The UK economy is looking quite robust as growth remains steady. Falling inflation, however, puts interest rate rises all but out of question.

GROWTH EXPECTATIONS:

The UK is growing well with plenty of indicators pointing in the right direction. Final GDP figures for Q3 2014 show the UK economy expanding by 0.7% from the previous quarter. This is down on the final figures for Q2 which surprised the market at 0.9% q/q. The NIESR GDP estimate had been picking 0.6% growth for Q3 and is now estimating 0.7% growth for Q1 2015. The Bank of England’s own growth estimate for 2015 is at 3.0%. This may come under pressure for a sluggish Euro-zone, however, the falling energy prices is likely to drive further consumption.

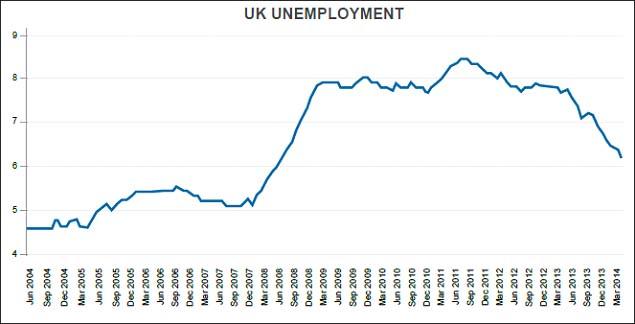

The Unemployment rate has improved considerably from a year ago when it was at 7.4%, to the latest reading of 6.0%. This will certainly please BoE Governor Mark Carney. The Claimant Count has consistently been on the right side of zero with an average fall of -22k per month throughout the quarter.

The PMI for the services sector, which accounts for 77.8% of UK GDP, has remained rooted in the high 50s during the quarter, with readings of 58.7, 56.2 and 58.6 for October, November and December respectively. These are slightly down on the 60.5 from September, however, it shows the kind of consistency that has allowed the UK to maintain over 3.0% annual growth at a time when others are struggling for 1% growth.

Retail sales were a mixed bag over the quarter, but it managed to gain momentum leading into the Christmas period, with November’s sales rising 1.6% from a month ago. This leaves overall sales up 6.4% from the same time a year ago, which is a fantastic result and again highlights the good position the UK economy is in.

MONETARY POLICY:

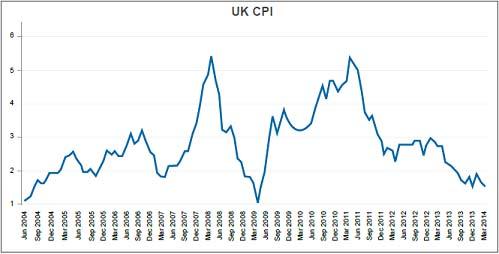

The interest rate has not budged from the 0.5% it has been at since March 2009, meaning the rate has not changed a staggering 70 times. The reason the rate is not moving at the moment despite the UK economy being robust enough to absorb a rate rise is that inflation is simply too low. Figures released in December show CPI falling to just 1.0% y/y, which is at the very bottom of the BoE’s 1-3% target range. Wage inflation too has been a slight disappointment at just 1.4%.

The market is betting on a rate rise in 2015, however, Governor Carney is unlikely to increase interest rates at all while inflation is threatening to break out lower of the target range. Thanks to the low inflation, the stimulus will be held in place and that’s something the BoE has been keen to keep for some time now. With a robust GDP growth rate, Services PMI and a strong labour market, the UK economy is sitting pretty.

The only real threat to the UK economy at the moment is if inflation falls to low. That is a real possibility with falling energy prices, however, the recent fall in the Pound is likely to counteract this as imports will become more expensive. Certainly, if inflation falls any lower than the current 1.0%, we may even see some talk from the BoE on ways to raise it.

FISCAL POLICY:

2015 is a big year in the political calendar for the UK because it is an election year. The current government (if re-elected) is looking to balance the budget within 3 years and to reduce public debt as a percentage of national income by 2016-17. The opposition has said it will balance the current budget “as soon as possible within the next parliament”.

Either way, both parties see the budget deficit as a problem that needs to be addressed. Fiscal responsibility is likely to be a major talking point leading into the election on 7th May 2015. We will see a lot of talk about cutting services and raising taxes, all of which is going to be unpopular in a nation that prides itself on its welfare system.

FX OUTLOOK:

The Pound once again took a beating over the final quarter of 2015 as the prospects of an interest rate rise became ever less likely. With inflation falling to the lower end of the target range, it is becoming more likely that the expected interest rate rise in early to mid-2015 will be pushed back much further. This alone is bearish for the Pound.

The US Federal Reserve on the other hand has made it clear that it intends to begin raising interest rates by mid-2015. The US economy is looking strong and the likelihood of a divergence in monetary policies is becoming more apparent. This will add further bearish pressure to the Cable (GBPUSD).

Despite the positive GDP and employment figures, low inflation is causing the Pound to fall and will likely to be the main driver for some time. The direction of the Pound will be determined by the language the Bank of England employs and that will depend on where inflation goes over the next three months. At this stage, it does not look positive.

EQUITY OUTLOOK:

The FTSE had a very volatile quarter as did many of the world’s equity indices. It pushed up close to the highs seen in the peaks of 1999 and 2007, however, it ended down 1.14% from where it opened the quarter. Trouble in Greece, Russia and commodity markets all had their effect on London’s main index.

The coming quarter could be a bullish one for equities as the likelihood of continually low interest rates will keep equities propped up. Low energy prices will hurt the oil and gas companies, however, the flip side is a benefit for most other companies through lower expenses so the net effect will be positive.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.