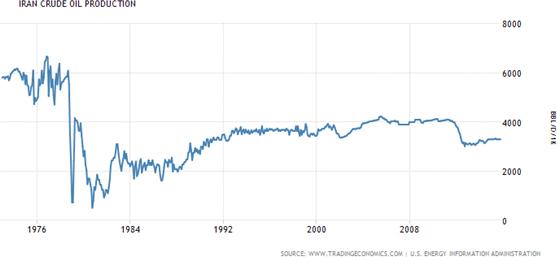

While the recent gains may give oil bulls a brief cause to celebrate, looking a little more deeply into the situation will reveal that production freezes can only carry the price so far. A major threat to the success of any production freeze planned by OPECis Iran. With sanctions only recently lifted, Iran has made it clear that it seeks to re-join the global oil market in a big way. Targeting 4 million barrels per day, Iranian production could dampen the effect of the production freeze. Keeping in mind that pre-sanction crude oil production in Iran was more than 6.6 million barrels a day, how long can any production freeze be expected to last while Iran continues to capitalise on its neighbours self-imposed production restrictions.

Even without Iranian dissent within OPEC, US shale poses an even greater challenge to the effects of the proposed production freeze. Any further price increases will ultimately be undone when the per-barrel price reaches the key $50-60USD threshold. The importance of this price comes from the US Department of Energy estimates; this range is calculated to be the point where shale oil becomes economically viable. The moment the price enters the key economic range, US shale begins to storm into the market and you can watch oil production soar until they overproduce themselves out of the market again. One only has to look back as far as April last year to see this reaction. When Oil prices broke above 50USD in March 2015, the US production began to climb until hitting a peak at 9.7 million barrels a day. As production increased prices stalled at the 61.00 handle as more oil flooded the market.The increased supply eventually driving prices into the fall we have seen over the past year.

If we have learned anything from the past it should be to avoid becoming over excited by short term trends. Current gains in oil prices are not symptomatic of a change in the true market price of oil. They reflect the results of a brief surge in buying from a weakened USD and misplaced hopes of an OPEC oil production freeze this April.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.