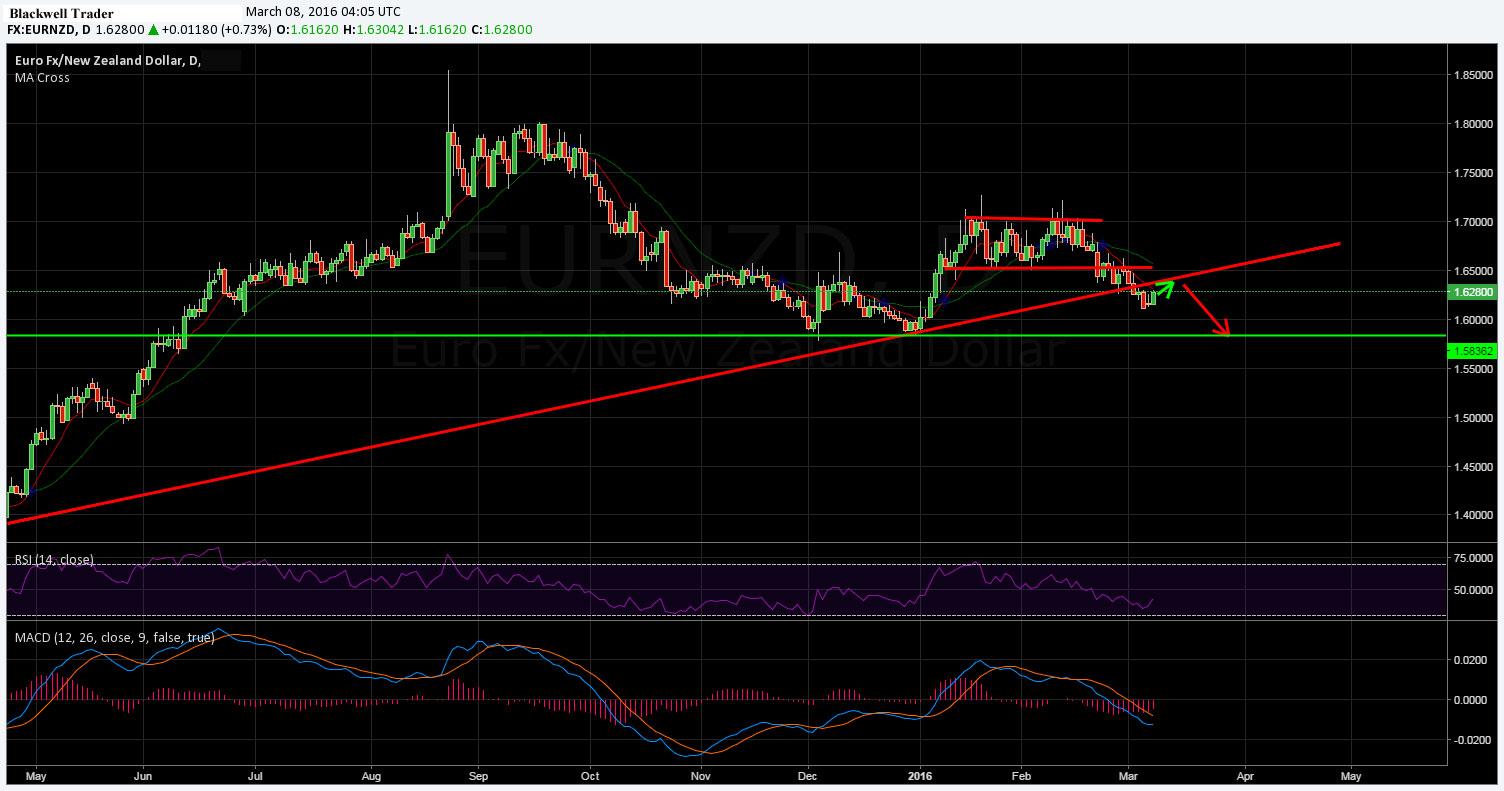

The Euro-NZD currency pair has been relatively quiet of late as price action has been constrained by a corrective structure. However, early March saw the structure break down, as price dropped rapidly through both the channel and the bullish trend line. Subsequently, there is a real chance that price will continue to break down in the coming days, thereby lending itself to short selling.

Taking a look at the pair’s technical indicators demonstrates a currency which is highly biased to the short side. The 12 and 30 EMA’s are both indicating bearishness as they rapidly decline, in line with the price action. In fact, the end of February actually saw both price action and the EMA’s declining sharply below the 100-day moving average.

The strongest signal of a short play in progress is the breakdown of the long run bullish trend line. Last week saw prices convincingly breach the bullish trend line from April of 2015 which strongly predisposes the currency for further downside moves. Given price action’s current location, a move towards the next major support level at 1.5834 is therefore likely in the coming week.

However, it should be noted that the RSI Oscillator appears to have reached relatively low within neutral territory and may require a small retracement to provide room for any large short pushes. Subsequently, look for price to retrace back towards the trend line, and the 12 EMA, before recommencing a tumble towards our target around the 1.5834 level.

Ultimately, given the strong risk/reward percentage, any potential short play in the EURNZD could reap significant benefits for keen traders. However, do monitor the EUR GDP figures, due shortly, as a surprise result could buoy the currency.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.