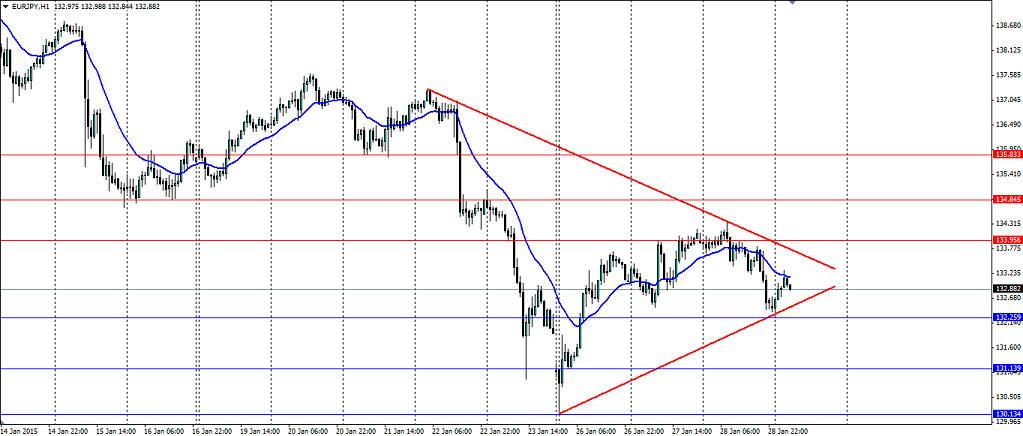

The Euro-Yen pair has been trending downwards in a fairly consistent fashion recently. A consolidative pennant pattern could point to an impending breakout that will see the bearish trend continue.

The trouble in the Eurozone is far from over and the new leaders in the Greek political landscape could cause some serious concern for the Euro. If the new Syriza party decide to default on their bailout loans from the EU and ditch the shared currency, the Euro will feel the full effect of this as the market will no doubt speculate about a wider breakup.

The Yen on the other hand has found plenty of strength recently as the turmoil in Europe sent investors looking for safety. We saw more demand for the Yen’s safety today as Singapore took the market by surprise and lowered interest rates. Certainly as the global economy looks to slow, the Yen will be sought after.

Inflation figures for Japan are due later this week and are expected to dip slightly. If inflation remains at 2.4% the pair will certainly break lower, however, a fall in the Japanese CPI could add bullish pressure to pair. Either way the news will add volatility. There is also inflation data due form the Eurozone which is expected to dive to -0.5%. The Unemployment rate is also due out along with German retail sales and Spanish CPI. Certainly there is potential for Euro to break to the downside.

Technically speaking, a pennant pattern is indicative of a continuation of the current trend, which in this case is bearish. If we see a breakout lower as expected, look for support to be found at 132.25, 131.13 and 130.13. A breakout to the upside, although unlikely, will find resistance at 133.95, 134.84 and 135.83.

A pennant has formed on the EURJPY pair that could indicate a breakout. A continuation of the bearish trend is to be expected for such a pattern, however, watch for inflation figures that could dictate direction.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.