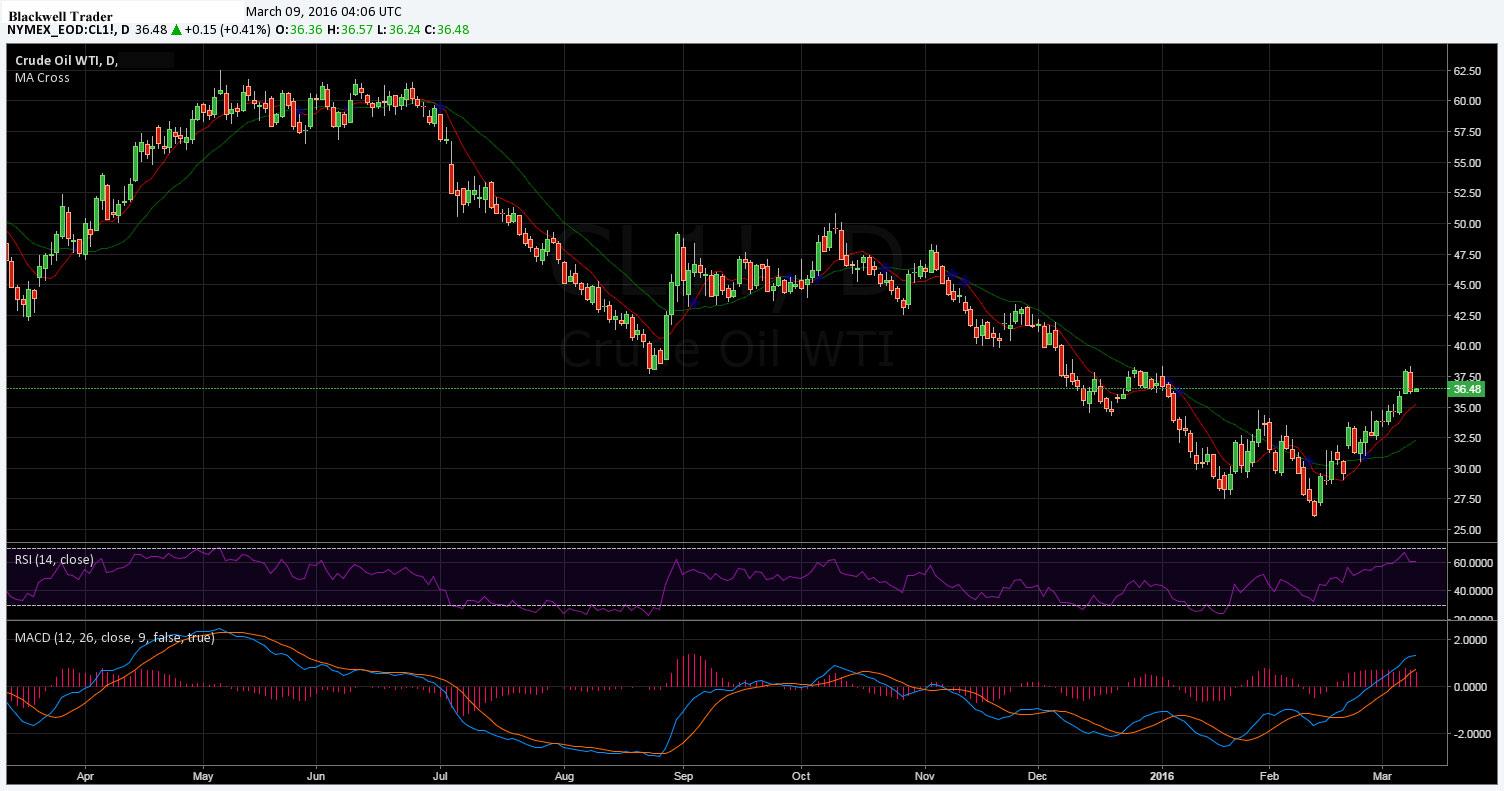

Recently the markets have been awash with talk about crude oil seemingly having discovered a bottom to the recent decline. However, the supply fundamentals remain unchanged, and despite the talk of re-leveraging, there is only one way for crude prices to head and that’s down.

The past few weeks have seen the price of Crude Oil (WTI) surging amid talks of production capacity constraints and re-leveraging leading to inflation for commodity prices. Subsequently, prices have reacted strongly to the rhetoric and the past few sessions have seen prices rally to a high of $38.37 a barrel.

Much of the upward price pressure in crude oil markets has been driven by the initial phase in rebalancing, with a range of oil supply curtailments evident in both the US Shale Industry and amongst OPEC producers. However, the realignment process has largely lost out to the increasingly robust Eurozone manufacturing data, as well as a significant level of credit growth evident in China’s January figures. Subsequently, there is a view that much of the world is now starting to re-leverage which is likely to flow on to growth and ultimately demand for the black gold.

However, these short term market corrections do nothing to help the plight of the needed supply rebalancing. The Crude oil supply glut is still a significant problem within the industry and the only way to clear that imbalance is for lower prices and some significant hard ship. Although the current world economic dynamics may lend itself to taking a short term bullish view on crude, ultimately any rise is not sustainable.

Subsequently, we expect Crude Oil to continue its rebalancing efforts throughout the majority of 2016, regardless of any short term price moves. It is estimated that the market will not reach a new, stable equilibrium, until Q1, 2017. At that point it is likely that some significant upward pressure on prices will occur. Historically, it is clear that a sustainable rally can only be created through by a physical deficit in the crude markets. And until the rebalancing is complete, that is an unlikely prospect.

The state of the Chinese economy is also a concern for future oil prices in the broader economic sense. There is continuing deterioration within Chinese Manufacturing, subsequently supported by much of the easing measures undertaken by the PBOC. In addition, China also has some significant credit constraints which likely predisposes it to consider fiscal policy over any form of monetary stimulus. Subsequently, the uncertainty component of any ongoing shocks to the Chinese economy is a real risk to both crude and metals demand.

Ultimately, especially given the level of uncertainty in China, re-leveraging and reflation will not support crude oil prices in the long run. Genuine price rallies can only be sustained by a physical deficit and that means a continuing of the rebalancing process. Subsequently, expect the pain to remain until we genuinely see supply shifting thereby moving price towards new and stable equilibrium.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.