The past 24 hours have been a difficult period for the Japanese central bank as they appear to be caught like a deer in the head lights as the Dollar continues to depreciate against the Yen. Subsequently, speculation is currently mounting that the Bank of Japan will shortly look to intervene in the market to depress the value of the Yen. However, the question remains at what point the venerable BoJ will dip their toes into the water.

March has been a relatively negative month for the Japanese Yen as the pair has faced not only some volatile domestic conditions but also a dovish FOMC. Subsequently, it was largely the US Federal Reserve’s dovish FOMC statement that started the latest bout of bearishness. In fact, the announcement that the Fed’s “Dot Plot” showed only two rate hikes for 2015 sent the pair tumbling.

So it really came as no surprise when late on Friday’s session the Bank of Japan started to do the proverbial ring around to find out what was going on in currency markets. Clearly, this type of action doesn’t rise to the level of quote seeking from the central bank, but it does point to rising levels of concern. It also points to a level of expectation setting by the BoJ as the noise around a possible FX market intervention starts to increase.

Subsequently, participants within the market are watching the 110.00 handle closely as historically it has been a key battleground for the pair. In addition, Japan’s central bank is unlikely to allow the currency to fall to far below the 110.00 handle given the expected impact upon Japanese trade. Historically, the BoJ have been relatively active in intervening in markets below the 100.00 mark and this pattern would likely repeat itself if the pair was to fall towards that level.

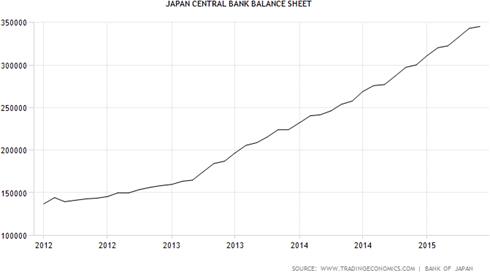

Additionally, the Bank of Japan has amassed a relatively large war chest of foreign currency reserves to fight off the rampantly bullish Yen. Despite a burgeoning balance sheet filled to the brim with QE, the BoJ has maintained reserves in excess of 1.25 trillion US Dollars. This is a significant sum that could be committed to depreciating the Yen. Given the latest round of ring around from the bank, there is no doubt that all the signals are currently in place for a large move ahead for the Yen.

Ultimately, the central bank is likely to sit on the side lines until the medium term USD trend arrives. Currently, the pair’s equilibrium has been shocked following the FOMC decision and it may take time for valuations to stabilise. However, if the Yen continues to strengthen against the dollar, a valuation between the 109.00 and 110.00 handles could see a decisive intervention in the markets. It’s always difficult to predict central banks but all of the ingredients are in place for that to form the key battleground in the weeks ahead.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.