Last week was fairly buoyant for the Cable as the pair benefitted largely from the general risk aversion surrounding the US Dollar. However, despite the recent rally, the pair is now facing a reversal of its gains as today has seen price action decline back towards the long run bearish trend line. Subsequently, the question remains, will the Cable continue to gain or will the BoE’s rate decision see it bearish again.

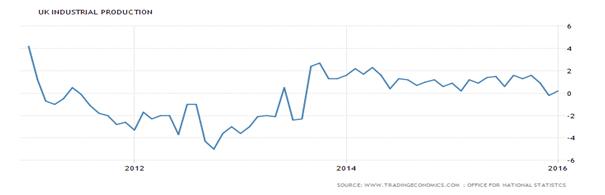

The Cable had a strong week, finally breaching the long run bearish trend line, as the pair was buoyed by a sentiment swing against the US Dollar. In addition, the UK Manufacturing Production figures came in sharply above estimates at 0.7% m/m. This result over-rode the previously weak UK Industrial Production figures and further buoyed the pair. This confluence of factors enabled the pair to shake off the bearish binds and rise sharply to close the week well up around the 1.4381 mark.

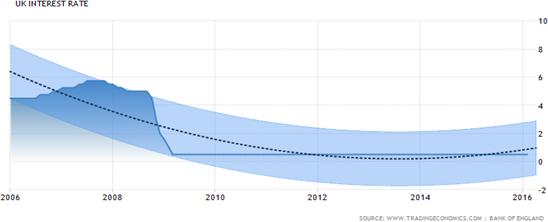

The week ahead is likely to be extremely volatile for the Cable as it faces both a slew of US economic data as well as a critical Bank of England monetary decision. The Bank of England’s decision on the official bank rate is due out on Thursday and most estimates have the central bank holding the rate steady at 0.50%. However, given the ECB’s recent rate cuts, there is added impetus on the BOE to depreciate the currency to stimulate export demand. Subsequently, the MPC meeting should be viewed as live but retains its bias as a “hold steady” event.

From a technical perspective, price action has recently broken through the long run bearish trend line in a signal that further upside moves could be likely. However, the pair now faces some stiff dynamic resistance as the 100-Day moving average starts to decline towards its current level. In addition, RSI is also nearing over-bought territory which could mean a pull back, towards the 1.4250 level, could be on the cards. Subsequently, our bias remains neutral until a retest of support around the broken trend line occurs.Support is currently in place for the pair at 1.4120, 1.3839, and 1.3514. Resistance exists on the upside at 1.4434, 1.4656, and 1.4944.

Ultimately, regardless of our neutral bias, the Cable is likely to see some sharp volatility in the days ahead. Subsequently, monitor any long positions closely as the downside is the probable trend direction in the days ahead.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.