The US Federal Reserve’s reputation for secrecy took a blow on Friday as a staff member “accidently” posted the wrong Zip file to the central banks website. The mistakenly posted file includes a range of reports and analysis from staff economists which largely forecasted a 0.25% increase to the Federal Funds Rate by the end of 2015. However, the accidental gaffe has led many to question whether the “accidental” leak was, in fact, intentional.

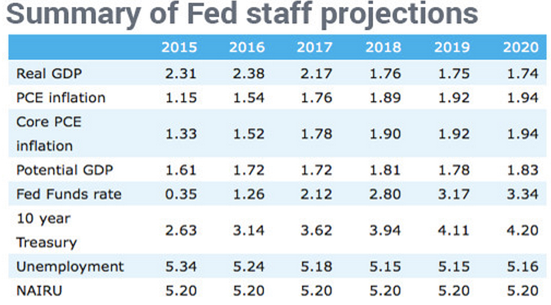

The confidential economic projections appear to show a single rate hike of 25bps as being projected for September along with the Fed assuming a 1.26% Fed Funds Rate in a year. This would mean that, according to the forecasting, the Fed would raise rates 3 or 4 times over the next 12 months. The increases are seen more as a form of normalising of rates rather than movement towards a tightening monetary policy.

However, buried within the economic forecasting and models was a range of projections that were significantly more dovish then has been publicly discussed by Fed Chair, Janet Yellen. Economic projections, through to 2020, show core PCE inflation failing to reach the Fed’s target of 2%. Real GDP growth is also relatively stagnant, and in fact is forecast to only reach 1.74% by 2020. This is surprising considering the Fed, and by extension Janet Yellen, has been extremely bullish over the expectation that inflation would begin to pick up substantially in the medium term.

The reality is that the current macroeconomic indicators are not showing the sort of economic activity that would justify a range of interest rate increases. Although the labour market has improved considerably over the past 12 months, inflation still remains lacklustre. Also, the US manufacturing industry has been declining for some time with the Manufacturing PMI showing falls since early 2014. Subsequently, the real wealth driving jobs in the manufacturing sector are evaporating and are partially the reason why inflation is relatively flat.

The abject lack of persistent or forecasted inflation within the data seems to beg the question as to why the Federal Reserve would raise rates, especially when there is little in the way of a fundamental case. In fact, it could actually be quite a significantly negative event considering the current fragility of the broader US economy.

The reality is that I see the Fed as being unlikely to embark upon a round of consecutive rate rises considering the current status of the economy. Subsequently, any talk of increases, without the inflation to back it up, is simply jawboning on a grand scale.

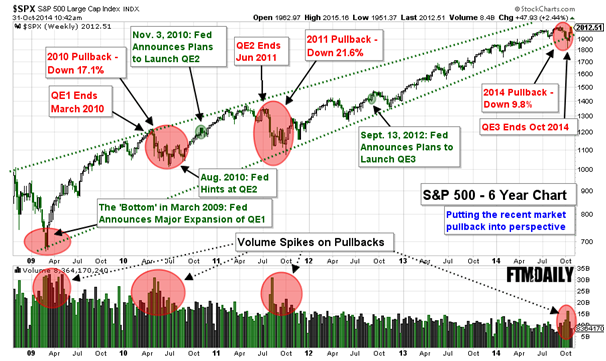

The Fed’s real reason for the continual drive to alter expectations is the fact that they have a problem on their hands in US equities. Successive rounds of Quantitative Easing have fuelled a speculative bubble in the markets, which have continued on an almost linear rise, despite static EPS across the exchanges. Stock valuations are through the roof and the Fed is starting to become very concerned that a sharp correction, similar to the Shanghai Composite, could form a real risk to the US financial system. The reality is they are attempting to let some pressure out of the market in the hope that they need not normalise rates.

Subsequently, the Fed is faced with an impossible choice. Commence raising interest rates and risk popping a large speculative bubble, or continue inflating that bubble through further tranches of QE. However, the Fed is fast learning what Japan already knew, you can’t fight a lack of inflation with just money alone. Any injection needs to be backed up by real economic activity, not just an increase in the money flow.

Ultimately, the coming quarter is likely to be extremely revealing for the Federal Reserve and we might just find out whether the Emperor has any clothes.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.