Falling in commodity prices led to a budget blowout and will likely impact growth, causing headaches for the RBA.

GROWTH EXPECTATIONS:

GDP, a mainstay of economic development, had been showing some strong results in the previous quarter as it lifted, despite most people believing it would worsen. However, the November reading came in at 0.3% (0.7% exp), which was much weaker than expected. Going forward, it’s likely we will see further volatility in GDP results as the Australian economy suffers.

Retail sales have continued to be stronger than expected with October’s reading coming in at 1.2% and November’s reading at 0.4%, both well above expectations. The retail sales in Australia have come as a surprise overall, as the domestic market had been struggling for some time.

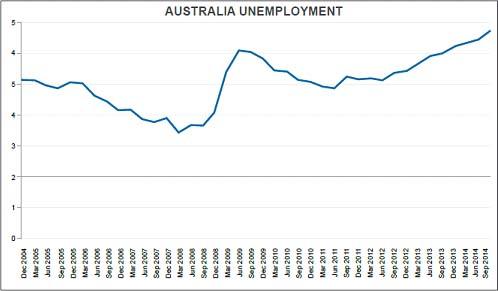

Unemployment has begun to worsen in the Australian economy and since the last quarterly report, it has lifted 0.2% to 6.3% with many expecting that further rises may be possible as commodity prices continue to decline. The RBA and the government will be watching this one closely as many are starting to get significantly worried about Australia’s labour market.

Chinese manufacturing PMI data has so far been robust, despite recent talks of a slowdown in China. With the most recent figures coming in at 50.1 showing there is still expansion in China, however, this could taper off in 2015, and we anticipate that results for manufacturing will remain suppressed.

MONETARY POLICY:

The Reserve Bank of Australia (RBA) has maintained a neutral policy throughout 2014 as it looks to push the AUD lower. It has managed to jaw-bone the dollar repeatedly, but going forward, it still remains more elevated than what the RBA is comfortable with. Many are now anticipating that we could see a rate cut from the RBA as inflation is low. Additionally, if there is no movement lower, some deputy governors have suggested currency intervention as a possible solution.

FISCAL POLICY:

Fiscal policy in Australia has worsened heavily as commodity prices have fallen, impacting tax receipts. The current 2014 budget blow out is expected to be around 40 billion dollars (AUD) and Australia is now expecting a 17/18 billion budget blowout for 2015 despite recent aggressive cutting from the government budget. Australia is not expected to produce a 1% GDP budget until mid-2020’s, so it seems the Australian government is going to struggle for some time, especially with its unpopular stance as of late.

FX OUTLOOK:

The RBA has postured itself in a neutral stance for 2014, and 2015 is looking to be different as Australia’s woes continue. As a result, we see the RBA trying to talk down the dollar further as well as looking to put pressure on the currency via other additional measures, such as an interest rate cut, or even currency intervention. Overall, the bearish outlook from last year is likely to carry over for some time until there is an improvement in the state of the Australian economy.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.