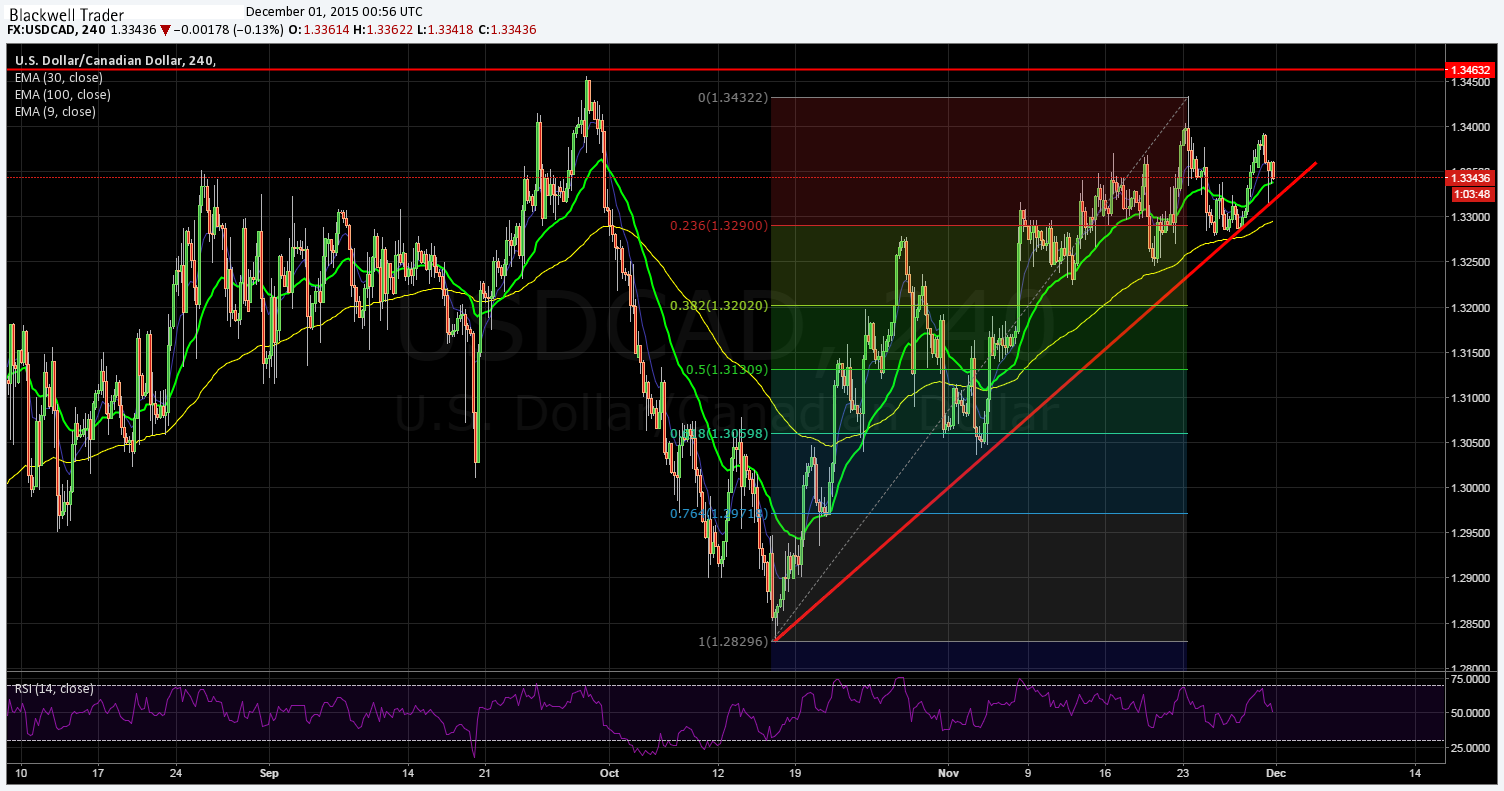

The USD/CAD continues to look buoyant as the pair remains supported by a strongly bullish trend line. However, last week saw the pair sliding back towards support and traders are now asking whether the pair faces a correction in the coming days.

The USDCAD opened last week around 1.3355 and rose steadily before resistance at 1.3455 caused the drive to falter and the pair to subsequently pull back to around 1.3351. However, the supporting trend line is looming, which coincides with the 23.6% retracement level, and a continuation of the bull trend is therefore likely to resume in the coming days.

The CAD’s price action has continued putting higher highs and higher lows on the daily and weekly charts whilst it remains well above the 50 EMA. The RSI Oscillator also remains well entrenched within neutral territory indicating that there is plenty of room to move on the upside. The real obstacle for any long-side move remains resistance at 1.3456 which will need to be surmounted to cement a move higher.

However, December’s looming US Federal Reserve meeting on monetary policy is clearly impacting the pair given the recent swings in and out of sentiment for the US Dollar. Subsequently, be very wary of any dovish tone from Fed Chair Janet Yellen in the lead-up to the FOMC meeting as it could be disastrous for the bulls.

Ultimately, the market truism of the trend is your friend clearly applies to the USDCAD, and the bullish run is likely to persist for as long as the hawkish rhetoric surrounding a rate hike by the Fed continues.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.